Fuck all of you guys bitching about lack of entertainment at iBankCoin. All of the clowns and all of the court jesters have been thrusted out from our confines. What you have left, walking these hallowed halls, is the Order of Men who are familiar with the speculative world that you endeavor to circumvent.

I’ve lost more money in a single week of drawdowns than you posers have in a life time of paper trading, trying to curry the favor of catamites looking for gurus on Stocktwits.

I have no interest in giving you insight, following a night filled of debauchery. Just know this, “The Fly” wins all the time, even when it appears he’s losing badly. I’ll recover from these hits; I always do. We will host the iBankCoin Investors Conference, whether you’re there or not.

It’s gonna be a great year, one way or another. I can’t let the negativity, that intends to suffocate me with its garish intentions, get to me. There is only one obstacle in my way to achieve unchecked success and Jeremy Bentham styled hedonism, and that is myself. Nothing is impossible, not even a Federal Reserve fueled rally that can rip and shred off the faces of every single bear alive.

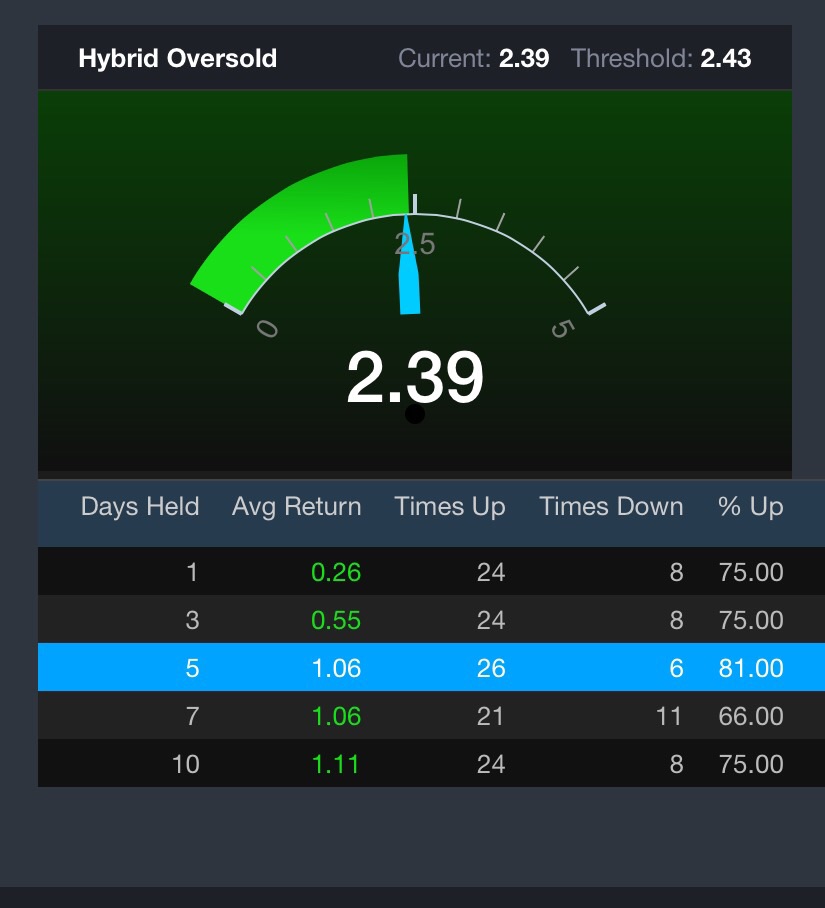

It’s time for a little mean reversion.

Comments »