Volume and range shot well beyond second sigma overnight. This is a clear signal that what you are seeing taking place in the markets this morning is anything but normal. The primary driver of this volatility was forex macro moves resulting from an unexpected move by the Swiss National Bank.

Also occurring overnight was a move higher in oil. This morning the markets are dealing with more earnings from big banks who one after another are seeing share prices lose value post earnings. BAC is trading lower as is C although Citi is currently holding its prior lows.

At 8:30am the economic data including initial/continuing jobless claims, PPI, and Empire Manufacturing brought in some buyers who were quickly faded. This afternoon after market close we will here from INTC while the entire semiconductor industry teeters on the edge of a breakdown. We also have many more banks set to report tomorrow morning and CPI before market open.

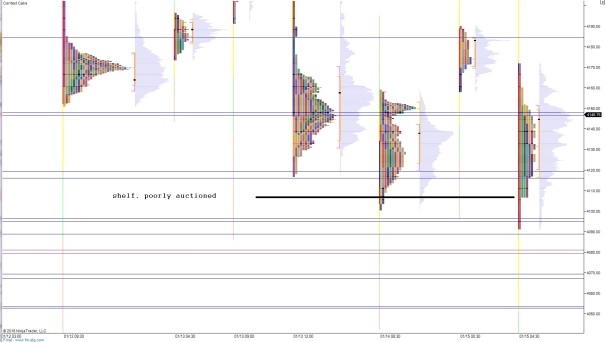

Turning our attention to the auction, we can see some weak shelving occurring right at 4106.75. This level will be a big tell today. My initial expectation is we ‘spill over’ the shelf which opens the door for a test of the overnight lows which puts us in range of testing the prior swing lows and the Nasdaq on the cusp of breaking lower. See the context below:

The intermediate term shows sellers controlling the market.

Yesterday the market continued trading lower until we closed to open gap from 01/06. Once we hit these levels a sharp buying response took hold and saw some continuation off the value zone around 4118.75. Buyers were unable to push through the early highs of the session during the afternoon ramp but did see their progress carry through into the overnight session.

The overnight session carried over 100 points of range and as we approach cash open we are trading right near the midpoint of that range. Early on I am looking the yesterday’s VPOC at 4138 as a short term pivot. If sellers can sustain trade below this level that adds confidence to my primary expectation for trade to take out the market profile shelf at 4106.75 (seen above).

Hypothesis 2 is strong buyers off the open who take out yesterday’s session high 4159 and continue probing higher into the volume pocket at 4171.50 and a continued auction higher to target overnight high 4190.

Hypo 3 is a slow open auction inside yesterday’s range and then 2-way chop between 4171.50 and 4118 which eventually gives way lower during the lunch hour.

I have highlighted these levels on the following volume profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

just thought I’d pop over to say “Hi”, Sir Raul..

sitting here watching this market has been such a joy, yeah my sweet azz. I’ve reset a few of my positions that I’ve posted trades here on your blog so thought I’d just let you know in case(anyone) is curious.

sold my 3’s and mid 2′ on ARO and now hold position last ins purchased on 2/17/2014 at $2.18(did not post entry, sorry)

reset a few biotechs one of my favorite oldies Disco duck and now hold position last ins purchased on 12/09/2014 at $1.16

also took nice size gains off ISIS from scoop acquired 05/07/2014 at $22.97(posted entry) and another oldie fave SNSS scoop acquired 10/10/2014 at $1.07

just yesterday I added back share of SRPT at 11 and change(have traded this a thousand times in 2011, 2012, 2013, 2014.. Posting 99% of all entries and exits here and on the pages of pickr..

Took more profit yesterday at $32.67 from 11/25/2014 entry of $19.87 UVXY.

**Who Say’s You Can’t Hold these instruments longer than a day?**

I had already taken a +50% gainer posted in mid Dec. if I had been watching closer I would have added back those profit taking shares(cost avg up off those $19.87) when it trailed back down to the low 20’s but I did ‘NOT’.

sale yesterday was at $32.67 for +64%

here:

Symbol UVXY

Description PROSHARES TR II ULTRA VIX SHORT ISIN #U

Shares *

Price 32.67

I took position in CREE for the first time since 09/22/2011 where I hold a very small core position at $29.25

here:

Symbol CREE

Description CREE INC

Shares *

Price 29.84

last but not least I have dbl positions cost averaging up on two of my Older energy holdings.

COP last acquired 2/25/2010 at $36.45..Check that shit out..YUP!!

and

XOM last acquired 7/21/2010 at $57.79.. and that, too!

Why the h#ll NOT?

made numerous other moves as well..quickie plays.

Getting very close to selling LULU and watching RVLT trailing back down to last in entry of $1.17 (would most certainly like to add back some of the 10k, half position, taken off just recently)

Watching the homebuilders and am very much considering cost avg up on some of my holding in that sector, as well, going back to the autumn of 2011.

Sorry this beyond LOooong winded post.

Stay safe out there all you beautiful people.

http://youtu.be/JZmbO6BQhWU

^that one’s for Chess..

😉

On a very interesting side note..

I hung out, briefly, with Dan Gilbert – Chairman and Founder, Quicken Loans Inc and his excessive entourage.

He is a very powerful and ‘Little’ man, as in a foot and a half shorter than me..

net worth at abot 30 BILLION Buck~a~roos..

I asked him, “How’s business going?” with a ((HUGE)) grin on my face.

This is the honest to ‘GOD’ truth..hahahaha

Sooz livin’ the High-roller life..

NOT!

Just interesting, that’s all..

this was just last evening..

oops on the typo’s up there..^

one very last note, promise.

Out of all due respect..

I did post those entries real time on COP and XOM on the pages of pickr..eons ago.

just wanted to make that point since there are many new iBCers out there that may question those entries.

I have mentioned core enteries here in the past although it has been some time.

HI SOOZ!

Hey You..

😉

Thought I’d show a quickie..

need to thank Chess for this one..although he traded out from a day or two before as it sold off I traded in..dang!

And that AZZWIPE Mr. P, who only makes $$$ all day every day, was all over it (uh~huh?)

Most Parts of this Industry and those involved make me question the sincerity..Too many “Lyng Sacajaweas” out there..yup!

(albeit..it is still very entertaining to read the 150 ST posts, one per minute..No SH!T, per day)and knocking shit out of the park while doing so..hahahhahahah

01/12/2015 YOU BOUGHT CREDIT SUISSE NASSAU BRH VELOCITY SHS 3 (Cash)

Symbol UGAZ

Description CREDIT SUISSE NASSAU BRH VELOCITY SHS 3

Shares *

Price 3.5899

——————————–

01/14/2015 YOU SOLD CREDIT SUISSE NASSAU BRH VELOCITY SHS 3 (Cash)

Symbol UGAZ

Description CREDIT SUISSE NASSAU BRH VELOCITY SHS 3

Shares *

Price 4.8301

Sure this was a nice trade but pales in comparison to the draw down on some of my long term investments..

It has not been an easy market for months now. I feel certain we can all agree about that unless you are a “Lyng Sacajawea” , of course.

“LYING Sacajawea”

D@mnit all..

oopsa there!

He’s really only worth three billion..

😉

Oh wait..

I stand to be corrected once again..

Forbes is telling me that his, Daniel Gilbert, Real Time Net Worth is

$4.3 Billion

As of 1/16/2015 @ 12:15PM

😉