Nasdaq futures are set to gap down into Tuesday after printing a slightly abnormal globex range. Heading into month end we have relatively light economic calendar. At 9:45 Chicago Purchasing Manager data is out and at 10am Consumer Confidence. Tomorrow premarket we have the ADP Employment change which some may consider relevant for gleaning insight into this Friday’s Non-Farm Payroll data.

Price managed to work just below Monday’s low before finding buyers overnight. Yesterday we printed a normal variation day after opening gap up. The last 2-3 weeks have been a neutral, fast, range and we are trading in the lower quadrant of last Wednesday’s trend day down.

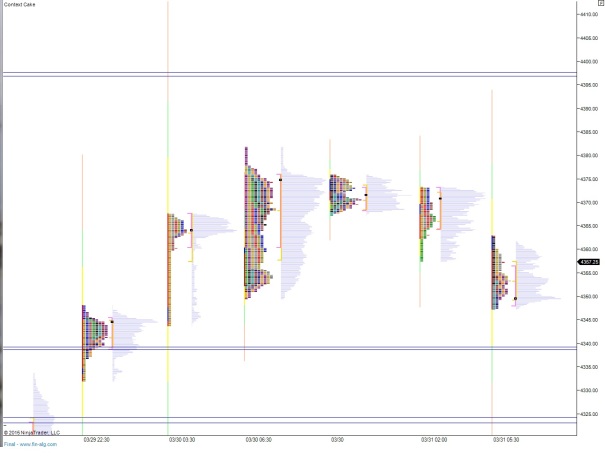

Early on my primary expectation is for buyers to attempt to push into the overnight inventory and test up to 4365. From here I will look for sellers to come in and work down below overnight low 4347.25. If buyers do not defend at 4338.75 then look for a weekend gap fill down to 4327 otherwise look for trade to balance out around 4350.

Hypo 2 is buyers push up through 4365 and work an overnight gap fill up to 4374.25. Then I will look for them to continue pushing higher above Monday’s high 4381.75 to target a move up to 4397.25.

Hypo 3 is a gap fill up to 4374.25 then sellers push back down to test Monday’s low 4349.50 before we balance out.

Levels in play are highlighted below:

If you enjoy the content at iBankCoin, please follow us on Twitter