I keep waiting and waiting for this fucking market to allow me the opportunity to dance on the graves of my enemies, urinate down on my foes from atop mountain; instead, all I get is this back and forth horseshit, with one clown car blowing up after the next.

It’s never cool for entire asset classes to disintegrate. The oil and gas implosion happened and I made very little noise about it–because my exposure was limited. Now the biotech sector is under seige; and again, I am laughing at it because I am not the one on the chopping block.

When the social media sector blew up for the first time, I was horrified by the outcome.

I know we’re all experts out there, sagely walking through this minefield of financial fuckery. I wouldn’t blame or cast aspersions upon any of you for having a rough go at it these last few years. This is a market to break gurus in half, shit them out, and flush them into the mouths of alligators. That was very disgusting. I know it. But that’s how I feel with this tape: utterly disgusted.

My bear blogger Bluestar is posting large picture of vermin, which is fitting. For the day, I’ll probably make some money; and in the past, I might’ve made fun of you for losing coin.

Not today. “The Fly” is turning over a new leaf with his readers, one with unparalleled understanding and comradery. For the time being, we’re all in the same boat, trying to figure out how to survive. Consider this a detente, a temporary ceasing of hostilities for the benefit of all.

Top picks: BIDU, SLCA, SHAK

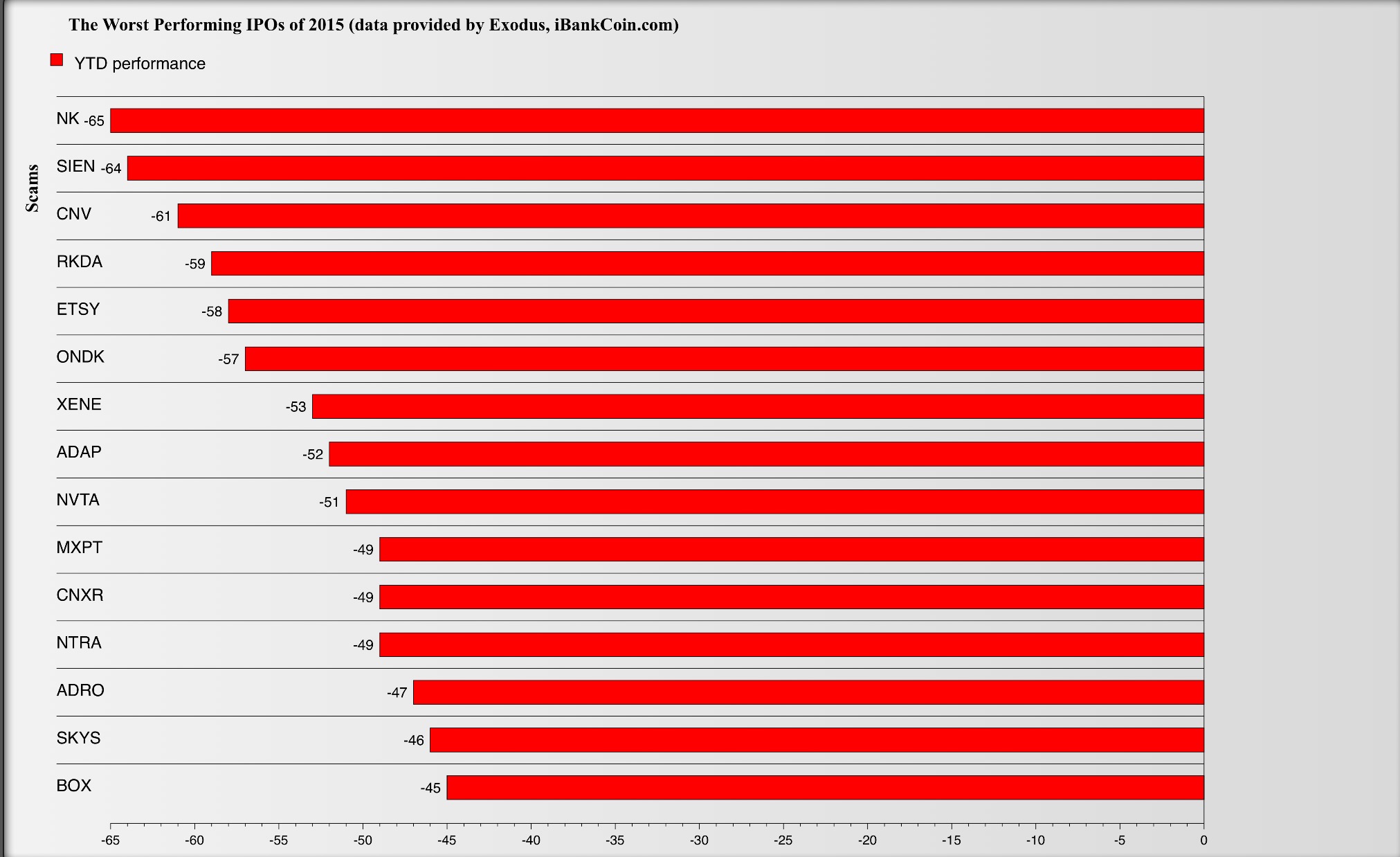

NOTE: Fred’s ETSY is at a new 52 week low.

Comments »