Nasdaq futures are currently priced to gap lower about 10 points after a wave of selling took out Tuesday’s opening swing low at 3606.50 around 6am. The selling accelerated at 8:30 when the PPI numbers were released. As price currently stands, we are set to open out of value and out of range suggesting the short term is out of balance and the risk environment is high.

Risk of an opening drive is elevated today, especially given the big gap left open from Monday’s open. The stakes are high because not only are we inside of option expiration week, but we also have prices on the Nasdaq which are attempting to escape intermediate term balance. Paramount to achieving this is printing a higher low on the intermediate term. I have roughly chosen 3595 as the price where I want to see signs of responsive buying. If they do not show up, we could be in for a fast liquidation trade because mean revision will set in and the short term profile structure below us is thin. Here is a picture of the intermediate term balance with relevant price levels noted:

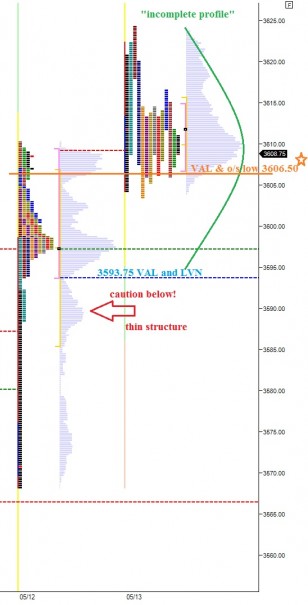

In the short term auction, yesterday was a neutral print with range extension on both sides of the profile. These prints tend to occur at or near inflection points. The profile shows responsive selling coming in soon after we range extended higher and taking out the lows. The rest of the action was spent printing volume in the bottom half of the profile which made for a saggy look. My expectation was for price to balance out this profile by trading down to 3595. I did not however expect to be waking up to these prices. Buyers continued migrating value higher yesterday which tells me the short term auction was still buyer controlled as of yesterday’s close. I have annotated the market profile below:

Scenario 1: market tests lower, finds responsive buying between 3595 – 3593.75 and begins rotating back to VAL 3606.50

Scenario 2: market tests lower, takes out 3593.75 and accelerates lower- opening drive down

Scenario 3: market tests higher finds responsive selling at 3606.50, balances out above Monday VPOC 3597.50 and then goes for overnight gap fill to 3608.75 then VAH 3614.75

If you enjoy the content at iBankCoin, please follow us on Twitter

scenario 3 in play, stopped out my GOOG