Back in the old days, the Federal Reserve would never, ever, dare to utter the words ‘global growth’ when describing American monetary policy. There is no doubt that the world has changed and American policy must now envelope the economies of China, Europe and other major trading partners. This isn’t to the benefit, per se, of the America people. Make no mistake, our multi-national corporations are the ones who benefit most from a policy that heralds in easy money for an undetermined amount of time. By extension, speculators in the stock market also stand to benefit. As corporate profits are bolstered by robust foreign markets, the share prices should appreciate here.

My position, as I’ve stated here on numerous occasions, is that the Fed should not hike rates. Deflationary forces are clearly the greater risk. Aside from my abhorrently high grocery bill, which has more to do with my aversion to GMOs than the availability of cheap produce and meats, prices have been dropping–across the board.

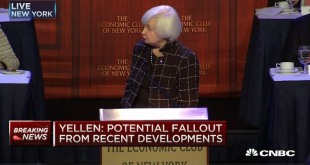

This is a significant speech and part in Federal Reserve history. Yellen is effectively on record saying that our central bank is beholden to foreign markets–because of the fact that so many of our corporations have picked up and left American lands, abandoned and scuttled factories, in favor for slave labor abroad. The slaves shall toil, working feverishly to produce products to be sold in Walmart and Target. Americans will buy those wares, at exceedingly cheap prices. But the funnel is narrowing. The availability of respectable paying jobs is lessening.

Twenty years hence, I doubt our infrastructure will be able to support the policy of chasing cheap labor around the globe in order to produce products to be sold cheaply to an orangutan brain’d consumer, who by then will be wholly dependent on government assistance.

Comments »