Quick note on the low print from today’s NASDAQ session. We printed a double low, which is considered a weak low in auction theory.

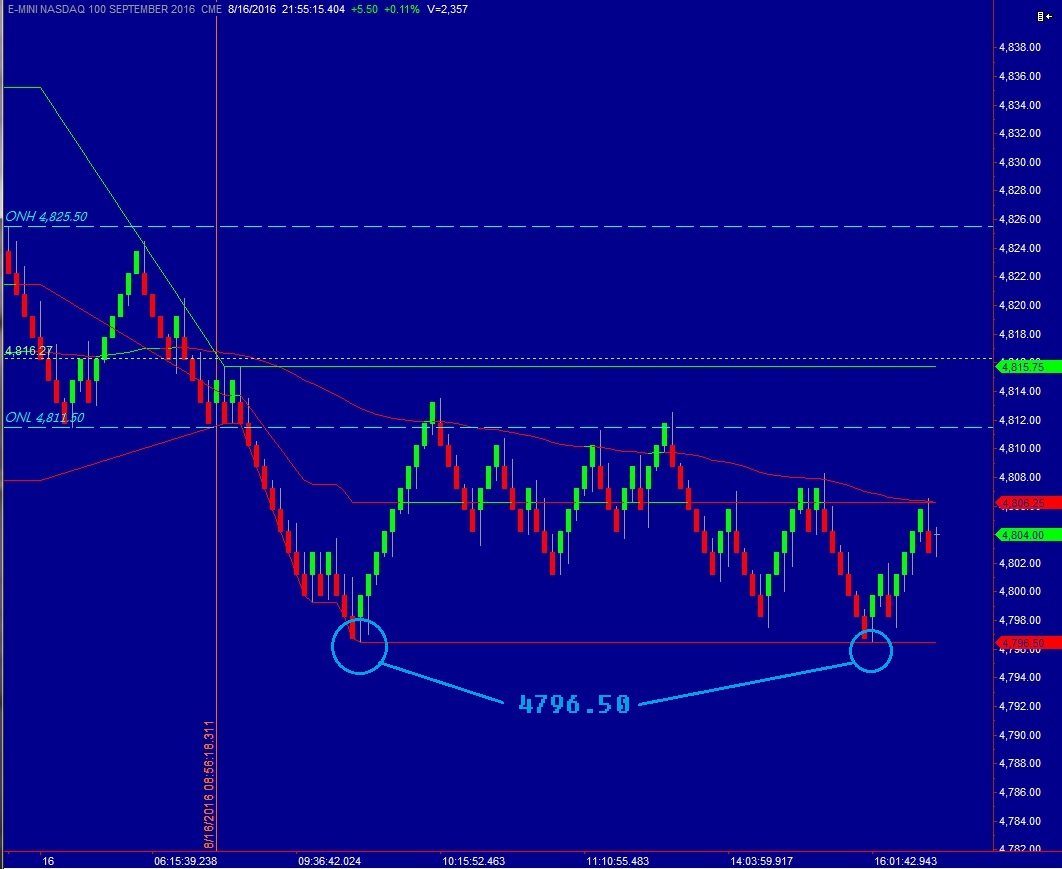

You can see it clearly on my renko chart:

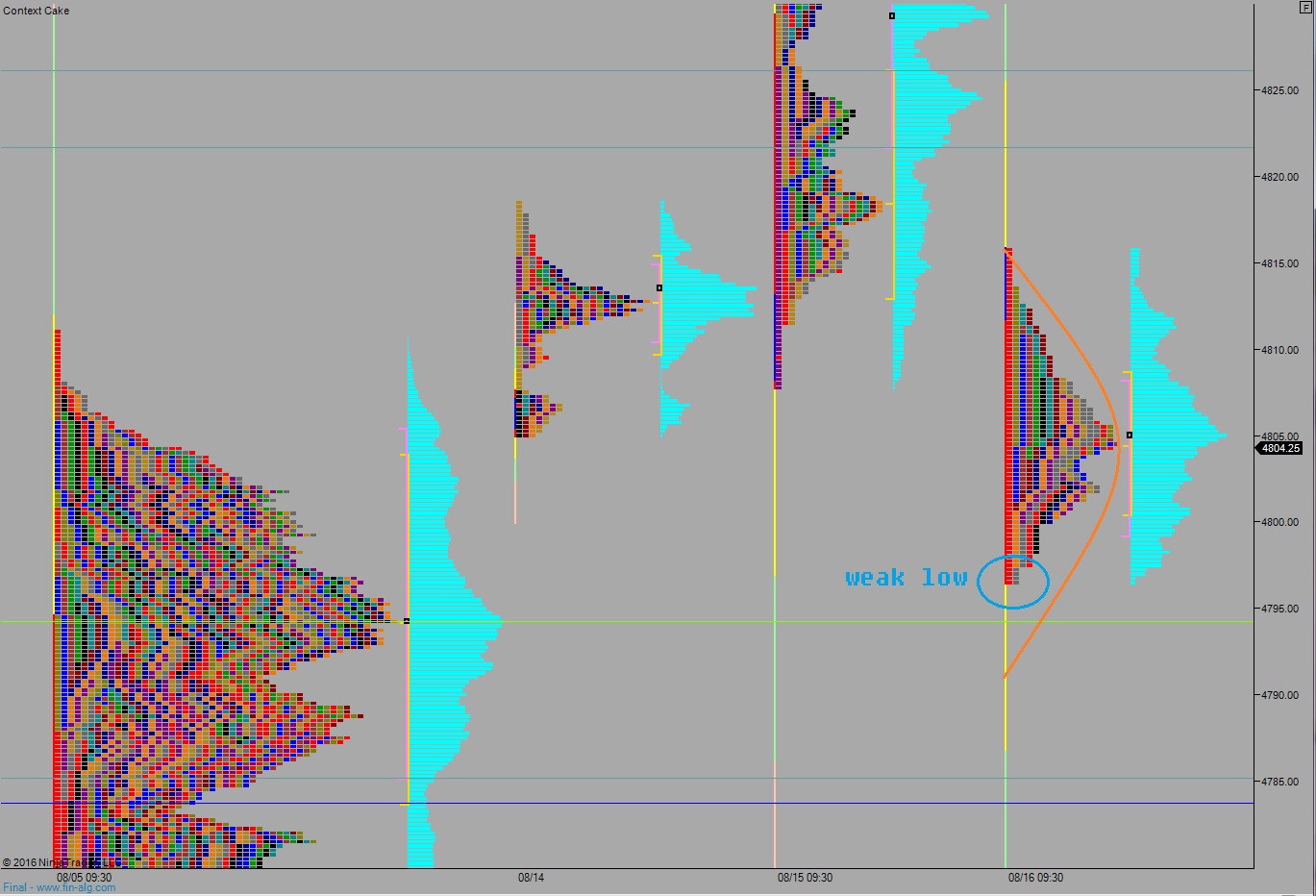

It shows up as a double TPO on old school market profile, see below:

What makes weak lows happen?

A weak low happens because higher time frame sellers were not initiating new positions intra-day. They may have been active in the morning and helps formed the wide initial balance, or range on the first hour of trade.

When the market drifted lower late in the session it failed to ‘test’ below the day’s low, instead stopping right at the low and reversing. This leaves auction theory junkies wondering what sort of order flow existed below that level.

Why does this matter?

It helps from my primary hypothesis, going forward. My main expectation is for the market to go down and test below that level before heading elsewhere.

My job is to execute all of the trades in my repertoire while I target those lows. I could tell you my specific trades but you wouldn’t know what to do with them. Make your own trades and you’ll feel much better about executing them.

Bottom line

Weak lows give us a bit of insight into the upcoming behavior of a market. This weak low is on the NASDAQ 100. Look for a test below 4796.50 /NQ_F in the near future and observe the behavior that arises after the event for insight into the next bit of potential market behavior.

Ann Lamott writes:

“E.L. Doctorow said once said that ‘Writing a novel is like driving a car at night. You can see only as far as your headlights, but you can make the whole trip that way.’ You don’t have to see where you’re going, you don’t have to see your destination or everything you will pass along the way. You just have to see two or three feet ahead of you. This is right up there with the best advice on writing, or life, I have ever heard.”

Weak low gives us context until it doesn’t. Then, we’ll keep an eye out for the next available context–like an algorithmic signal from Exodus Strategy Session or a huge excess high or some crazy 3rd sigma NYSE TICK.

The Dow Jones 1-ticked it’s lows giving us the potent failed auction reversal potential and the Russell has a weak-ish low. So you have to decide which index is the likely driver here. I say the NASDAQ, especially after the way Big Tech coasted through earnings.

You keep on coming back here and I’ll do my best to take forecasting one day at a time.

If you enjoy the content at iBankCoin, please follow us on Twitter

Jesus. you’re a walking encyclopedia. Thanks as always.

Where should we go if interested in the details of auction theory?

Mind of Markets – Dalton

Mind Over* Markets – Dalton

many thanks. It’s been ordered via AMZN