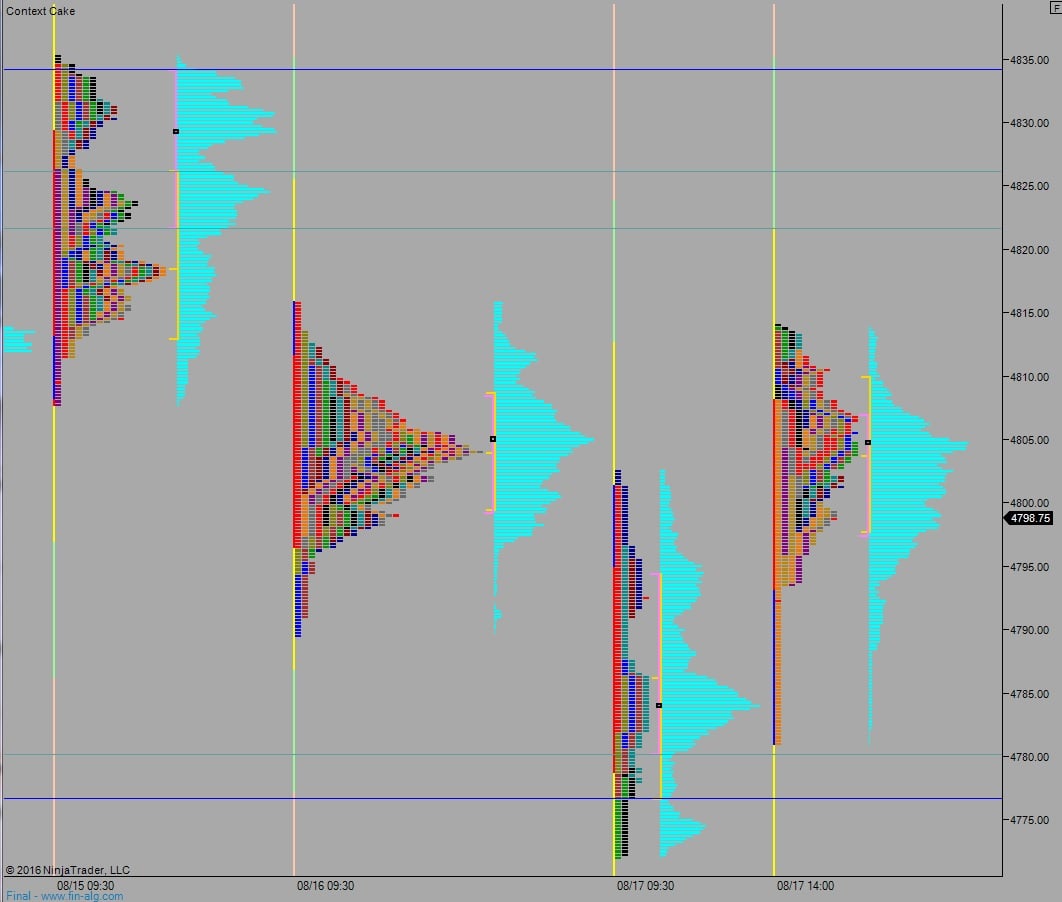

The NASDAQ was pushing a bit more aggressive today, both ways, in a manner of trade that resembles a slug fest between higher time frame buyers and sellers.

Either can claim victory on the session. In the case of a draw and until further notice, the ‘W’ goes to the bulls.

However, the tape is showing the day-types the tend to occur at-or-near inflection points, peaks and troughs, the intermediate highs and lows.

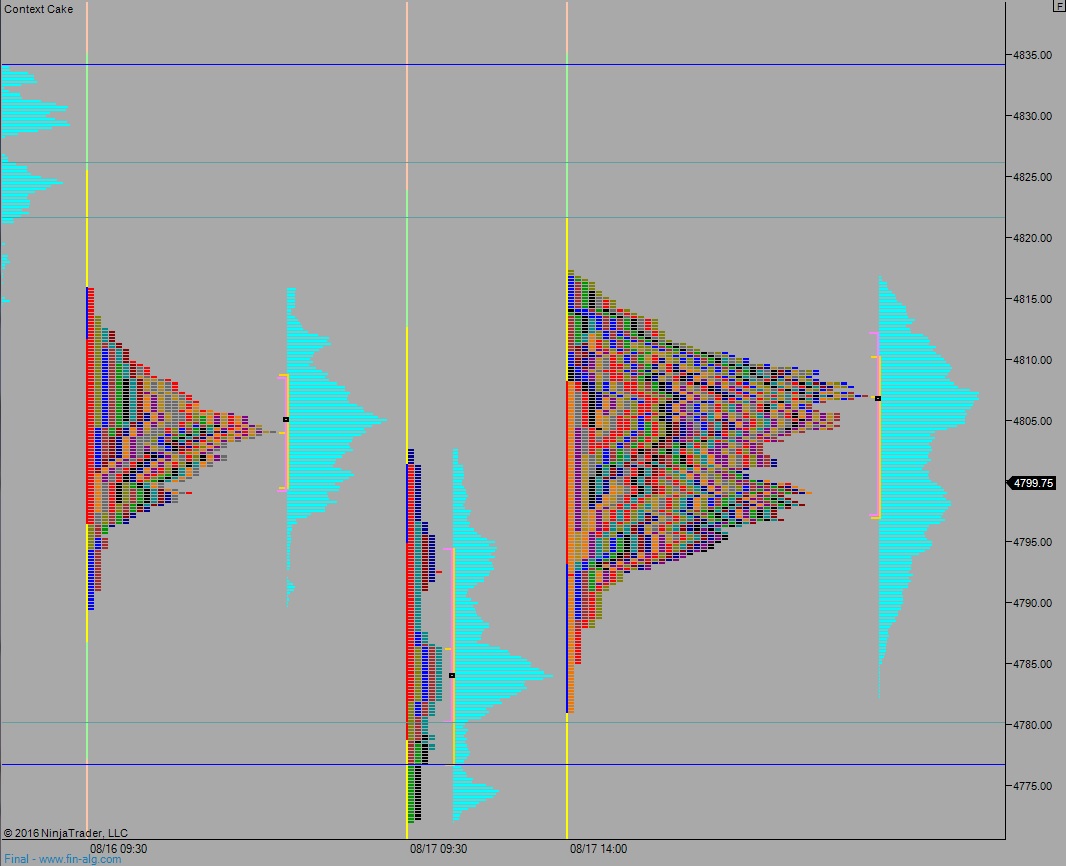

Let’s run through the recent string of odd-ball occurrences, shall we?

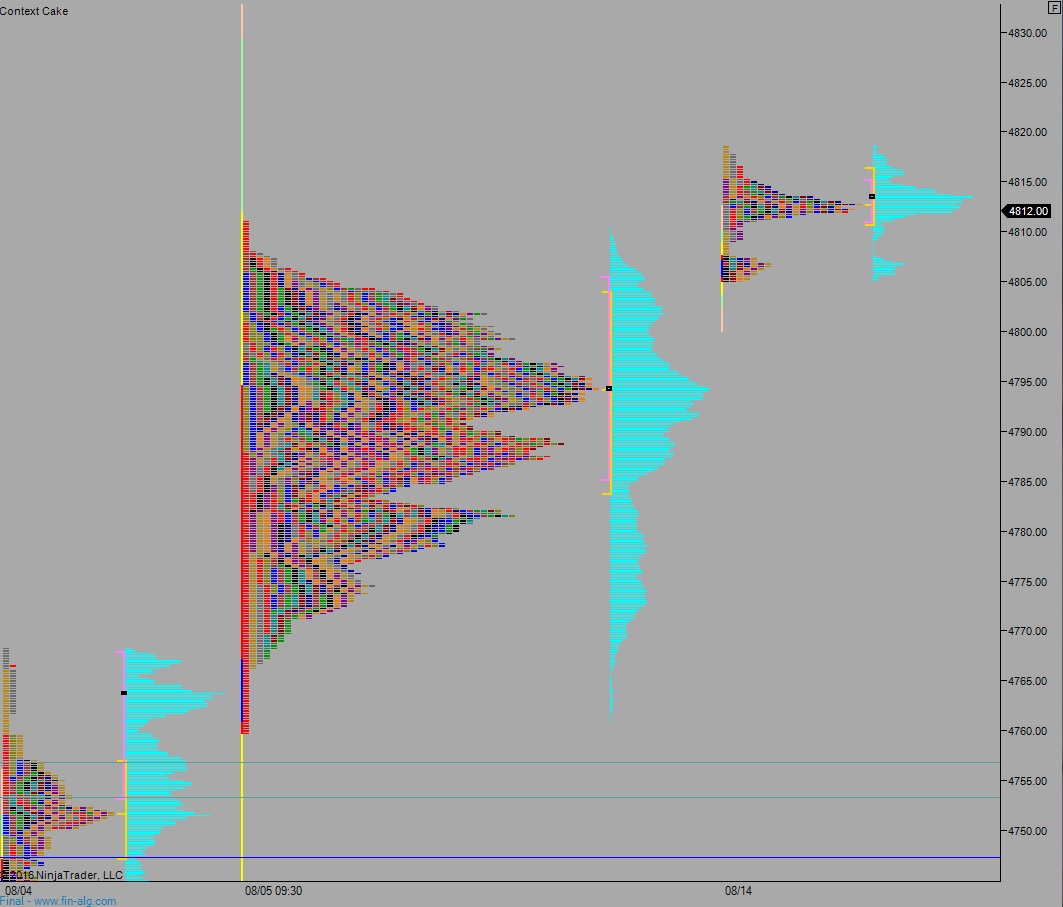

- Monday, 8/8/2016 – the oddly named ‘Normal Day’ which happens about 6% of the time over the past 5 years (personal study).

- Thursday, 8/11 – another Normal Day

- Tuesday, 8/16 – Normal day

- Wednesday, 8/17 – Neutral Day (about 20% odds, or 1-in-5)

- Thursday, 8/18 – Neutral Day

- Today, Monday 8/22 – Normal Day

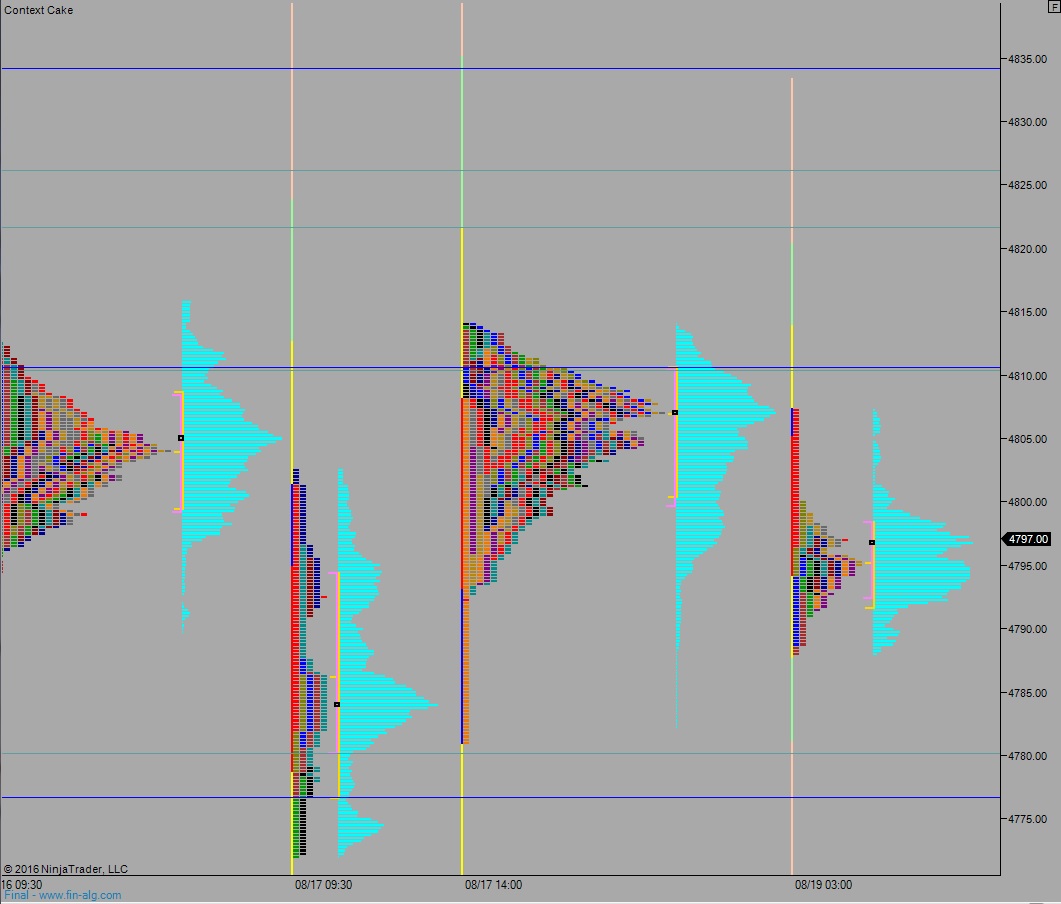

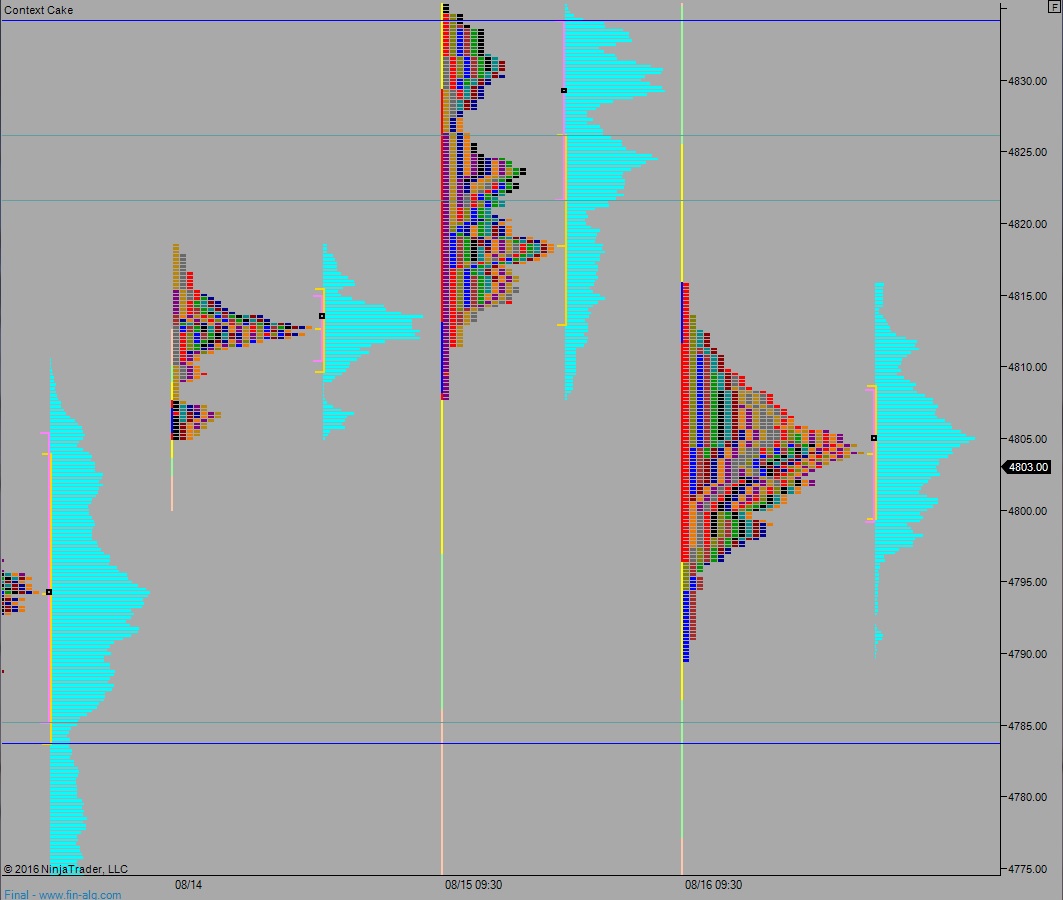

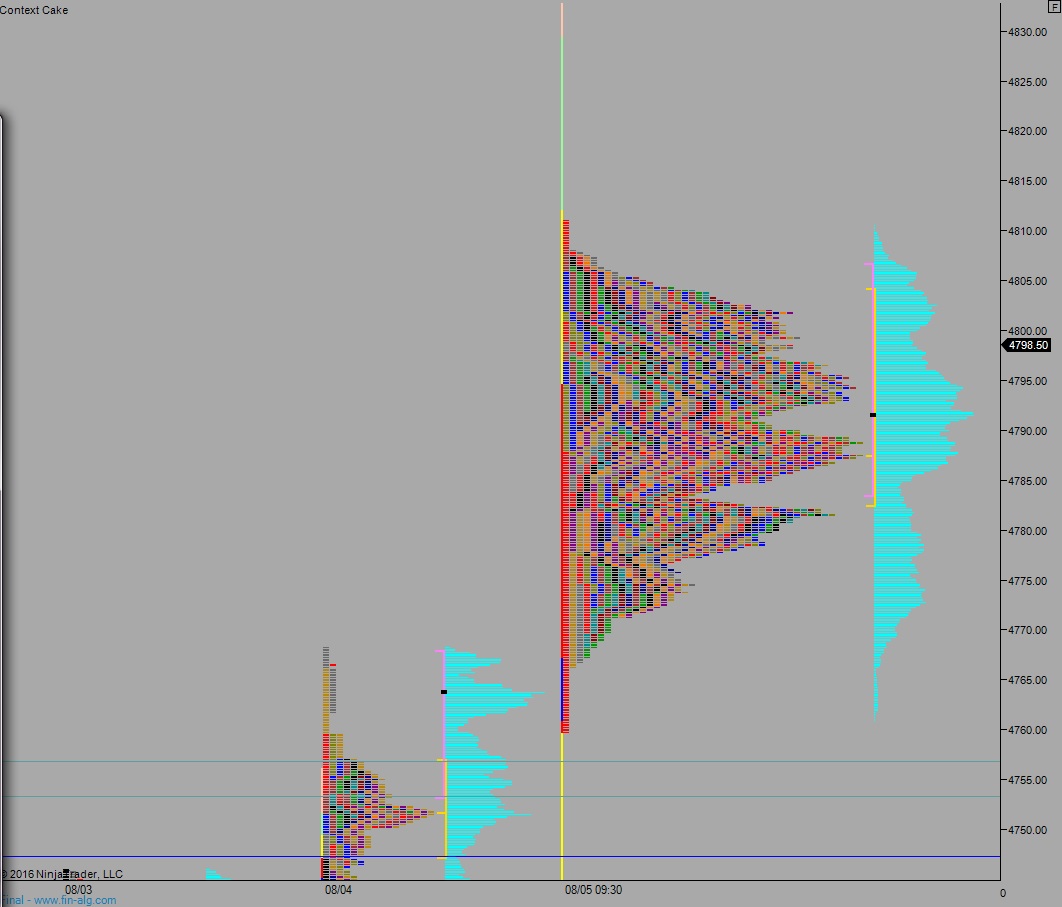

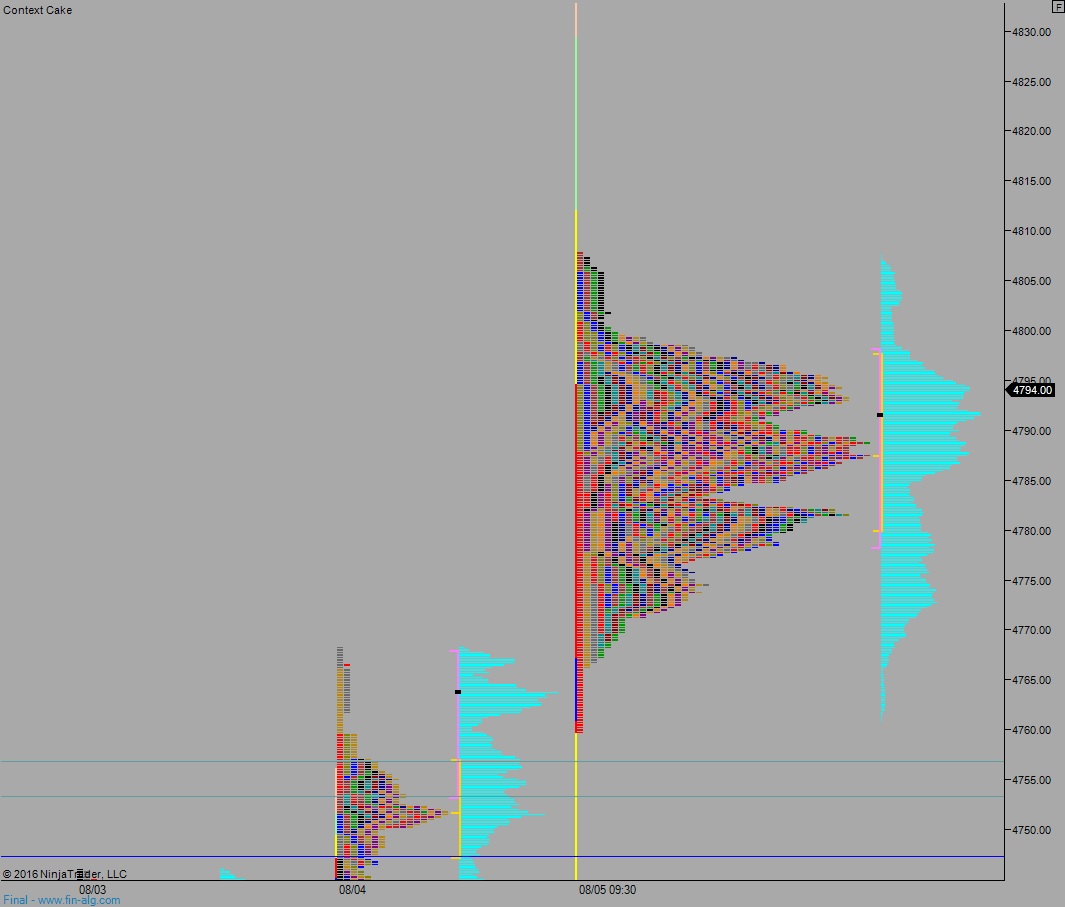

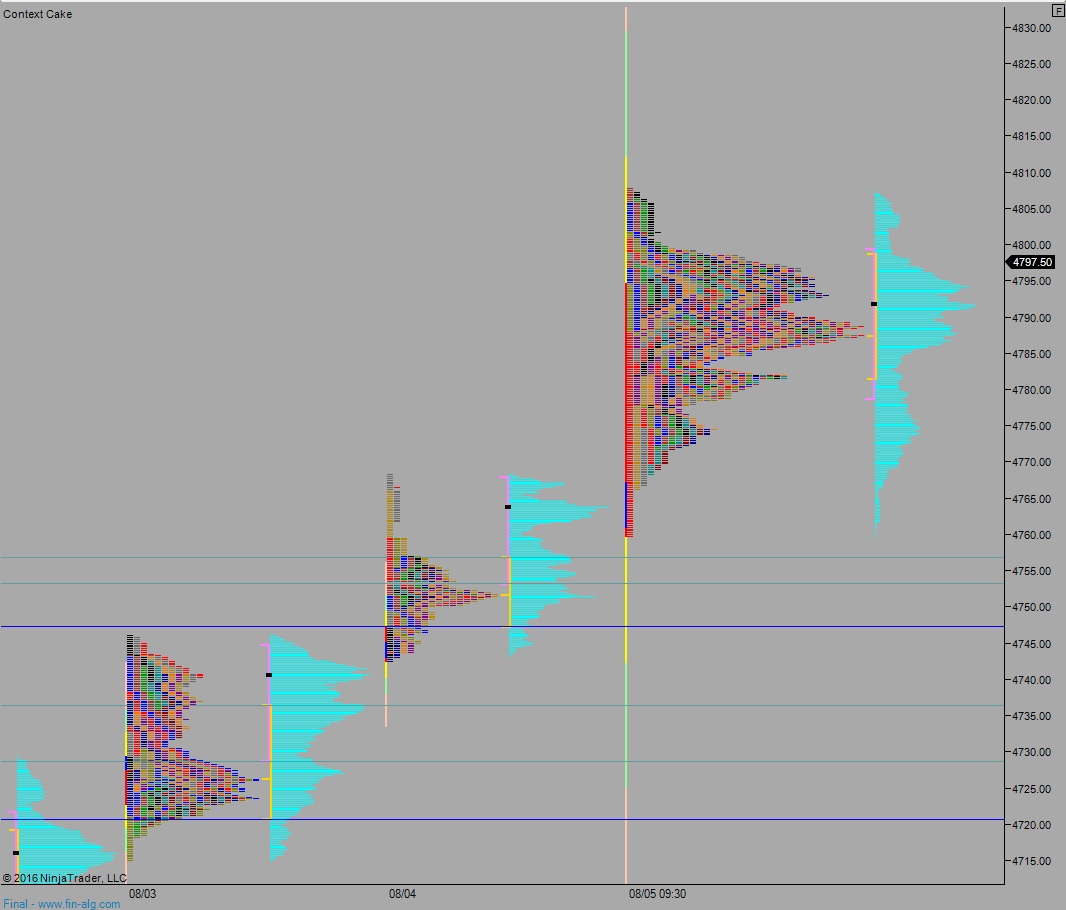

We have seen more normal days in the 11 trading days then we have all year. Together they blob up to form this big ole’ fat drip-shaped balance:

Funny how nature enjoys certain shapes and structures isn’t it? Our good Italian friend Leonardo Fibonacci liked to write mathematical models of pine cones. These days we build balance and trade the levels it produces.

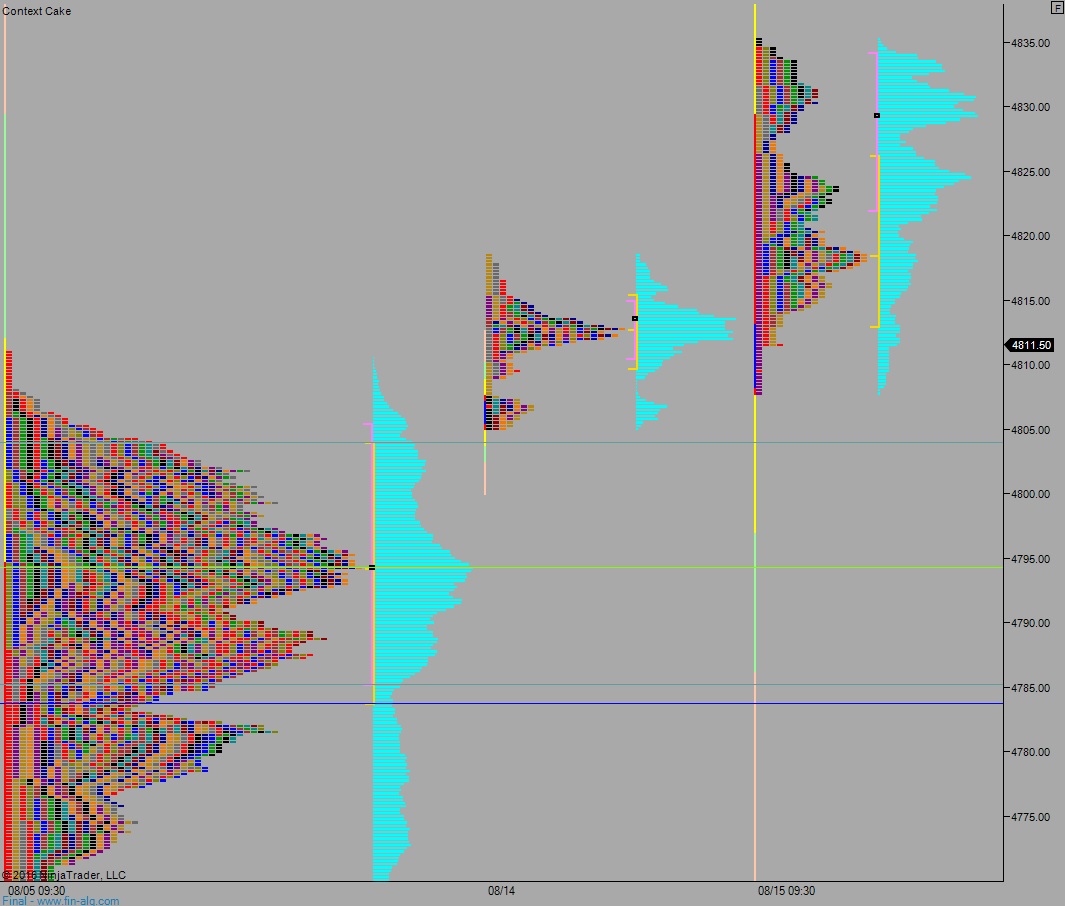

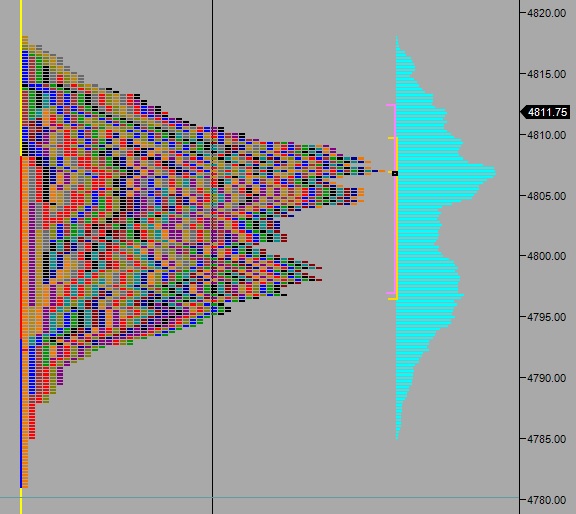

The tear drop shape is a bit more clear when you view all trading activity through the lens old school, TPO market profile:

Writer’s note: Perhaps it looks more like an icicle, especially when you tilt your head to the left, but I’m really trying to make the Forrest Gump Headline/Photo combo work.

Markets in balance tend to stay in balance until acted upon by a force greater than the gravitational pull of the collected balance.

Writer’s note(2): I just made that up, but it has a nice ring to it, doesn’t it?

The higher time frame seemed active today, but neither participant showed any initiative. Fade rips and dips back to the mean looks like the move until Jackson Hole.

The NASDAQ is liquid at these levels and has formed a fat balance. Trade accordingly.

Comments »