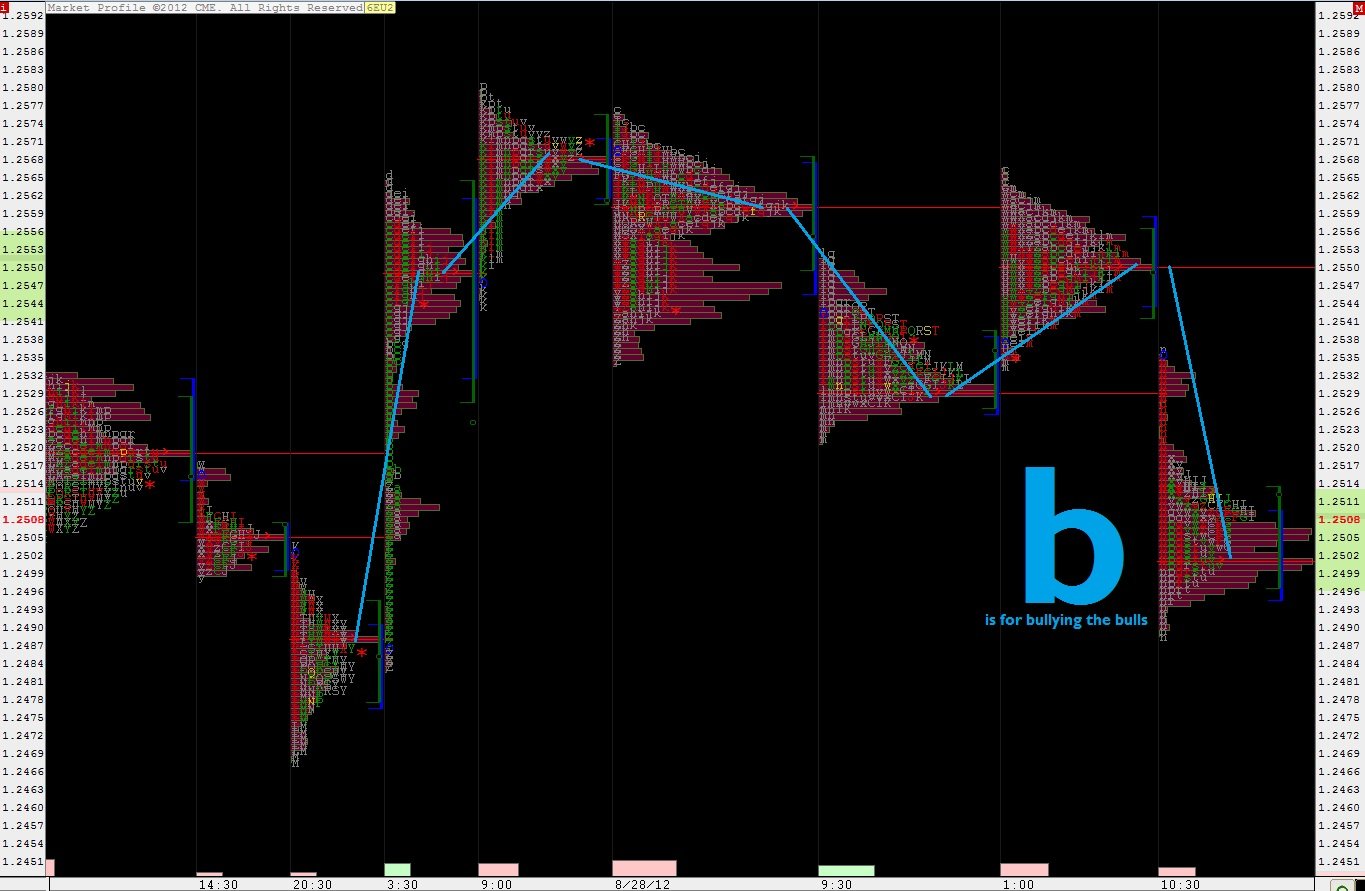

Just as technicians define recurring chart patterns on their price charts, so too profilers attempt to gain insight by spotting a picture. However, they’re not as clever it seems, opting to name the following setup to define exactly what they interpret the activity to mean. Behold, the long liquidation:

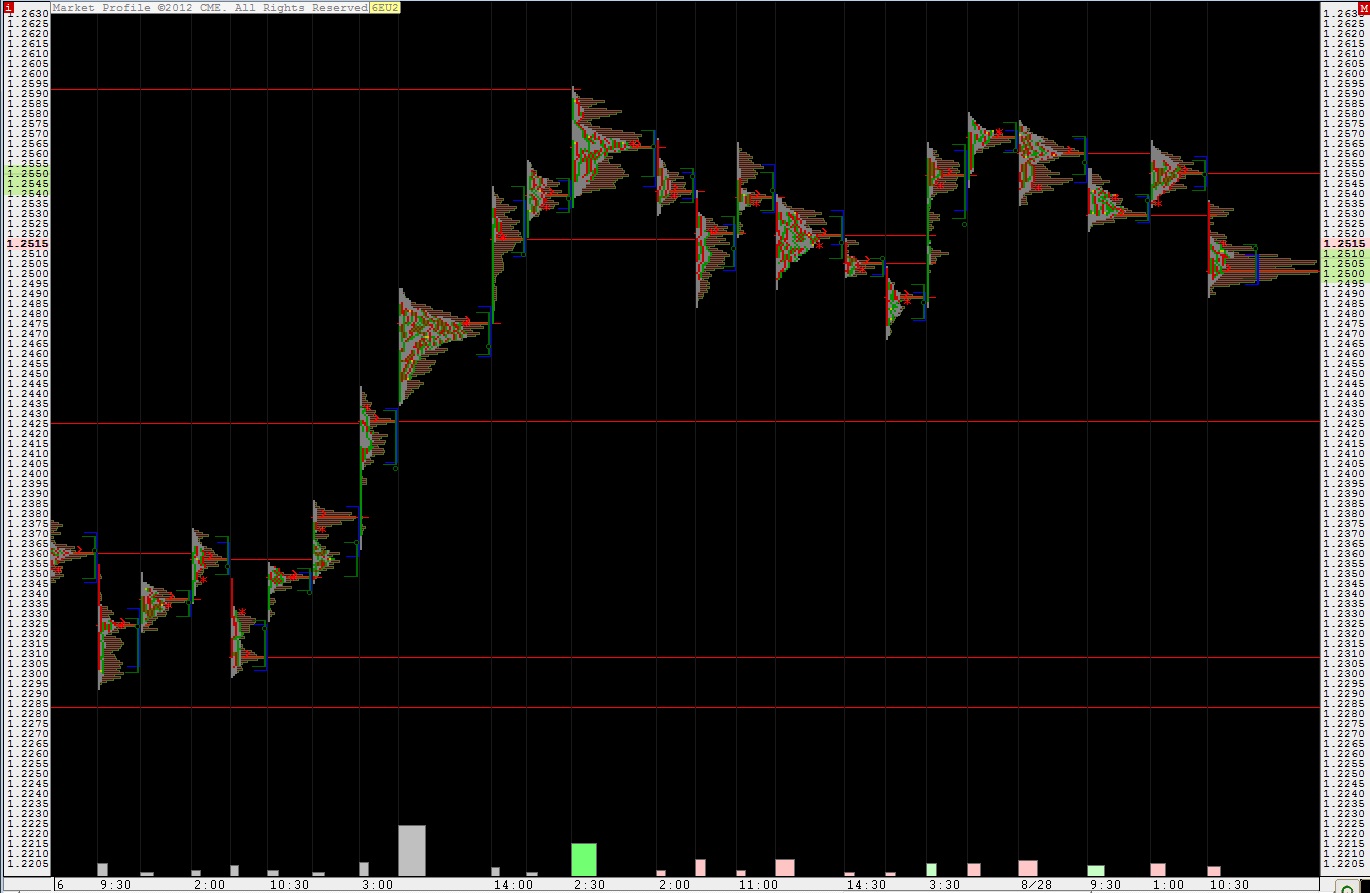

A long liquidation resembles a lowercase “b”. Where the setup occurs in the context of prior profiles gives additional meaning. Observing the current market on a pulled back chart we see the Euro has been trending higher since working through a long consolidation of annual lows July-August. We put in a higher low on 08/27 but are yet to make new highs which would add significant conviction to the long trade:

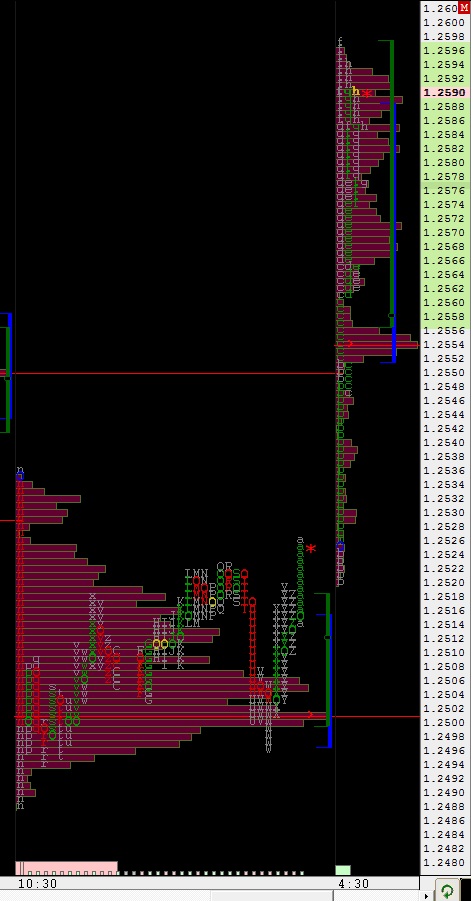

The idea behind the long liquidation is the same as a short squeeze; they’re a short term phenomena/reaction. The long liquidation can happen when the market gets “too long” and needs to rebalance the inventory. Once complete, one could expect price to continue in the direction of the trend.

A little bullying if you will, but without the beef to back it up. Get’em bulls. You could play a break of the bracket high and set your stop below the volume point of control on the long liquidation profile.

UPDATE: The move did indeed go higher. However, placing a stop below the VPOC of the LL profile would have resulted in a stop out prior to the move:

If you enjoy the content at iBankCoin, please follow us on Twitter