I’d like you to think about what I am about to ask you over the weekend and then formulate a plan in the event it happens.

As you know the banks are under pressure now, not because the underlying assets of their govt backed bond have gone sour — but because the fucking Fed has gone from 0-5.25% in a year. For those new out there, when rates go up, prices of the bonds go down. So the bonds SVB was buying at 100 are now trading in the 70s, all thanks to Powell.

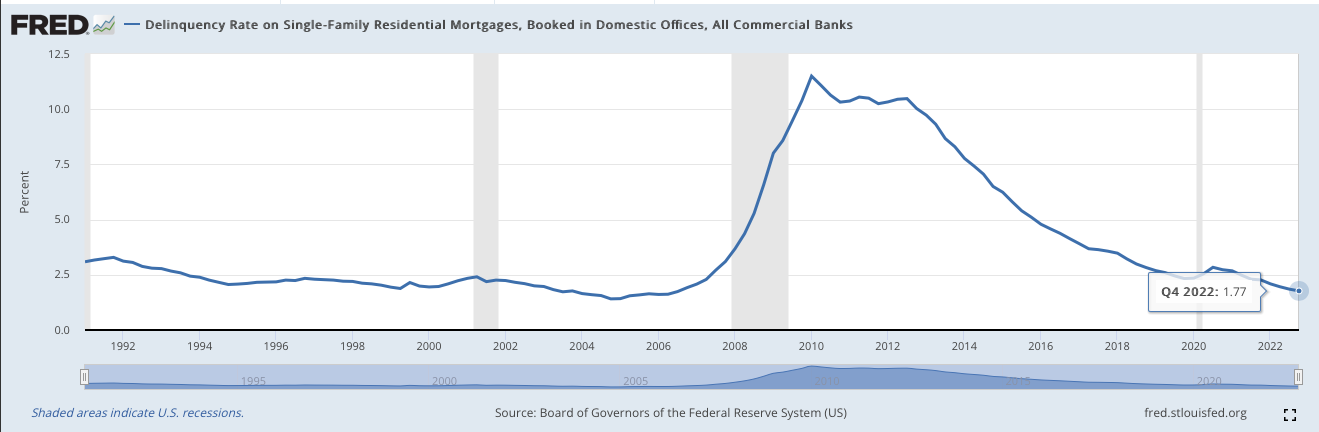

The important aspect of this entire scenario is — no one is talking about the underlying assets underneath those MBS bonds. Pray tell me, what do you think will happen to the price of those bonds if, for example, delinquencies rise to 5 or 6%? Would they sink again to $50, or maybe lower? How confident are you in the notion, if you will, the average pleb can afford a high interest rate car and home loan?

MOREOVER, and this goes without saying, what will you do when these pressures causes mass layoffs — the type of layoffs not seen since 2008?

If you enjoy the content at iBankCoin, please follow us on Twitter

Seems to me kicking that can down the road wasn’t the best choice. That snowball is getting pretty damn large! The system is as corrupt as corrupt gets. The average pleb is fucked plained and simpled, yet nothing changes and life goes on? I probably spend too much time on mountain tops questioning everything. I can’t see the future, but somehow with all the misaligned judgment and poor choices made everyday life still goes on. No endgame in sight

“all thanks to Powell”

Powell is a mob lawyer, a pleasant-demeanored presenter, a disposable tool; he’s not a decider. Anyway, your question re underlying assets is a good one.

But the elephant in the room is: what will The Mob do as we lose this war with Russia ..as the non-Israel mid-east bonds together with Russian and China and against the mob and the dollar? Does the mob have a plan ..or should we steel ourselves for the spasms of a dumb wounded beast of a crumbling empire?

0% to 5% after more than a decade of free to easy money is a shock transition that finds the weak. Household debt has not shown to be the weak link yet because balance sheets are way better than 2008. Instead it is banks directly, thus far. So as rates continue to get upward pressure we can expect more weak links to appear, maybe MBS, maybe something else. The Fed won’t ease without a good reason this time. Be it recession and unemployment, one could allocate to bonds in view of a new rate cycle. A financial crisis would be more confusing and quick to play. The Fed is not done raising rates at this time.