Whenever the VIX enters ‘The Retard Zone‘, it’s time to concern yourself with booking profits and getting the hell out of dodge.

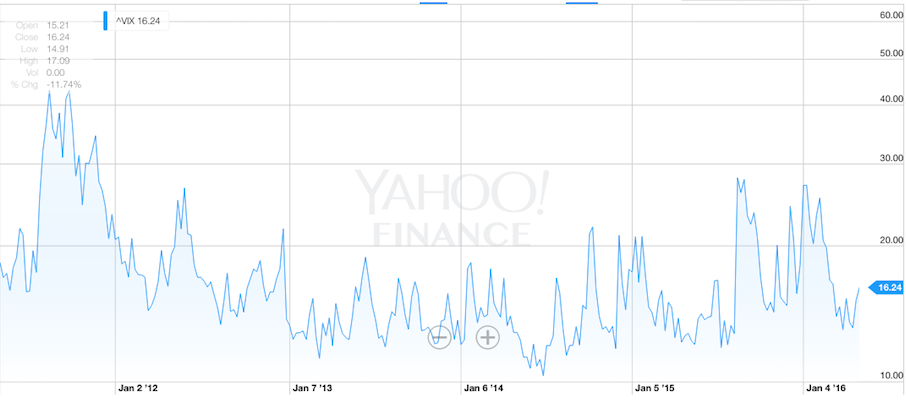

This week’s pullback, although small and insignificant, was coupled with an uptick in the fear index, better known as the VIX.

As you can see with the 5 year chart below, the fear, for lack of a better word, may just being getting started.

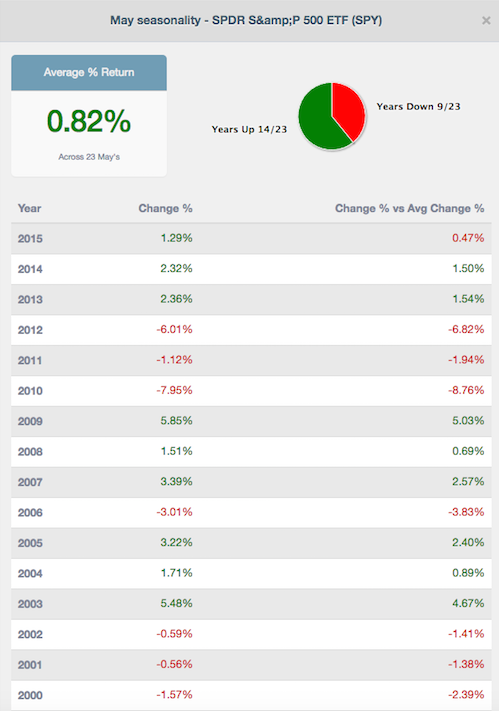

Heading into May, all eyes are on trends and seasonality factors. People are morons and like to throw out phrases that rhyme to sound cool, such as “go away in May.” Since I’ve been away the whole damned time, it’s a natural recommendation for me to tell anyone “go away.”

The numbers aren’t all that wearisome, from an empirical standpoint.

We may very well be repeating 2012 or 2010, all entirely possible. But for the past three years, during the month of May, the SPY has gone higher.

Gold was an outstanding performer today, higher by 2.2%. Crude was flat and stocks underperformed. There is a palatable fear in the air. I can smell it and sense that it’s growing with each and every day. The summer months are nearing and people don’t want to get on the other side of this mountain, should trouble reemerge.

The ark floats.

Comments »