Nasdaq futures turned in a relatively normal session overnight after drifting higher a bit during the shortened Labor Day session. As we approach cash trade in the US the Nasdaq futures are trading up about 7 points.

The only major economic release for today is slated for 10am when ISM Manufacturing and Construction Spending data are released. Looking out on the week, we have Factory orders and The Fed Beige Book during tomorrow’s regular session. Thursday we have an ECB rate decision before market open with a Draghi presser and US Jobless Claims. Thursday we also have ISM Non-Manufacturing composite. And finally Friday before market open we have Non-Farm Payrolls and Unemployment stats premarket, arguably the only economic data point worth observing aside from The Fed.

On a long timeframe, looking at the monthly volume profile prints, we can see how much progress was made during August. Much of the thin profile makes sense if you consider how well the prices we auctioned back in July. However some prices received very little consideration and might welcome a retest at some point in the month. See below:

Looking at the intermediate term, we can see the market beginning to come into balance although buyers still control this timeframe. The value migration higher began to slow last week. Overall the structure just below current prices is well-auctioned and likely to provide support in the short term. If we push down through it however, it would then be considered an overhang of supply. I have noted the key intermediate price levels below:

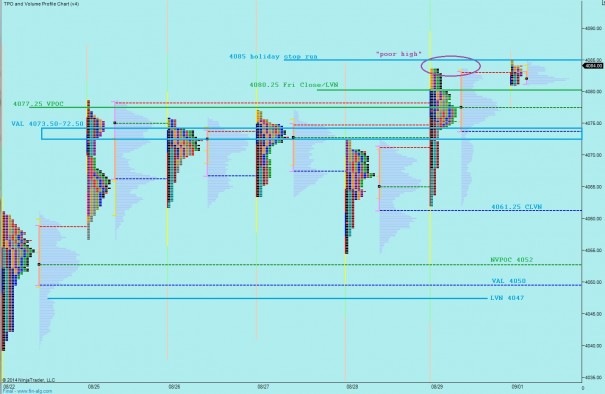

Finally, I have marked up the market profile with short term levels I will be observing today. One piece of context which gave me confidence to press long through the weekend was the high on Friday. This was a prime example of a poor high, one vulnerable to be taken out. I will likely merge the small Monday auction into Friday’s profile, but kept them separate for us to observe the poor high:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 1 – sellers push off the open to close the range gap to 4085. Responsive buyers arrive and make an attempt for overnight high at 4096. Price takes out overnight high and is met with initiative buying before settling out and balancing near 4100 century mark

Hypo 2 – sellers push down through overnight low at 4080.75 and close Friday gap to 4080.25. Selling momentum carries price down to VPOC at 4077.25. Another rotation down takes us to VAL 4073.50-72.50 where responsive buyers are found and we balance out near 4080

Hypo 3 – drive higher off the open, gap and go higher, take out 4100 early and sustain trade up near it before anther leg higher

Hypo 4 – buyer push off the open, failed auction just above overnight high 4096 and then a strong responsive sell back down through Friday VPOC at 4077.25 which sets up a break through VAL 4073.50 and a test of CLVN at 4061.25