John Shrewsberry, CFO of Wells Fargo, spoke among fellow bankers Tuesday in New York and assured everyone the big bank can continue dominating our society without the aggressive sales tactics that encouraged their employees to commit wholesale fraud.

Bloomberg has some direct quotes from Mr. Shrewsberry:

“I think we can make this pivot in a way that protects our business model.”

“These bad practices were not a revenue-generating activity, it was really more at the lower end of the performance scale where people apparently were making bad choices to hang on to their job,”

The leaders at Wells Fargo are being huge dicks to their underlings, and their public behavior reveals how sad life can be for workers at the bottom of the corporate world.

John Stumpf, the CEO of Wells Fargo, was also blaming ‘the lower end of the performance scale’ Tuesday while speaking to The Wall Street Journal.

As public and congressional pressure mounted on Wells Fargo & Co. executives, its top two bankers had an explanation Tuesday for allegedly illegal sales practices across the company: It was employees’ fault.

Chief Executive John Stumpf defended the firm and the efforts it had taken to stop the behavior, which included opening accounts for customers without permission. “There was no incentive to do bad things,” Mr. Stumpf said in an interview with The Wall Street Journal. He called the conduct that led to last week’s settlement with federal and local authorities “not acceptable,” adding that the bank doesn’t “want one dime of income that’s not earned properly.”

The company fired 5,300 employees, mostly managers, it said were involved in the sales practices described by the settlement—the settlement which to some resembles a paltry fine:

Meanwhile Carrie Tolstedt, the head of the group that was exposed for creating some 2 million fake credit cards and bank accounts designed to churn out late fees, quietly left the bank Tuesday morning. She walked away from the growing firestorm with a nice $125 million package. A sad corporate day indeed, unless you’re at the top.

Blame the minions and eliminate them

Wells Fargo sent the cavalry out Tuesday to defend their company, hoping to quell the outcry before it grows into something worse. After all, Wall Street’s initial reaction to the settlement was mild:

And perhaps everyone would have glazed over if the top executives of the banking firm weren’t throwing their low-level employees under the bus. But now the story is how these banksters are attempting to control the damage, and as Jim Cramer tweeted Thursday morning, Wells Fargo’s problem is not going away any time soon:

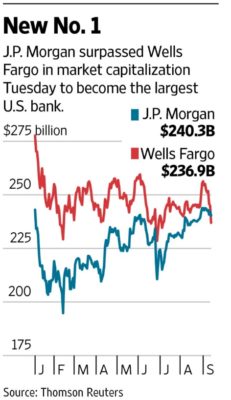

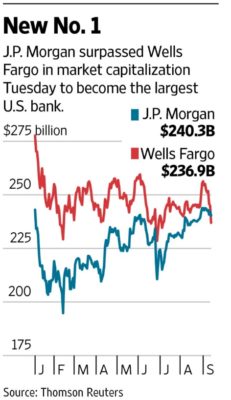

It might even get worse, mostly for investors and lower management. As for the egomaniacs at the top, they’re confident the company can just ‘pivot’ (corporate speak) and keep their status as one of the top banking overlords of the world. Although not the top USA bank anymore. They lost that position, on a market cap basis, after their little hiccup:

Toxic work environments kill attrition. They also kill the incentive to work hard and benefit the corporate organization. The whole thing stinks.

Wells Fargo stock (ticker: $WFC) is down -10% year-to-date.

Reader’s Bonus – below is the entire WSJ article, in case you’re unable to scale (or tunnel beneath) their paywall. FREEDOM!

Wells Fargo CEO Defends Bank Culture, Lays Blame With Bad Employees

Says that at the bank, ‘There was no incentive to do bad things’

As public and congressional pressure mounted on Wells Fargo & Co. executives, its top two bankers had an explanation Tuesday for allegedly illegal sales practices across the company: It was employees’ fault.

Chief Executive John Stumpf defended the firm and the efforts it had taken to stop the behavior, which included opening accounts for customers without permission. “There was no incentive to do bad things,” Mr. Stumpf said in an interview with The Wall Street Journal. He called the conduct that led to last week’s settlement with federal and local authorities “not acceptable,” adding that the bank doesn’t “want one dime of income that’s not earned properly.”

At the same time, the San Francisco bank said it would soon eliminate the practices at the center of the controversy: branch-level sales goals that encouraged employees to cross-sell products to customers. Last week, Wells Fargo paid a $185 million fine to regulators, including the U.S. Consumer Financial Protection Bureau, after findings that many accounts were falsified or forced on unsuspecting customers.

Many of the employees felt pressure to sell customers multiple products or services—for example, home-equity lines to certificate of deposit holders—to stay in their jobs or earn bonuses tied to sales goals, according to interviews with current and former Wells Fargo workers. Some branch employees met with their managers several times a day to report their progress on meeting cross-selling targets, they added.

On Monday afternoon, Wells Fargo was the country’s largest bank by market capitalization. But by Monday evening, word came of planned congressional hearings. By the end of the day Tuesday, a 3.3% stock decline meant that Wells Fargo, with a market capitalization of $236.9 billion, was now second in value to J.P. Morgan Chase & Co., with $240.3 billion. Wells Fargo had surpassed J.P. Morgan in 2013.

“They’ve been perceived to be the highly credible, high- quality institution,” said John Pancari, a bank analyst at Evercore ISI. “This is a chink in the armor.”

The fine itself is tiny for a bank Wells Fargo’s size. It represents only about 3% of the bank’s second-quarter profits. But analysts are now concerned that the bank’s customers will grow more suspicious of Wells Fargo’s motives and eventually move some of their deposits and lending business to rivals.

On Friday, one analyst, Richard Bove of Rafferty Capital Markets, downgraded Wells Fargo shares to “sell” from “hold,” dropping his target price on the stock to $44 from $51. The shares closed Tuesday at $46.96.

Mr. Stumpf, who is slated to be questioned by the Senate Banking Committee next Tuesday, initially wouldn’t comment on who was ultimately responsible for the practices and sales-driven culture that led employees to move customers’ money into new accounts without their knowledge, in some cases generating fees for the bank.

He later said through a spokeswoman that when the bank falls short “I feel accountable and our leadership team feels accountable—and we want all our stakeholders to know that.”

Rather, Mr. Stumpf said that some employees didn’t honor the bank’s culture. “I wish it would be zero, but if they’re not going to do the thing that we ask them to do—put customers first, honor our vision and values—I don’t want them here,” he said. “I really don’t.”

ENLARGE

The 5,300 employees who were fired over five years due to improper selling, Mr. Stumpf said, included bankers, managers and bosses of those managers. Chief Financial Officer John Shrewsberry said about 10% of the employees let go were branch managers or higher.

Mr. Shrewsberry said the bank’s issues stemmed from “people trying to meet minimum goals to hang onto their job.”

Much of the activity occurred in Wells Fargo’s large community-banking division. That unit generated $12 billion in revenue in the second quarter and accounted for 57% of the overall bank’s net income during the quarter. On Tuesday, Mr. Shrewsberry said the bank is spending $50 million annually on addressing these issues.

“Cross-selling has been a religion there,” said David Hendler, founder and principal of bank research firm Viola Risk Advisors, LLC. “They can’t say we’re not going to do that and not have another idea to roll out in the meantime,” Mr. Hendler said.

Wells Fargo has sought to put the 5,300 figure in the context of its overall workforce of nearly 270,000 staff. But Mr. Stumpf acknowledged Tuesday that the number of dismissed employees was far higher than he wanted.

“The 1% that did it wrong, who we fired, terminated, in no way reflects our culture nor reflects the great work the other vast majority of the people do,” he said. “That’s a false narrative.”

Some employees who recently left were critical of the executives’ message. Mita Bhowmick, a former Wells Fargo teller in Pennsylvania, said of responsibility for the sales tactics, “It was all management: their boss, then their boss, then their boss.” Ms. Bhowmick took early retirement from the bank in 2014 at age 58. “They are putting pressure on employees, and it’s sad,” Ms. Bhowmick added. “People need their jobs.”

A public and political uproar followed the allegations that Wells Fargo employees had opened as many as two million accounts without customers’ knowledge and sometimes created fake email addresses on phantom applications.

Staffers at Wells Fargo allegedly created fake email addresses, such as “[email protected],” to enroll unknowing consumers or people who don’t exist in online-banking services to hit sales goals, said the Los Angeles City Attorney’s office, which had previously sued Wells Fargo over sales practices.

The bank’s settlements prompted the Senate Banking Committee to call a hearing to look into the bank, saying it would invite Mr. Stumpf to testify. Mr. Stumpf said Tuesday that he is prepared to attend and “share Wells Fargo’s story.”

When asked if he was worried about his own position, Mr. Stumpf said his whole focus is on leading the bank. “I’m thinking about how do we move forward,” he said.

Wells Fargo executives said the bank still wants to grow sales, but decided it would no longer set targets. “We think to the extent that some team members used a sales goal as a motivation to do something that is inconsistent with our culture… [it’s] just not worth it,” Mr. Stumpf said.

Comments »