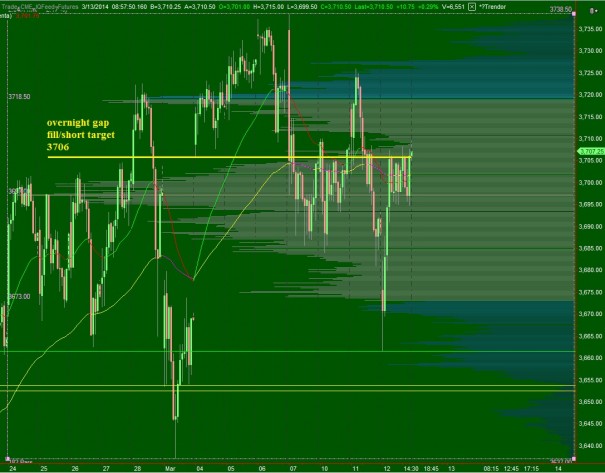

NASDAQ futures are lower overnight after trending all day yesterday. The sooner one can recognize a trend day the better, for any position taken with the trend is considered a “risk free” entry into the following day, meaning the low of the trend day is likely to be revisited at the least. That has not always been the case with some of the V-shape bounces of the past, however the sellers did accomplish more downward progress yesterday then we have seen since late January.

The long term timeframe is still buyer controlled. We are in the process of testing the current swing low right now on the daily chart at 4200 on the COMPQ. The weekly chart shows a good picture of indecision, but still an auction firmly in the hands of the buyers. Prices are still trading above last week’s low. The sellers want to see a weekly close below last week’s low to confirm the outside bar reversal candle.

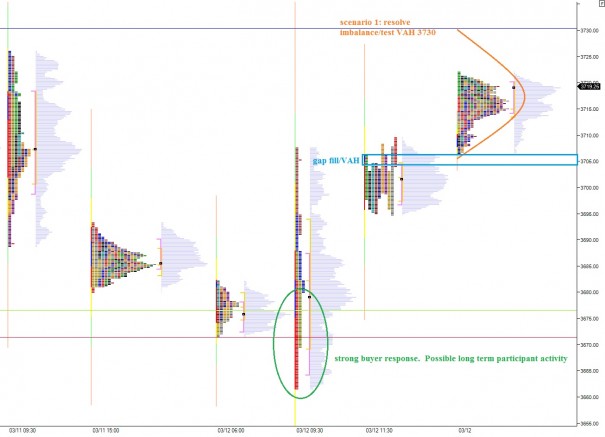

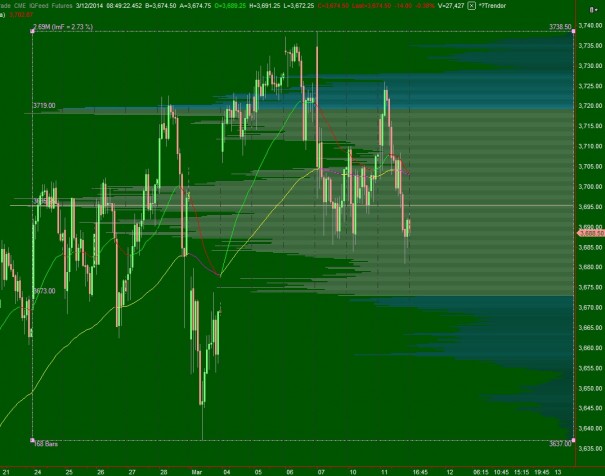

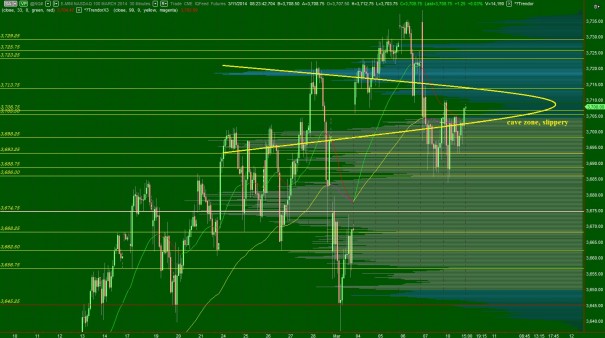

The intermediate term is seller controlled with a slight potential for balance. The market formed a tighter balance area spanning March 3rd –to-present which was disrupted by the sellers. Sellers can be seen printing a series of lower highs and lower lows which yesterday broke through the balance low. However, if we go back to our longer dated balance spanning back to February 19th one could make the case for balance. However, this balance is reliant upon holding yesterday’s low on a retest and is thus vulnerable. I have highlighted this balance on the following volume profile of the intermediate composite:

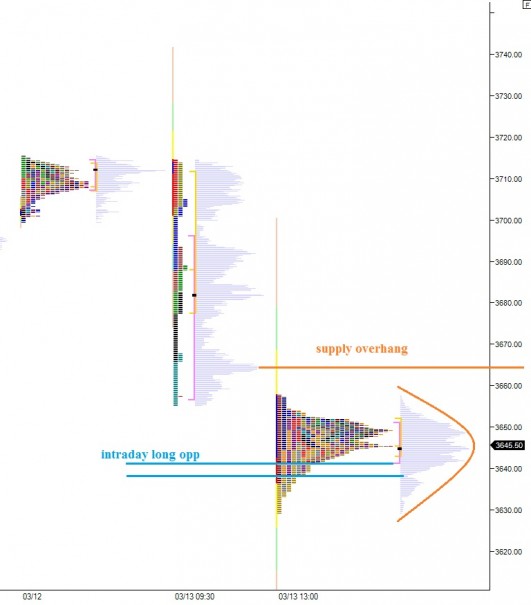

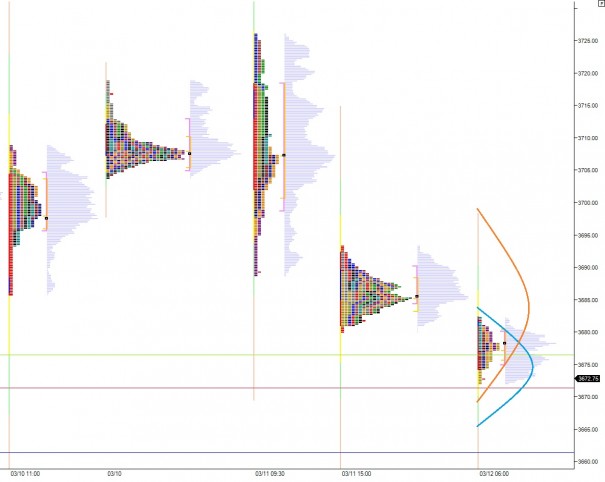

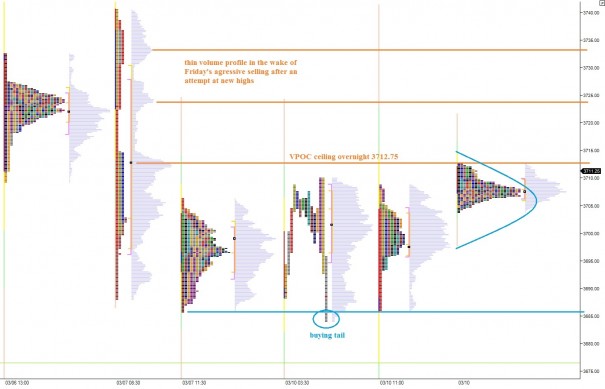

The short term auction is seller controlled. This can be seen by the lack of overlapping by value area and value migrating lower. The overnight auction which was a continuation of yesterday afternoon’s late stabilization is fairly balanced.

Risk of an opening drive is low because we are set to open inside range, and inside value. Thus I expect some chop. I have highlighted this current profile and made some observations below:

Comments »