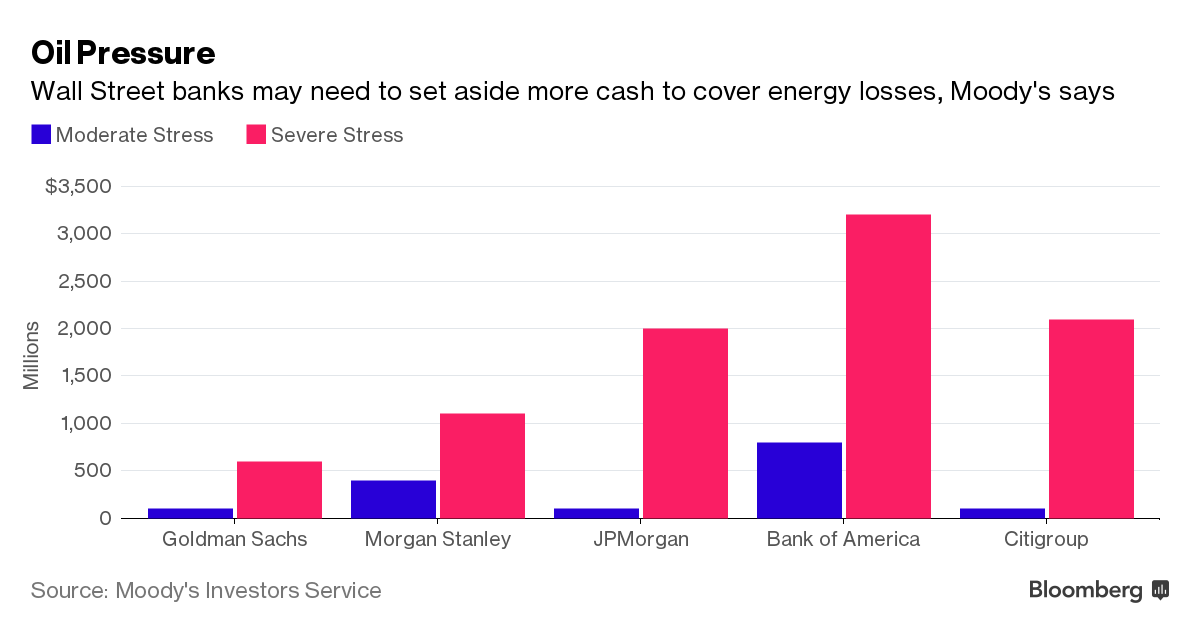

The boozehounds over at Moody’s concocted a number, seemingly while intoxicated, suggesting that under a dire scenario, banks would only need $9 billion to get back up to snuff with capital requirements.

“Yes, the sector is troubled,” said David Fanger, a Moody’s senior vice president and author of the report. “It will generate losses. But it’s not so large that it will blow a hole in the banks’ assets.”

With close to $400 billion in distressed oil and gas loans and recovery rates at just 20%, my instincts tell me this $9 billion number can grow should a ‘severe’ scenario materialize.

If you enjoy the content at iBankCoin, please follow us on Twitter

lol. where is Wells Fargo on that list? Don’t they have the 3rd largest E&P loan exposure?

Or Cullen Frost

Moody’s forgot the first rule in racketeering: make sure to get your story straight with the other colluders. Example:

Moody’s estimate for “Moderate Stress Scenario”, JP Morgan:

$100M

Form JPM 10-K (Dec 2015):

Non-performing: $277M

Criticized: $4263M

Noncriticized, non-investment grade: $13.16B

Investment grade: $24.4B

Total: $42.1B

So…assuming that we haven’t reached “moderate” stress yet (if we have, then just label the damn cahrt “Current”!), looks like Moody is WAY underestimating what losses JPM has already admitted to. Notably, the Criticized level is up 7500% from $56M in Dec 2014.

ACTUAL

My favorite line from the 10-K:

“The Firm continues to experience charge-offs at levels lower than its through-the-cycle expectations reflecting favorable credit trends across the consumer and wholesale portfolios, excluding Oil & Gas. ”

I’m sure that JPM experienced charge-offs at levels lower than its through-the-cycle expectations in the 2007-2009 time period as well, excluding Housing.

Amen

This is not bullish.

They will give you any number or opinion you want for a price.

Oil to $50 by May Day.

You may have already picked up on this, but remember two weeks ago when HBHC got hit hard, not because of earnings, but because they were increasing reserves for bad energy loans by 460%? To be fair HBHC is as small bank out of the state of MS and has concentrated exposure to energy loans. But understand that they were forced to increase reserves by the regulators after a review of the bank’s shared credits that showed a surging number of energy loans being classified as delinquent or stressed. The point is, this is just one small bank who opened their floodgates to oil companies when oil was at $100. We’re there any other banks who might have done the same thing? This will not be the last we’ll hear of increases in loan loss provisions, believe me (extra Trump)!