Out of more than 200 industries listed in Exodus, just 4 posted negative results over the past month. Those were all in the drug sector, tethered to the obtuse racking of the biotech sector. The selling has been unrelenting and has greatly diverged from the rest of the market.

Interestingly, the top performing sector, by far, year to date, are utilities–currently up more than 14%.

The highest returns over the past month were in energy related stocks, up on average 36%, followed by aluminum (+26%) and Iron/Steel (+26%). Without question, the best performing stocks were the ones down the most in January and February, indicative of a classic dead cat bounce unsupported by improving fundamentals.

It’s also worth noting, tech stocks have lagged the rest of the market during the recent rally, up just 8.3%, representing the lowest return ex-utilities, of all the principle sectors. The tech heavy NASDAQ was up just 5%, compared to the broader based SPY return of +7%.

In other words, tech and biotech have purposely lagged, as degenerates piled in, headlong, into commodities and soon to be bankrupt retail outlets.

Screening for stocks with market caps above $10 billion, these were the standouts over the past month.

PBR +77%

CLR +77%

FCX +55%

BBD +53%

DVN +49%

VALE +41%

TSLA +39%

CX +36%

WY +32%

FCAU +27%

ULTA +27%

WDAY +26%

HPE +26%

AA +26%

FDX +26%

WHR +25%

The average return for stocks with market caps above $10 billion, over the past month was +9.7%. The average return for stocks with caps ranging from $1-5 billion was 12.3%. Markets caps $5-10 billion returned 10.6%. In general, returns were similar in all market cap groupings. The principle divergences were abundant in the tech and biotech sectors.

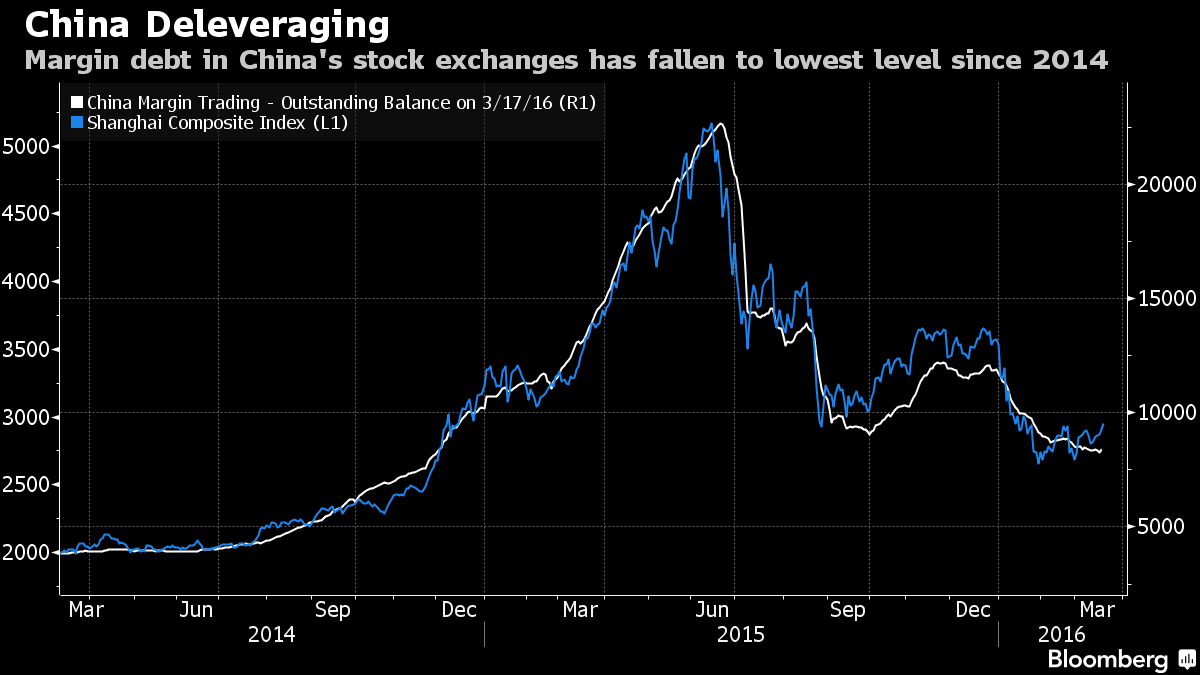

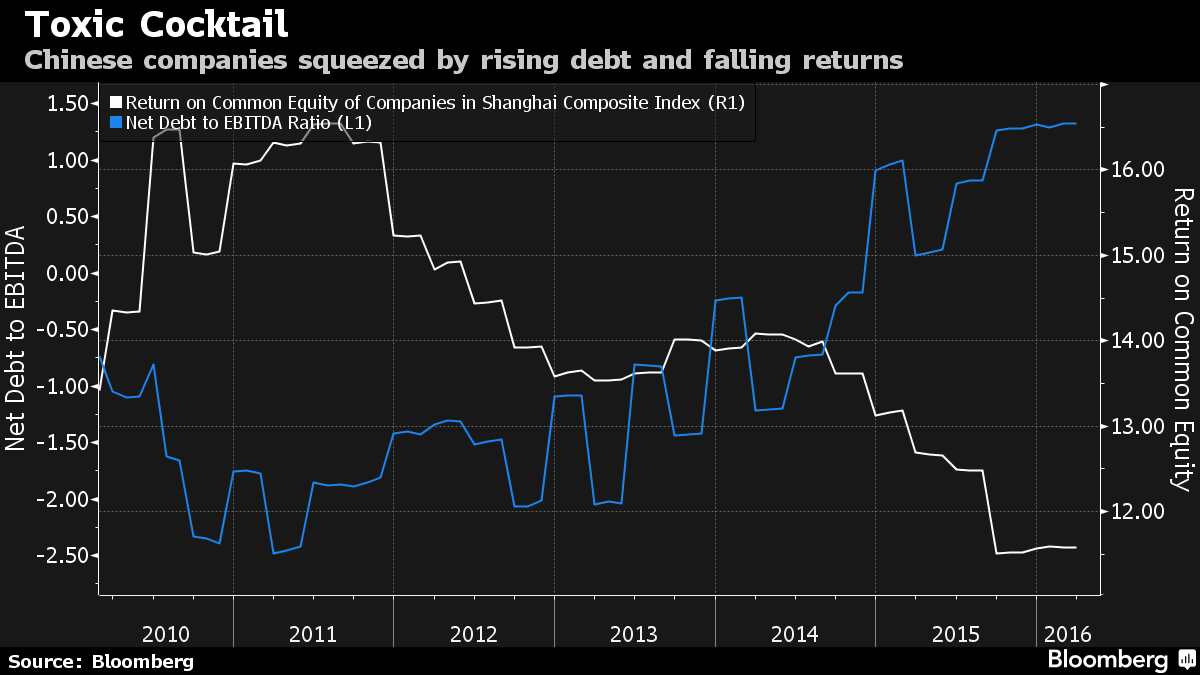

My take: while the idea of reflation is an alluring one. It is entirely without fundamental backing, as the Chinese economy continues to weaken–hampered by a 260% debt to GDP ratio, slowing growth and account receivables at 16 year highs.

Comments »