The Nasdaq continues to experience balanced conditions in the short term. Early this morning we saw a wave of selling come through the market right around 4:30am when we had some speakers in London as well as UK loans for home purchases data which came in better than expected. The selling found responsive buying just below our low of the session yesterday and we quickly snapped back to the other side of balance. As we come into the USA cash session futures are currently up just over one point.

The economic docket for today shows Cash-Shiller home price index at 9am followed by New Home Sales and Consumer Confidence at 10. We have some treasury auctions taking place at 11:30am and Fed speaker William Dudley at 2pm.

The overnight profile has changed form slightly, the shelf which I was keen on yesterday was disrupted overnight and as a result we now have a more balanced-looking profile. The spill over the shelf last night carries a bit of expectation for accelerated prices to the downside. Thus, seeing a responsive buyer eager to purchase at a perceived discount gives buyers a bit of conviction here. There is not much need to observe the overnight profile, more important is to observe any price action if we trade below the overnight low at 3783.75. Should we revisit this level and not see a similar response from buyers that might reveal a change in the context of buyer conviction.

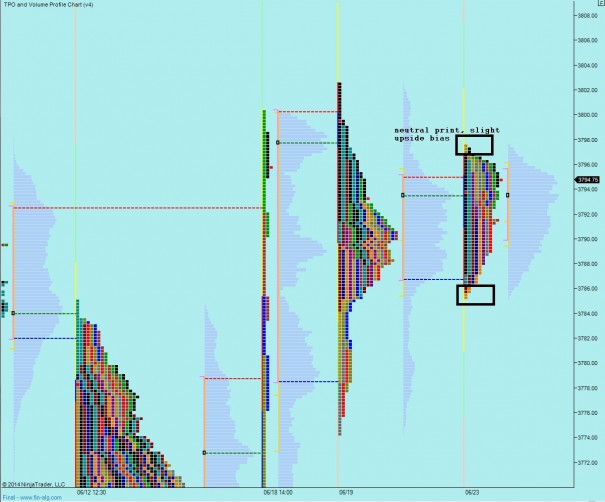

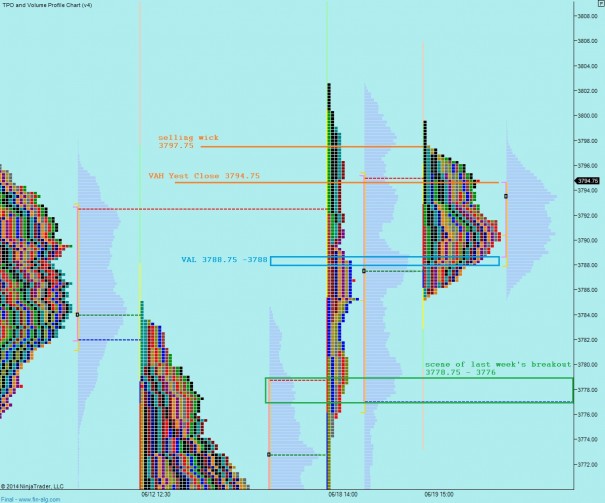

Below I present the daily market profile first before then after splitting and manipulating the distributions. Yesterday was a neutral print with a slight upside bias which suggests a decent amount of conviction on the part of the buyers, especially since their range extension was the second one and they defended the move back to the mean. The second chart gives us clear short term levels to work with today:

Buyers are in a position in the intermediate term to drive higher. If they cannot however, this entire upper distribution might be called into question by the market and a sharp rejection candle lower may be the final result. Keep that in mind as the week progresses because sometimes we glean much insight from the market when it does not behave as we expect at certain junctures.

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 1 – small test lower to 3792 then drive higher taking out globex high 3807.25

Hypo 2 – test lower, down to value area low zone 3788.50 – 3788, find responsive buying back to 3795 and continue balance

Hypo 3 – test higher to selling wick at 3797.50 then find responsive selling down through value area low 3788 to target overnight low 3793.75. Secondary target for liquidation is 3778.75