Yesterday was a tricky day in the NASDAQ. We ended the day slightly lower than Tuesday, yet the intraday action suggested buyers were making a bit of progress toward overpowering the sell flow we have experienced of late.

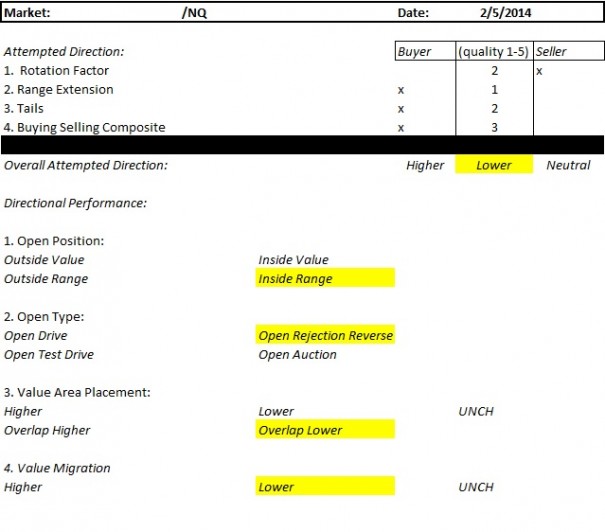

I had to run through my market report template to confirm what I had been speaking about yesterday. This template helps me answer the two basic, sweeping questions that stem from the market’s ultimate purpose in facilitating trade:

Which way is the market trying to go?

and

Is it doing a good job in its attempt to go that way?

Here is the template:

Yesterday’s market was attempting to continue lower in the morning but responsive buyers were found below recent swing lows. This resulted in the snapback rally we saw intraday that was perhaps fueled by POMO. As a result, even though the market was attempting to go lower, however volume dried up and responsive buying took hold. Now we have a floor to work with and the auction pressed higher. Buyers managed to take control of the day timeframe.

The intermediate term control is still in seller control. This can be seen as a series of lower highs and lows best seen by tracing the migration of value like I have done on the following volume profile chart:

Long term control is still buyer dominated, but becoming more questionable. The daily chart no longer shows a series of higher lows. Instead one must take to the weekly chart to see buyers still controlling the long term trend. I will call this control into question if price closes below 4000 on the $COMPQ on a weekly basis.

Overnight we have seen higher prices in the NASDAQ, however as the USA comes online the prices are fading a bit. The key level I will be watching today is 3435.75 on the /NQ March contract. This level printed a very low volume node on the buyer snapback rally. If it holds, it would suggest a sentiment shift, and buyers showing up again at the scene of their reactive buying. If we sustain trade below it, it will become apparent another leg lower is materializing. I have highlighted this level on the following volume profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

I enjoy reading your market analysis each morning. I like hearing updates about Elroi too. Good stuff all around!

Ditto that^