This is the funniest story I’ve read in 2016. I could see it now, the average savage going about his day in the stock market and an elusive Gekko type character steps into the fray to completely fuck all participants. Apparently, this “dude” is so big, he bends the market to his will. Participants are going apeshit trying to find him, but cannot.

“Nobody knows anything for sure,” Ozaner said in his office in a picturesque neighborhood on the shores of the Bosporus. “And this is Turkey, where usually we all know what’s going on.”

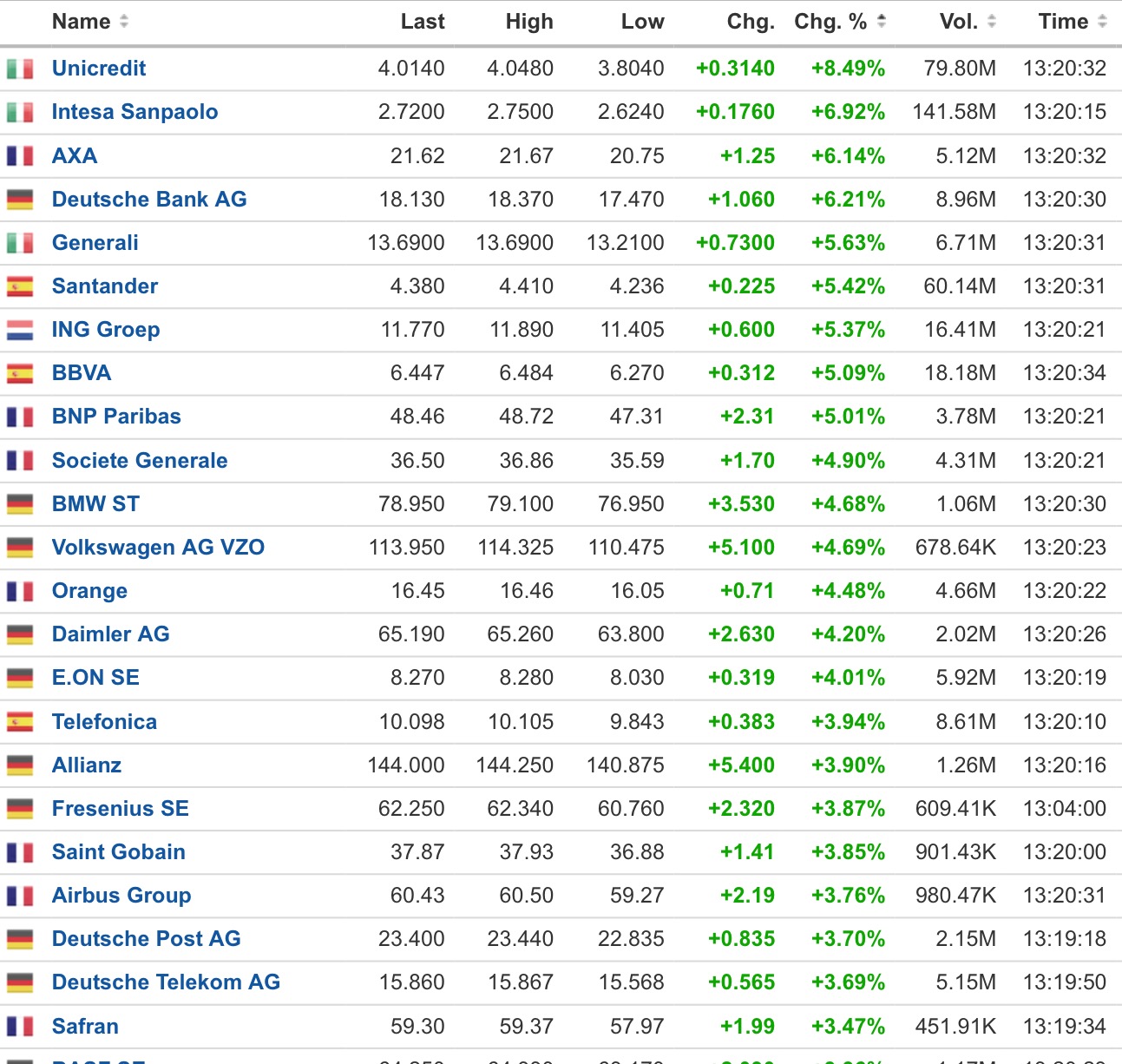

“Herif,” or “the dude,” has helped lift the average daily trading volume on the Borsa Istanbul almost 8 percent this year, compared with a 15 percent decline on the main exchange in Warsaw and a 27 percent plunge in Moscow, data compiled by Bloomberg show. The Borsa Istanbul 100 Index has advanced 13 percent in the period, outpacing Russia’s Micex and Poland’s WIG20.

Closely held Yatirim Finansman, which handled less than 2 percent of all trades two years ago, now accounts for the majority on some days.

On Feb. 22, for example, the brokerage placed buy orders for 486 million liras ($167 million) of shares, about 15 times more than Merrill Lynch, the second-biggest dealer that day, according to official data. And in the 16 trading days to March 8, it registered almost 1 billion liras of buy orders for Turkey’s six largest banks and Turkish Airlines — helping push the Borsa index to consecutive three-month highs.

In all of January and February, Yatirim Finansman bought a net 1.23 billion liras of stock, almost 70 percent more than the next largest buyer, UBS Menkul Degerler AS. This is why Istanbul Portfolio’s Ozaner said the secretive buyer is now “making the market.”

“There’s a giant bull in the china shop,” said Kerem Baykal, a fund manager who oversees about $610 million at Ak Portfoy. “He’s got deeper pockets than anyone else in the game and can move the market in any direction.”

“The Dude” is straight up fucking with Turkey, a menace of the first magnitude. I hope he fucking destroys the exchange and makes it crumble into pieces.

Comments »