I am trading miserably. I took a look at my positions, asked myself if given fresh cash today would I buy these stocks, and then I made wholesale changes.

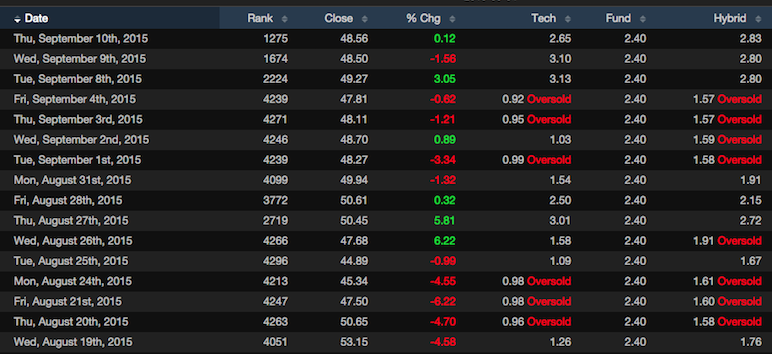

I sold ONCE (scared of the FDA), CYBR (what a dog!), partial YELP, HABT (SHAK is better) and all of EGO (what was I thinking?). With those sales, I’ve added to an already large cash position. I haven’t made any real money since June. This back and forth is tedious and I am wasting time and energy with these high beta names. Something is clearly wrong with the tape and until the tone improves, I am probably better off doing nothing.

I am sure as soon as the market starts going higher, I will be tempted to move back into stocks. Truth is, my timing has been off and my stock selection has been poor.

Trending stocks have been scarce and oversold bounces have lasted all but a few days. I will try to formulate a course of action soon. But for now, I am a man without a plan, in the wilderness, surrounded by savages.

Comments »