Each week I put together a report called the Strategy Session. For a while it was a standalone product. Now, it’s included with your Exodus membership. In it, I recap the prior week’s action and build context and actionable trade setups for the following week.

Each week there is a section where we look very closely at one of the tools inside Exodus. Since the gates are open to the public this weekend here’s a sneak peek at this week’s educational piece. Hot from the presses at Exodus Academy, enjoy:

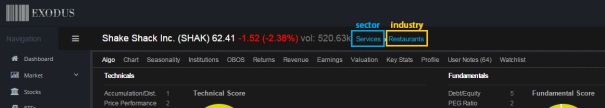

In Exodus, we compartmentalize stocks into several sub-groups. Take Shake Shack (ticker: SHAK) for example. Shake Shack is a stock, more specifically a service sector stock, more specifically a restaurant.

The idea to pigeonhole stocks into sectors and industries has its roots in methods established around 300 B.C…seriously. Aristotle was a philosopher and a scientist. The last great Greek philosopher, he was a meticulous organizer who wanted to clarify our concepts, especially of nature. His explanations are based on sensory observation and are a foundation of logic. Instead of a lecture on Aristotle, here’s an application of his work using my oldest pet:

A few years ago I adopted a nearly-feral dachshund. Her skittish behavior and incredible speed earned her the name Momo—she behaves like a momentum stock!

Momo is a living creature, more specifically an animal, more specifically a vertebrate, more specifically a mammal, more specifically a dog, more specifically a dachshund, more specifically a female dachshund.

This is a very Aristotelian (read: logical) way of describing my doggy.

We built Exodus to make ourselves better investors and traders. In the hyper-competitive field of public investing, it is vital to comport yourself to established facts. Our belief is that anyone can make good decisions if presented with the right information. Therefore the software confronts you with well organized statistics. Armed with probabilities and logic, members are empowered to make objective decisions. Every stock in the system belongs to a sector and industry, here’s SHAK:

On the Dashboard page, we display the market caps of each sector. This is accomplished by coagulating the markets caps of all 4,740 stocks into their respective sector. The result is the simple-to-understand Sector Composite Market Cap chart, see below:

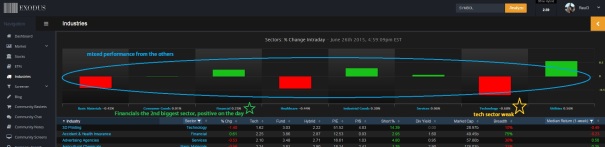

If we go to the Industry page, we can then see the intraday performance of these sectors. This is like peeling back the curtain and looking under the surface of index prices—indices like the S&P 500, Nasdaq 100, Russell 2000, and Dow Jones Industrial Average (more compartments!).

Check out Friday’s readings. They were telling a story. Tech was weakest sector on the session which put some context behind the tech-heavy Nasdaq being down more than the other indices. It also called the early afternoon weakness into question when we saw the selling wasn’t broad-based, but instead isolated to a few sectors. See below:

Not bad right? Free trials end Sunday, if you haven’t signed up yet email me [email protected] now. At the stroke of midnight Sunday any straggler found within our kingdom with the exiled via our human catapult.

If you enjoy the content at iBankCoin, please follow us on Twitter

You gave a great presentation Friday so I signed up as a distinguished Gentlemen.So could you elimate the Riff raff please! Thank You.

Lol! Single some out!