A few random data points for this Saturday.

We are technically strong. Any ideas of us barreling directly to hell should be labeled as fake news and the sender executed for violating state laws.

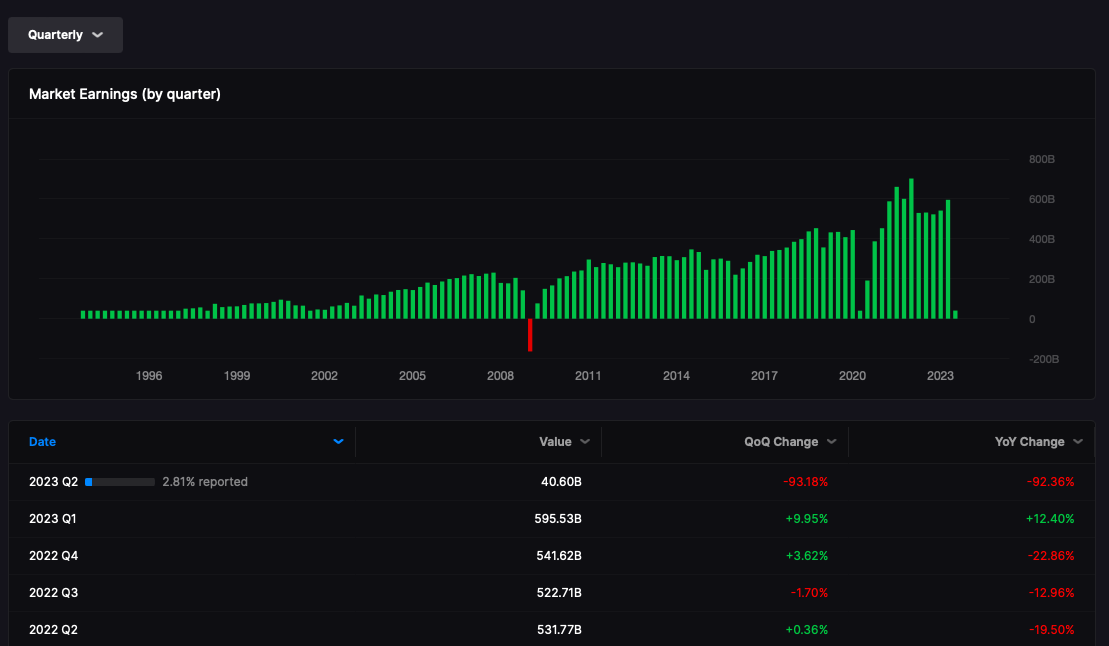

Aggregate earnings busted loose last quarter. It appeared, at the time, we were dying. But in hindsight — we were in the process of turning it around.

What are the lessons to be learned?

Inflation was caused by the fucking COVID stimulus checks you stupid piece of shits. The FOMC has been running gambits forever and never caused the type of inflation we saw last year. The only difference was the stimmy checks.

The Fed 100% knew this and used the cover of inflation to hike rates back to a normal range. Understand something, ZIRP was a major problem for central banks — because it prevented them from staving off MASSIVE COLLAPSE in the event it happened. So what they did was — they used COVID and the inflation it would 100% cause by sending the poors TRILLIONS in free money to get interest rates back to traditional levels.

Place aside your hatred for the Fed and please acknowledge the brilliance in these moves.

What are the net results?

People, for a time, enjoyed some money and for a moment had to pay $12 for paper plates. But now ordinary folk, especially retirees, can earn 5%+ in treasuries, effectively stabilizing many pensions.

The rate increases, for whatever fucking reason, did not collapse the economy. I am still trying to figure that one out. My hunch is the upper 5% is so rich now — the lower 95% no longer move the needle and are mostly chaff and/or slave cattle to be spent in wars and factory accidents.

Comments »