All of the broader global indices have erected themselves upon the temple of greed. Wanton depravity is currently ongoing, with the NIKKEI leading the way in a most heinous of fashions.

Right behind them, in second place, is the Ted Cruz of this party–the burgeoning nazis out of Germany.

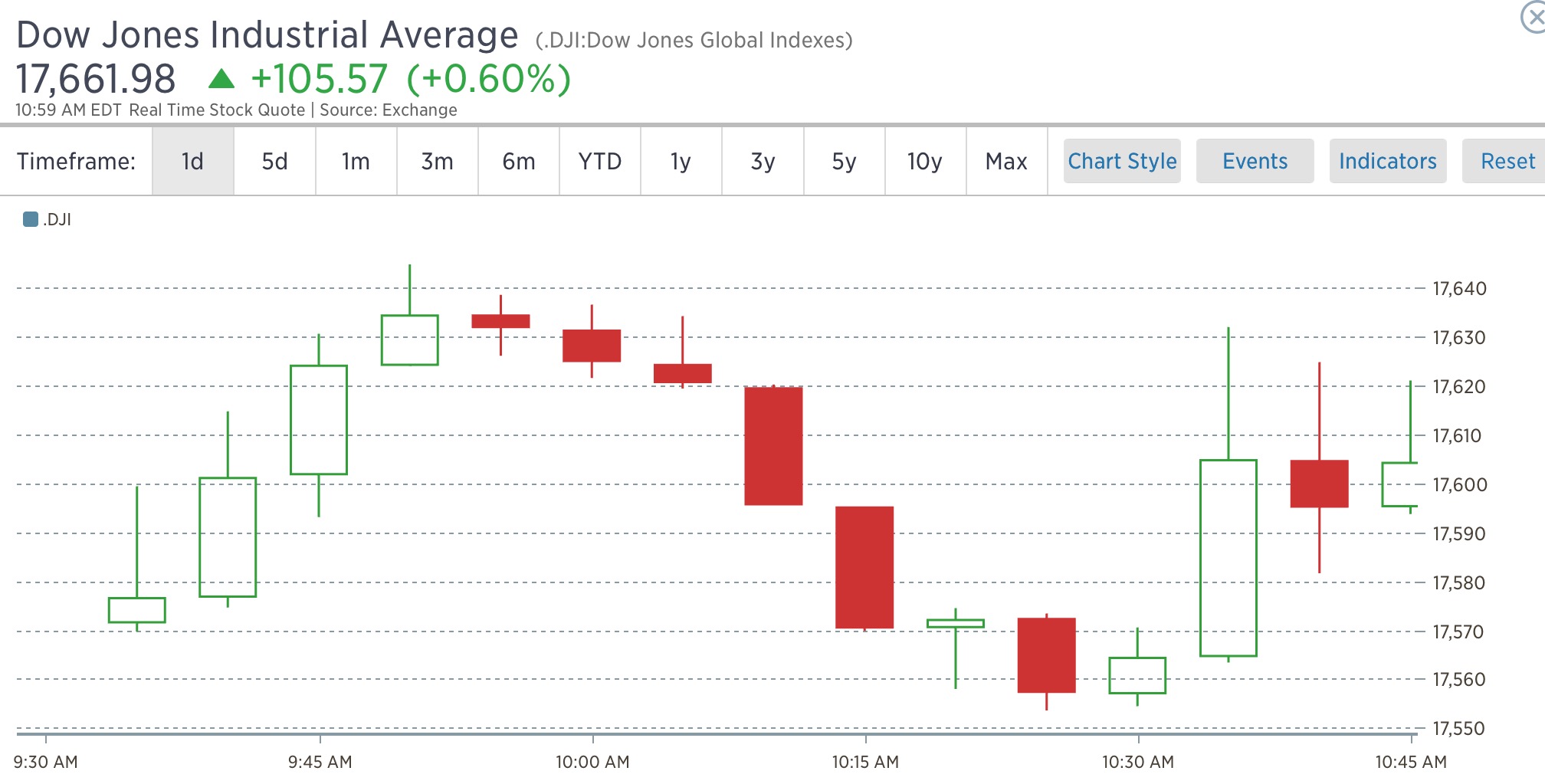

Last but not least is our futures, vibrantly lit. They’re fucking glowing Waldo. Watch us shine.

Before I enter my coffin and sleep for the next 3 hours, I wanted to bring attention to iBankCoin’s Peanut Gallery. I started this project, bringing on writers to the site, many years ago, only to suspend it due to grave errors and syntax malfeasance taking place within its boundaries. A few month’s ago, I resurrected it; and to my delight, I was quite pleased with the results. However, as time waned on and the novelty of the PG wore off, many of the newly fashioned writers resumed their lives as alcoholic vagrant panhandlers. Ergo, I’ve been forced to cull it, out of respect for the dignity of these halls.

As you could understand, my hands were tied in this regard.

The writers billeted at iBankCoin are honored by the standards set forth within these halls, which, hitherto, have gone unmatched by any finance site in its station. This is the paragon of financial news and information.

Therefore, for the last time ever, I am opening the doors of the Peanut Gallery to a fresh stock of eager and aggressive writers. Do not waste my time if you do not have a passion for this. I am not here to fulfill a bucket list wish of yours. I would fucking kill you for much less.

All those comfortable with these terms and have an interest, email me at Flybroker at Gmail.com

nite, nite.

Comments »