Let me just say, I cannot believe it’s 2023. The time flies and not in a very graceful way.

Here’s my take on week 1 of 2023.

It was rot up until Friday, typical of the sort of market we’ve endured for more than a year. The big leaders were in China: BABA +22%, PDD +17%, fucking BEKE +27%.

Airlines +11%

Gold +10%

Copper +8.9%

Aluminum +8%

Foreign banks +7%

Interesting divergence between copper and other materials and oil. For a long time they traded in sync; but recent weakness in oil and gas has caused a divergence — with oils lagging and stocks like FCX, X, and CLF surging.

On the issue of gold: I believe it has filled the void the SHITCOINERS left behind with their disaster. Is gold done going higher? If this is a legit breakout — hardly. Here are seasonal returns in January for AEM.

From 2014 to 2017, gold socks commenced sizable breakouts in January, much more than the current +10% gains.

Interestingly, there is a tight correlation with gold and rates. As you can see below, as TLT goes — so does AEM.

I’d argue TLT is way ahead of itself here, with limited upside potential. Who are we kidding — inflation isn’t dead and the Fed are not going to slash rates just to save some fucking retards leveraged long NFLX.

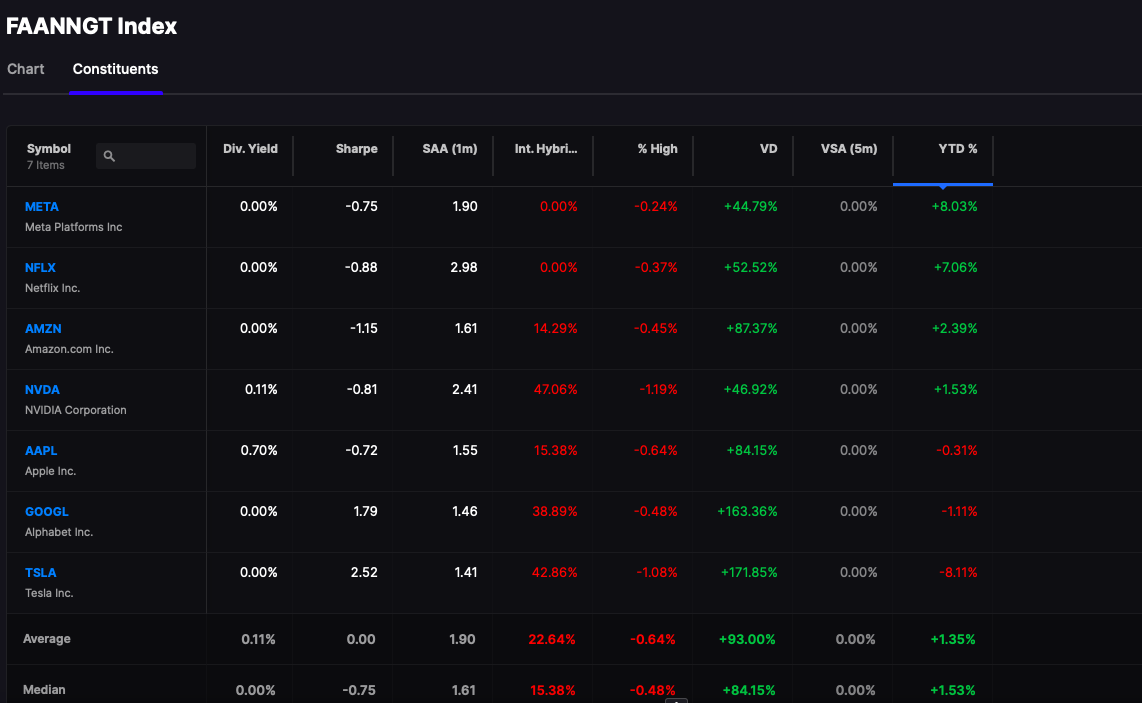

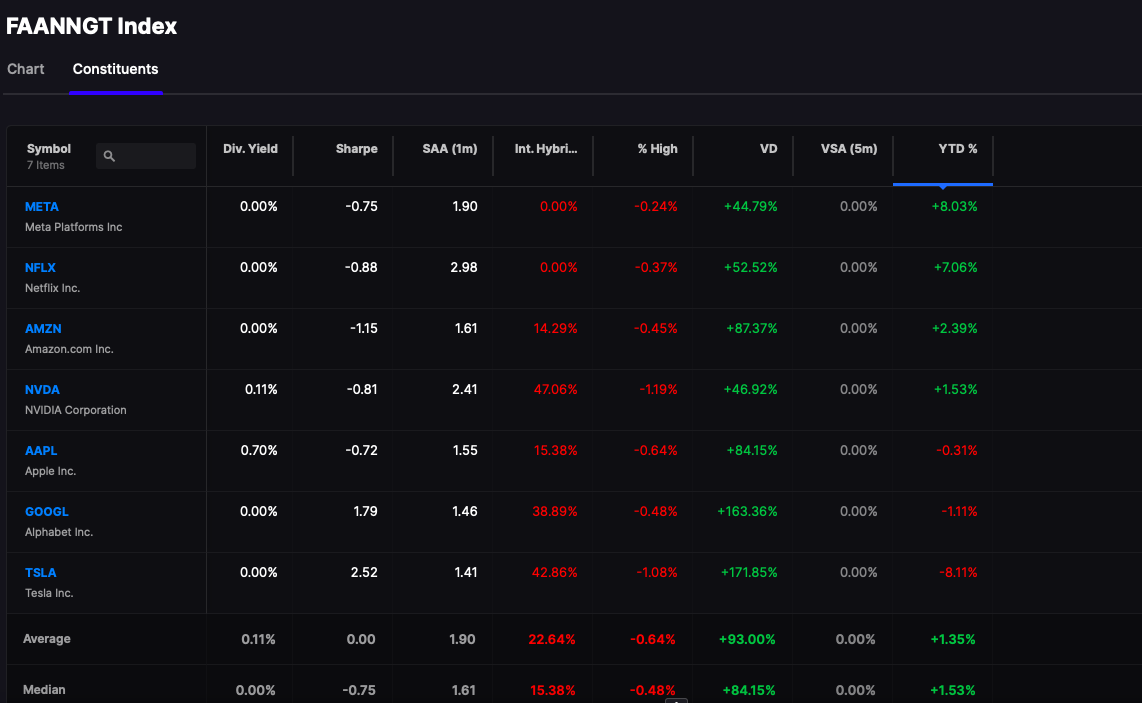

Regarding the FAANGT block of stocks — middling — with outperformance in META/NFLX and woeful underperformance in TSLA — as monsters like Bill Miller sell it short.

If I didn’t have a brain and only glanced at the price action of stocks for the first week of January, I’d like it. Lots of industries jimmied higher, from retail to tech. The high growth cash burners DID NOT bode as well as real companies like WYNN (+13%) — which is a good thing. If we start next week strong again, I might just get out of my own way and stop hedging.

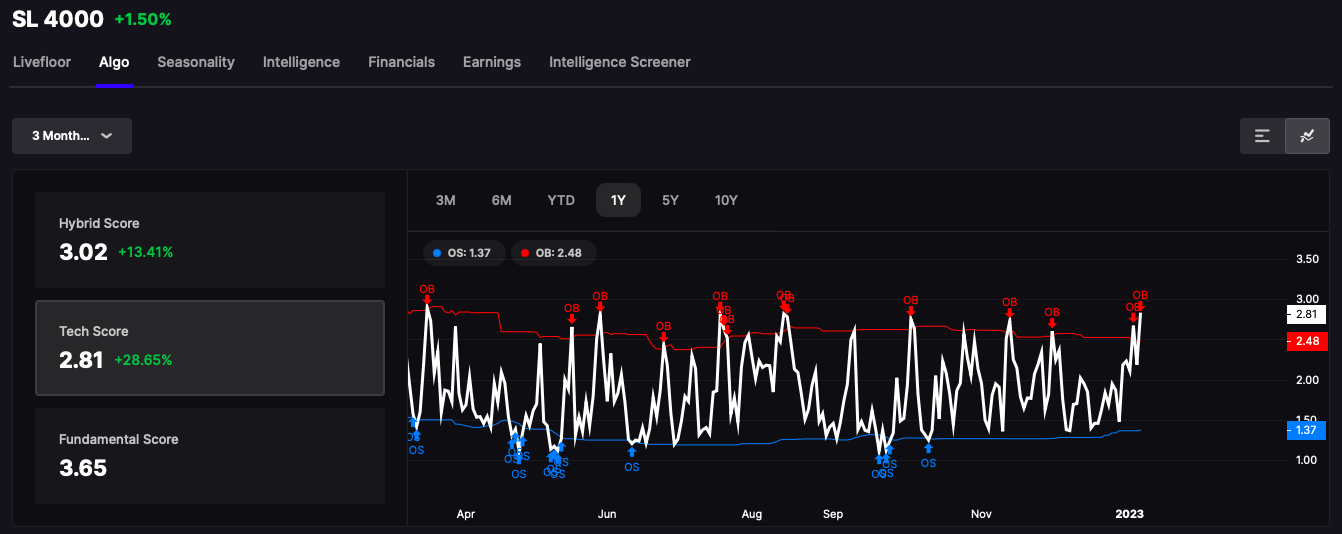

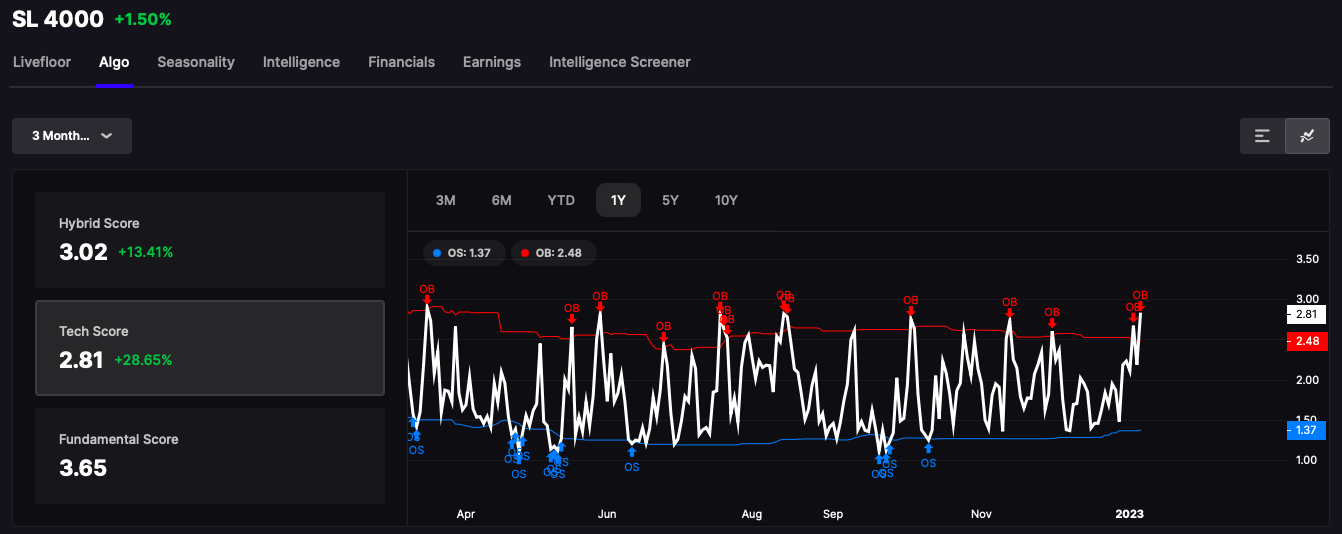

There is, however, an overbought signal inside Stocklabs now on our long dated mean reversion algorithm — which is foreboding. In the past, the OS was a buy and the OB was a buy — because stocks always went up. But over the past year of bear, the OB was most definitely a sell signal — solidifying my thesis to be true that a bear market would in fact be actionable with the often ignored OB during bull runs.

My confidence level on any signal, including my own, is always met with suspicion. I don’t view this as some sort of holy grail, but instead a guide to the past and what might be in the future. But like Ebenezer Scrooge once found out, the future can be altered based upon some good deeds. Should we get some news that is BAD next week, we might very well continue to rally — because we’re at the point in the cycle where bad news is now viewed as good for stocks.

NEVERTHELESS, I activated my algo account, which has been dormant since October, to sell short stocks via SQQQ. God willing, I will be entreated with gains early next week — betting on the misfortune of others — snatching their gold chains and making them mine.

Comments »