The Nasdaq is up about 5 points ahead of the US cash open after a slow grind higher of an overnight session. The major economic news overnight came from China who released CPI and PPI data both of which came in below expectations. Here in the USA, we have crude oil and other energy data set for release at 10:30 and then a 2pm FOMC minutes release.

If we open where the market is currently priced, then we may seem some sharp moves off the open because we are in a very thin pocket of volume left behind during yesterday morning’s liquidation. It will be interesting to see if responsive buyers show up to defend the overnight drift when the cash market opens.

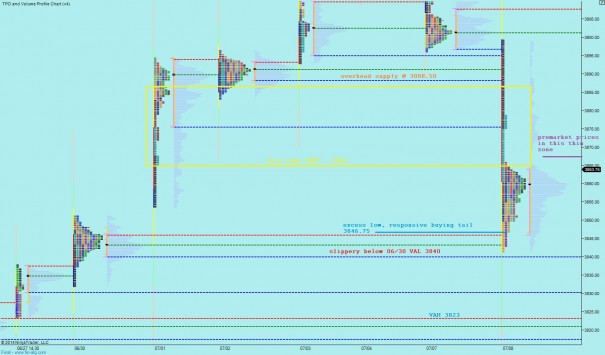

Yesterday the process of establishing balance accelerated. Price moved sharply lower to entice responsive buyers to participate in the market. The elevated prices prior to the selling were deemed unfair short term and the balancing process began on the intermediate term. All of the upward progress achieved at the start of the quarter was tested and the gap which started the month/quarter was filled. Markets abhor a gap, thus seeing it back-and-fill is a net positive for the overall structure of the intermediate term. The market was trying to test the conviction of last week’s buy flow, to see if a strong bid truly existed at these prices. It did a good job, as you can see below responsive buying showed up. Whether buyers defend again today or progress higher will help us understand if we are truly coming into balance intermediate term or whether more selling is needed. I have marked the relevant price levels below:

Short term we can see the sharp rejection of higher prices. We opened near the bottom of Monday’s range and rejected and reversed lower. After that it was off to the races until we saw a strong enough reaction. Sellers were able to extend the initial balance range for an hour and a half after the initial balance suggesting liquidation was occurring on a longer timeframe. However we did see buyers coming in. The market is doing a really good job finding participants which leads me to suspect we come into balance on the short term. This hypothesis is contingent upon holding the VAL from June 30th because below there we have the possibility to slide. I have highlighted this support and other observations on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

hypo 1 – test higher to LVN at 3875.25 and find responsive sellers before rotating lower to fill overnight gap to 3863.75

hypo 2 – press higher, through LVN at 3875.25 to 3882.75 and balance up here ahead of afternoon FOMC meeting

hypo 3 – test lower to overnight gap 3863.75, small rotation higher and then continue rotating lower to VPOC at 3859.75

hypo 4 – drive down through overnight gap 3863.75 and VPOC at 3859.75. continue lower to test buying tail at 3846.75

Do you own YELP ? and what do you think here ? Thanks.

I don’t own it, I really want to own it but the weekly chart looks a little HnS-y

like a perfect mix of hypo 1&2 today