One of Russia’s mistakes in the war is not understanding the level of hatred the west has for it. The west blew up their pipeline, sent men and weapons to kill Russians, and yet Russia continued to supply Europe with the materials they needed to survive.

Yesterday’s announcement of the Ukrainian – Russian grain deal ending topped off with missile attacks on the Port of Odessa might elucidate the thinking inside Moscow: total disconnect from the west.

If so, the duplicitous Turks will not be used to transit gas and oil into Europe. And if so, indelibly, Europe will freeze due to lack of natural gas.

This was always Russia’s trump card, but they were too soft to play it. I suppose they wanted their cake and eat it too. But this war has devolved and the rhetoric borders on pro genocide.

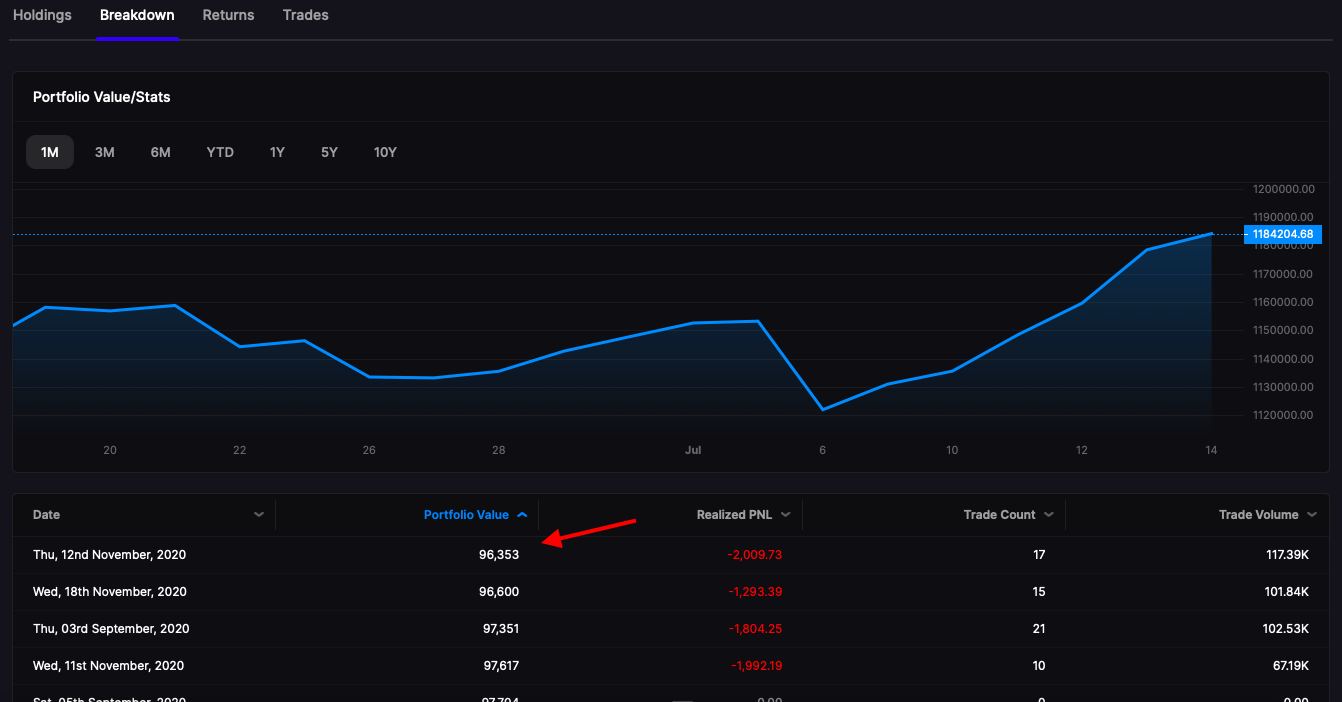

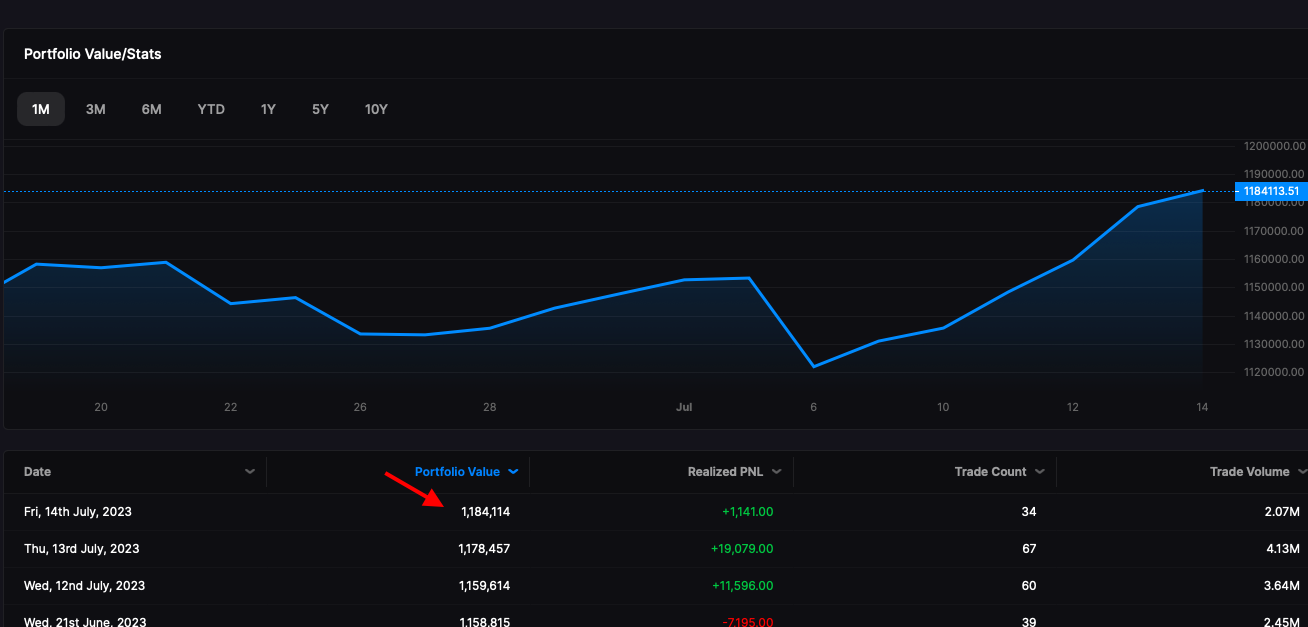

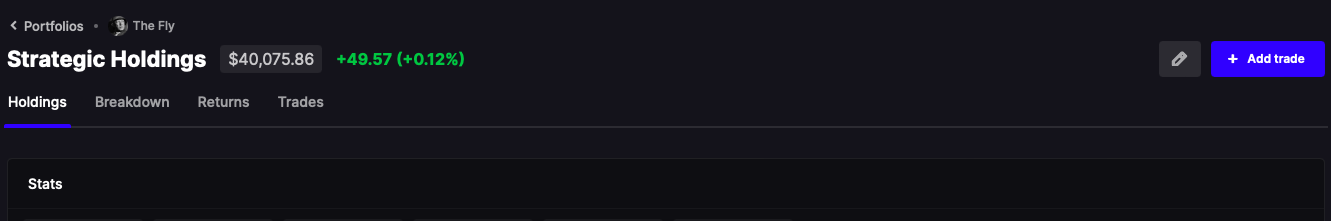

Markets are beginning to price this in today, with a major lift in fertilizers, drillers, coal, and anything commodity related. This trade appeals to me incredibly and I’ll be partaking in its bounty.

Comments »