Italian stocks, led by banks, are surging today on news that a ‘bad bank’ fund will be established and launched as early as Monday.

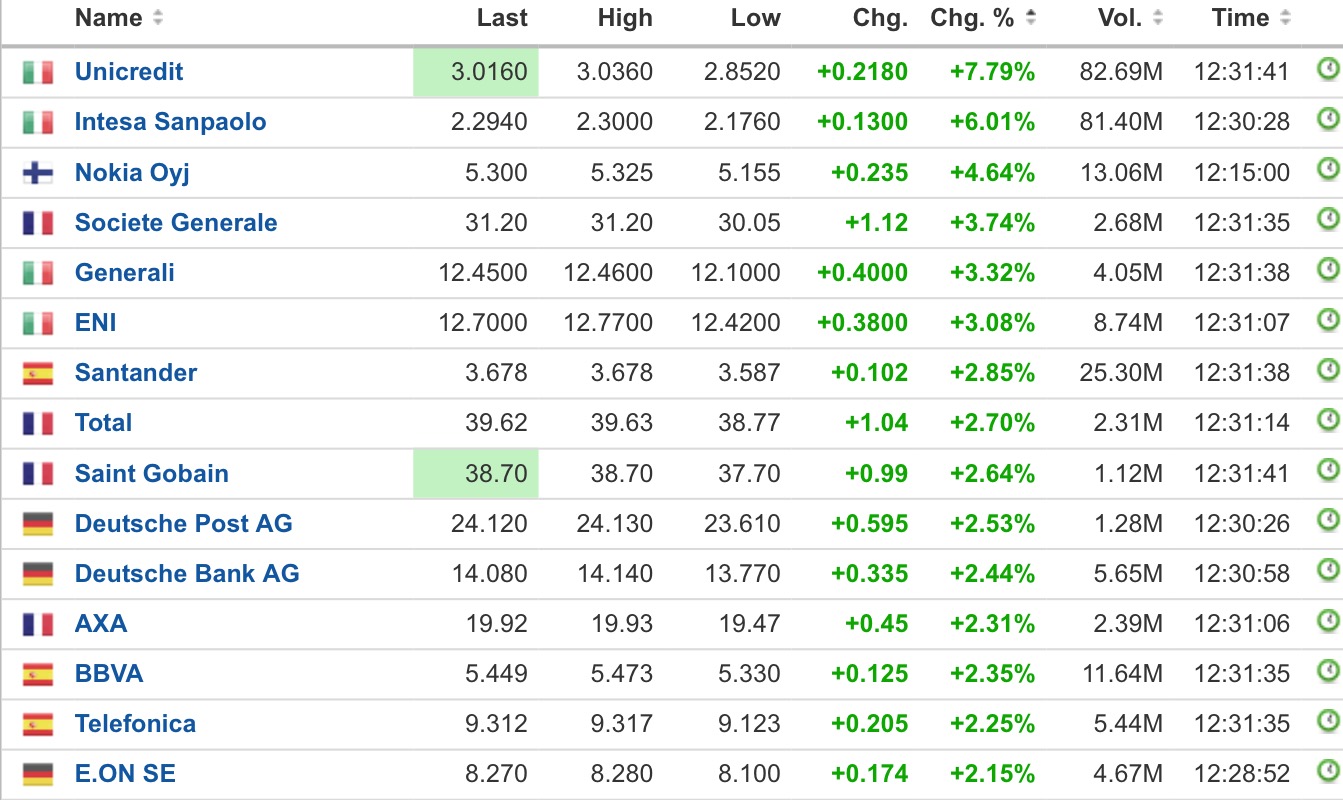

Here are the to gainers in the eurostoxx 50 now.

While this plan has been known for sometime now, it’s launch date was always in question. The fact that this Italian fund might be ready as early as Monday, investors are using that element of surprise to their advantage by roasting short sellers on the spigot.

Dow futures are up 85.

Comments »