NASDAQ futures are coming into Friday gap down after an overnight session featuring normal range and volume. Price worked lower overnight, down through yesterday’s low before settling into 2-way trade back inside Thursday’s range.

The economic calendar today literally only contains the Baker Hughes Rig count at 1pm. There are no other economic events. Not even low impact, non-eventful ones. Baker Hughes will likely be a non-event.

For all intents and purposes, after 11am and aside from the 3:30 ramp, today is likely to be a non-event.

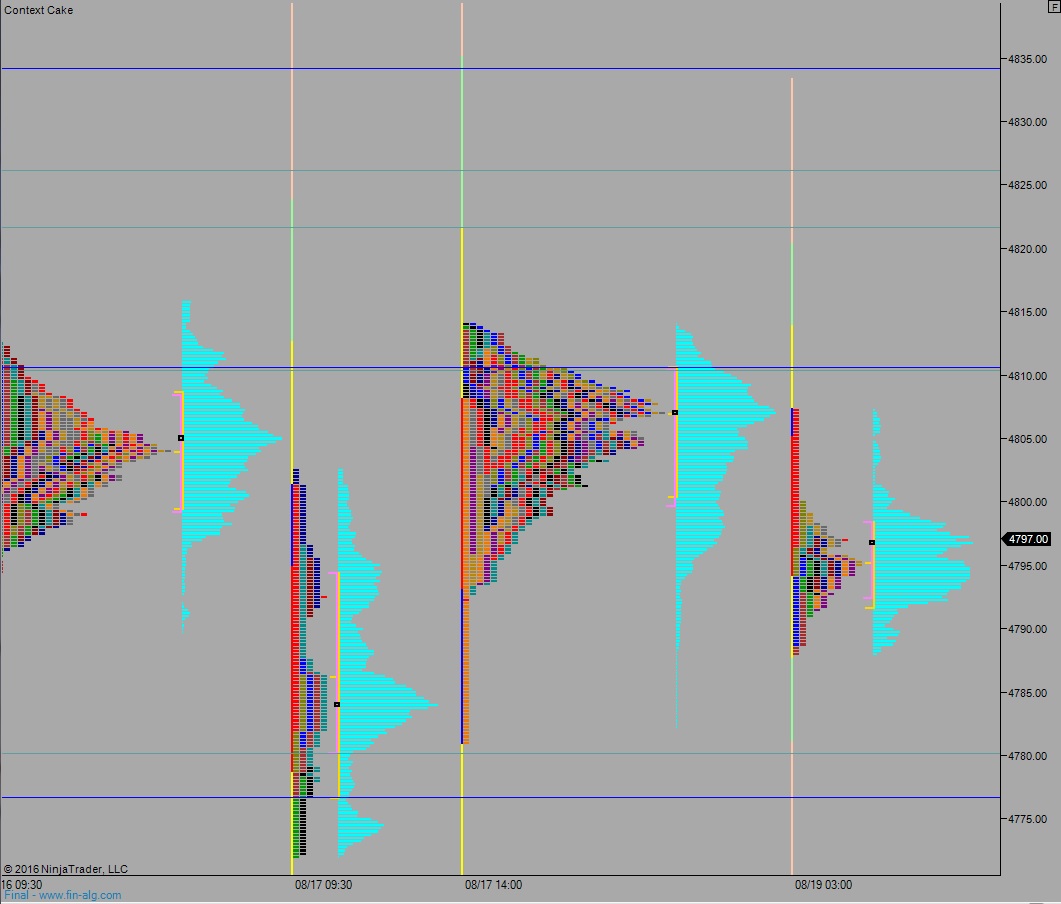

Yesterday we formed a neutral day. We have been printing abnormal market profiles all week. This tends to happen at-or-near inflection points.

Heading into today my primary expectation is for sellers to be active around 4800. They go take out overnight low 4788 and push a liquidation down to 4780 before two way trade ensues.

Hypo 2 is for the overnight short sellers to be ransacked by a geyser of buy orders early on that push closed the overnight gap up to 4807.25. Look for sellers up at 4810.50 and two way trade.

Hypo 3 strong buyers close gap up to 4807.25, sustain trade above 4811.25 setting up a move to close the gap up at 4822.75.

Hypo 4 full on liquidation takes us down to 4767.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: