Life isn’t about outfoxing the next guy, via wit and ingenuity. It’s about offering a butterfly knife to your enemies eye, then BBQing it for a late afternoon snack. In other words, crazy people were shorting stocks last week, while me and my ilk were popping champagne corks like faggots at an art gallery.

I thrive off of adversity. I am not happy when things are going swell. It seems, I tend to ignore my own advice, in order to create custom made murderholes, built for men like me to dig out of.

Instead of hedging my bets, as discussed earlier, I bought more. I swear, sometimes I look at my moves and think “WTF did you do that for, asshole?” But, eventually, it all works out, like a sloppy Joe on a toasted bun.

My reasons for buying [[ERX]] : my balls told my brain and my brain forced my hand to click the mouse. Fairly straight forward, balls to brain indicator, if I might be so bold.

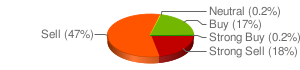

Today’s losses were fairly “chockful,” led by oversized scum bag stocks and whores represented by letters of the alphabet.

God willing, money managers will pebbles the size of cantaloupes will buy tomorrow’s opening decline. However, my end of day gut check suggests I am in for a fierce “punching off of the face” first thing tomorrow morning.

Comments »