Before you throw yourselves into lit fireplaces, I want you to consider one thing: the entire country might, very well, go bankrupt one day. Aside from the mountains of national debt, $19 trillion and counting, our burgeoning oil and gas sector has about $250 billion, most of which is now low quality paper, thanks to the collapse in crude.

Just like when home prices collapsed, causing the underlying debt of those who financed that sort of shit to vanish, one could make a similar argument that the shale oil boom laid the seeds for the complete and utter annihilation of these United Steaks of America.

Let me explain.

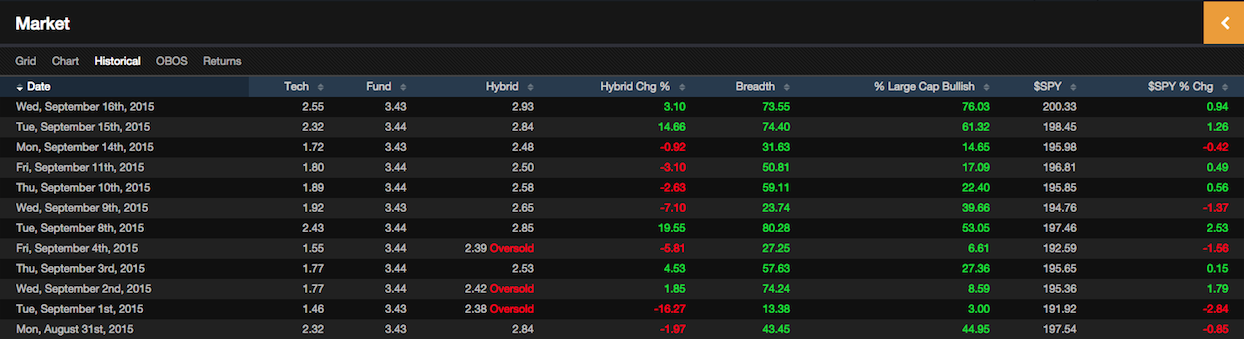

The credit crisis of 2008, actually started in 2007. Things got dicey and were quickly swept under the rug. As home prices continued to decline, the credit quality of that paper got downgraded, causing banks to take action, raise capital, in order to offset the write downs they were taking on illiquid, seldom traded, debt instruments. I suspect a similar scenario, albeit smaller, might be taking place now.

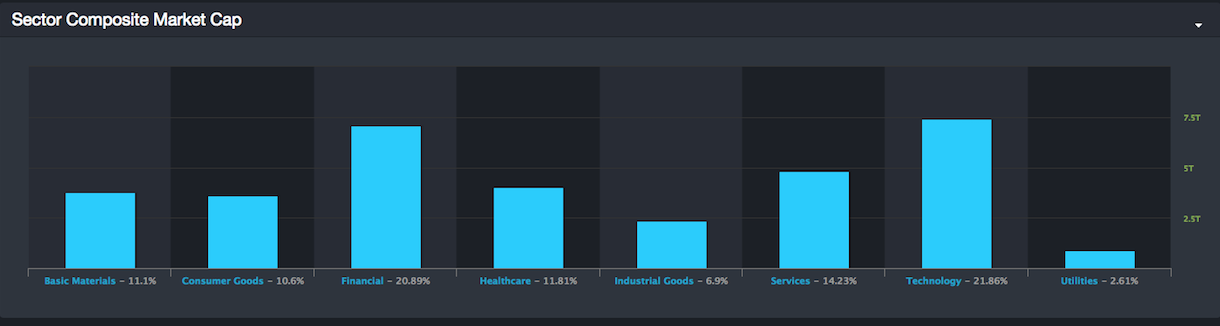

As that price of crude dives lower, the knife inside of CHK turns rapidly. Their guts are being mangled, strewn out across the ground. It’s only a matter of time before it bleeds out. If CHK were to go bankrupt, who is affected by it? I am not merely picking on CHK. This is a question that needs answers. Who owns all of that oil and gas debt?

How much does CFR, a Texas bank, own?

Within time, all of these questions will be answered. Since the drop in crude is somewhat fresh, I’m guessing the financial ramifications won’t be realized until Q1 of 2016.

Comments »