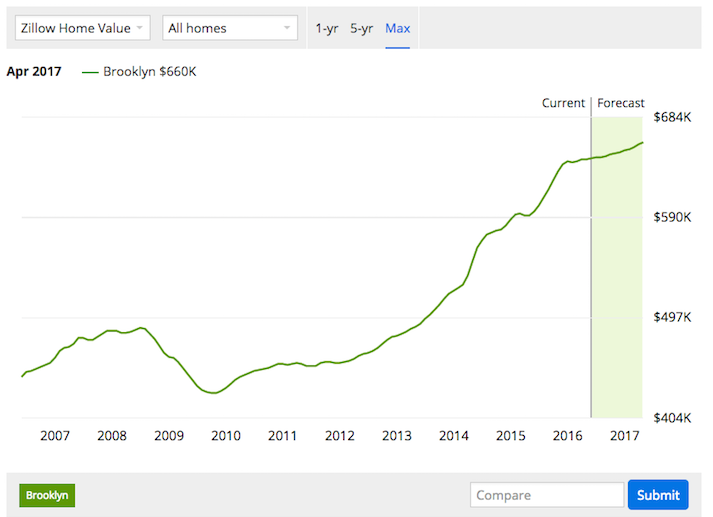

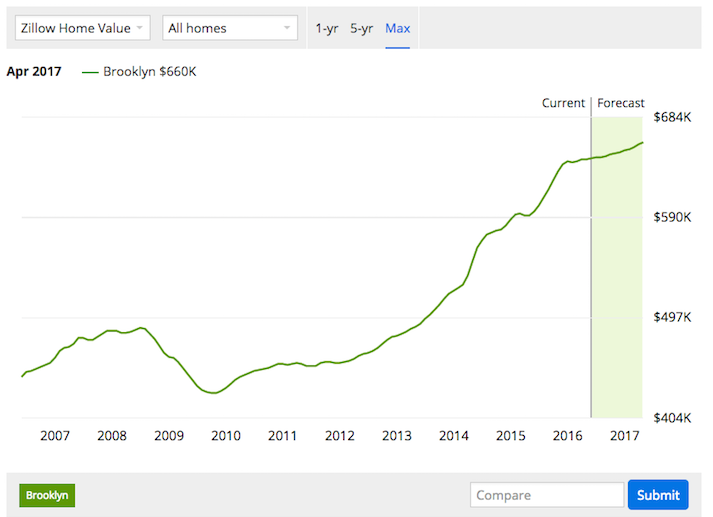

I grew up in Brooklyn at a time when it wasn’t cool. It was dangerous to walk around in today’s hipster neighborhoods, places where brownstones fetch $3 million, up from 250k, back in the 1990s. I’ve never seen shittier homes selling for such high prices. Broken down, piece of shit, houses are selling for a million dollars, in horrible neighborhoods filled with burglars and rapists. You have no idea.

Enter Dime Savings Bank of ‘Williamsburgh’. They’re offering exorbitant interest rates of 1.1% for deposits in order to lend into this bubble. What.can.go.wrong?

As of March, the bank, whose parent company, Dime Community Bancshares, has been publicly traded since 1996, had $5.5 billion in assets, up by $1 billion since the end of 2014. JPMorgan Chase & Co., the nation’s largest bank, is 439 times as big as Dime, with assets of $2.4 trillion.

Lending on apartment buildings used to be a tougher business. One in 10 New Yorkers left the city during the 1970s, and those who remained faced a surging crime rate. City neighborhoods were deteriorating. Mahon would sometimes arrive at the bank on a Monday to find burned-out cars smoldering on the corner.

Now the city’s 8.6 million residents face a housing shortage. The value of apartment buildings has soared, and owners have a steady stream of rent checks to borrow against. Dime lent out $1.3 billion last year, up 37 percent from 2014. It continued to step up real estate lending this year, originating $377 million in loans in the first quarter.

To keep up with the demand, Dime needs deposits, and the customers at its 25 New York-area branches have only so much cash to save. Plus, it’s difficult for any bank to win new clients, said Collyn Gilbert, an analyst with Keefe, Bruyette & Woods Inc. Changing banks can be a hassle. “To get deposits in the door, you really need to pay up for them,” Gilbert said.

Last year, Dime began touting its 1.1 percent rate on money market deposits, using banner ads, Bankrate, and other websites. Online customers came from all over the U.S., especially the Northeast, California, and Florida. Since the beginning of 2015, the bank’s deposits are up 30 percent, or $814 million, with most of the new cash in money market accounts. In the last quarter alone, Dime took in $305 million in deposits.

In a sickening gesture to lure bicycle riding hipsters into his banks, Mahon, its CEO, is catering to the younger generation through moronic design.

The new branch at Williamsburg’s Bedford Avenue will look more like a coffee shop than a bank, with big doors opening onto the sidewalk, welcoming pedestrians to stop in and charge their phones. Light fixtures made from mason jars will illuminate the coffee counter. The goal is to appeal to the neighborhood’s young, new residents in a way that Dime’s 1908 headquarters does not.

Why is he doing this? Well, the answer is very obvious.

For millennials, Mahon said, “It’s a little bit of an obstacle to come into a big limestone building.”

The next generation is one rife with fucking imbeciles.

Comments »