I love how the temperature of the internet changes during our 1-2 days of sheer terror. It is like the days of terror are new! Friends, tell me, have we completely forgotten how to take heat?

Typically it gets worse before it gets better, like influenza.

I have some names deep in the red on my books—FSLR and YGE. I have some WBMD too, my family doctor of choice, off nearly 8 percent since my purchase.

These trades may be wrong and I may be crazy, but it just may take a lunatic to manage a book of high velocity momentum stocks.

We went risk off today. There were warnings if you put your ear to the rails. The only problem is the weather is cold, and if you aren’t careful your ear will freeze to the tracks and then you are toasted because train.

I lost 1.24% today but could have lost very much more. Social media stocks proved a store of value in these rough waters. The only weak spots were Z and YELP. I was fortunate to scale a piece of YELP yesterday if only for my psychological wellbeing. The problem is it goes much higher, eventually, so I am now tasked with getting my size back on.

I sold all of my ONVO yesterday which brought a warm feeling to my emotional capital. The action you are seeing in this stock is caused by a weak investor base, lacking the necessary discipline of institutional money. You will continue to see erratic behavior from this name. Let it get bloodied and beaten, like ENPH, and then we shall reconvene to purchase zeroed out Zecco accounts.

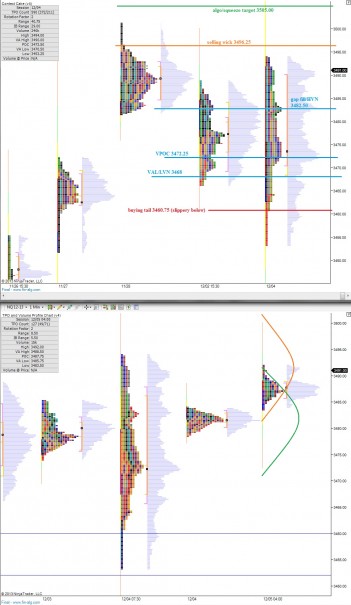

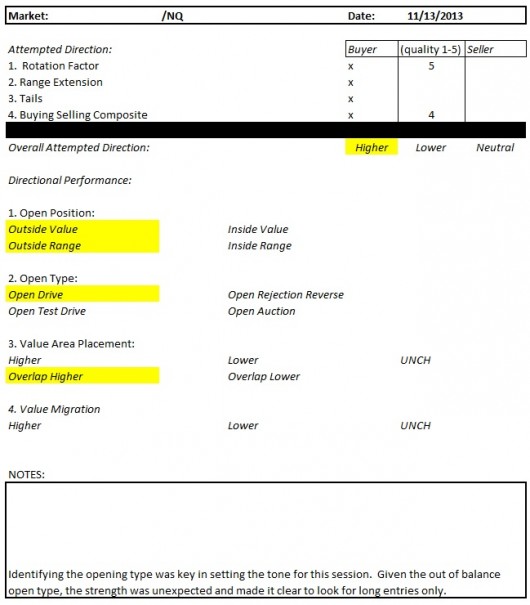

I tried a long in the NASDAQ futures today, just before noon. It was a low risk trade with decent probabilities. It took me out for a small loss, but had I remained stubborn it would have destroyed me. These are the victories of discipline and they do wonders for your confidence.

I scaled off some CREE shares I knife caught in November. It pays to work your cost basis down when you are working on the wrong side of the chart in a momentum name.

I had some pretty extreme order flow readings into the bell, panic liquidation if you will. My hope is that it continues overnight and into early trade tomorrow. It is then that I will be stalking my prey:

ZNGA the dog

FCEL the future

TSLA the inventor

Finally, it is with great pleasure I ride in The Fly’s BALT boat. I have seen too many Fly trades in my internet years to muff this one. I started buying on October 31st like a sage of sorts. I have been a buyer since, several times, riding the diligent work of my elders who are much wiser. There is no need to reinvent the wheel out here. It is all about building upon the previous generation. That’s the American dream.

Comments »