Futures are lower overnight on above average volume. The largest impulse rotation occurred around six AM and futures have since shown little bounce. The price action was able to take out prior swing lows from August 1st. Swing highs and lows are rarely set during the globex market, thus we might expect these overnight lows to be tested once the cash market opens.

The economic calendar is quiet for US trade mostly, however we do have Crude Oil inventory data out around 10:30am.

Prices are currently trading outside of yesterday’s range which suggests participants rejected the aggressive balance formed on Monday and Tuesday. The question we must be asking ourselves throughout today is, “Is the market done finding buyers?” If we do not see any strong reaction from buyers today, then the market is likely to continue exploring lower until it finds such a demand.

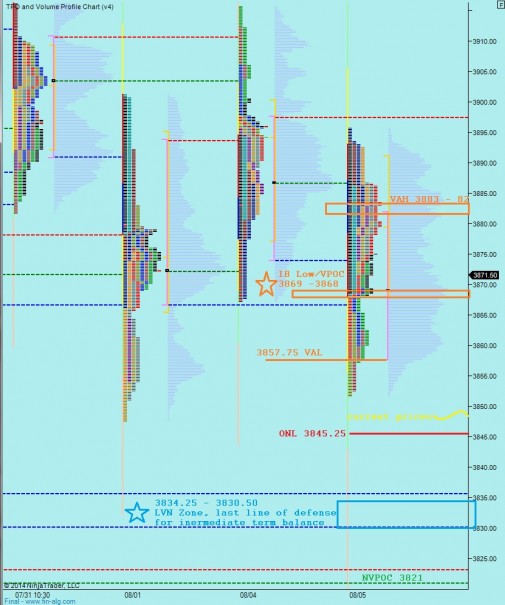

I have marked up the intermediate term prices on the following volume profile chart. We are trading down in the thin tail of an intermediate term balance dating back to the start of July. With prices making news lows early today, the argument can be made for a shift into intermediate term seller control. However, we should first observe how we open, see below:

Finally, I have marked the short term levels I will be observing on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

opening swing /NQ_F 3848.50 – 3842 open auction outside of range

Open Auction Out-of-Range: market opens outside of the previously traded range. There is a high probability of other time frame action and these can be big days. There will be a higher level of conviction by responsive as well as initiative buyers or sellers.

sustaining trade above this IB LOW/VPOC can entice a major squeeze. KEEP THE LEVEL close it is your morning pivot

Good call.

thanks

I went long this morning for a trade. We need a bounce before I short some more. My two cents

working off the oversold conditions, sure, I was just telling The Pelicans about how sellers are still perceiving prices above our intermediate term VPOC (the price where most volume has traded over the last 27 sessions) as a premium and are willing to sell above 3889. It’s the red volume line on the blue chart above. Still finding conviction responsive selling up there

I agree we are on the same page.