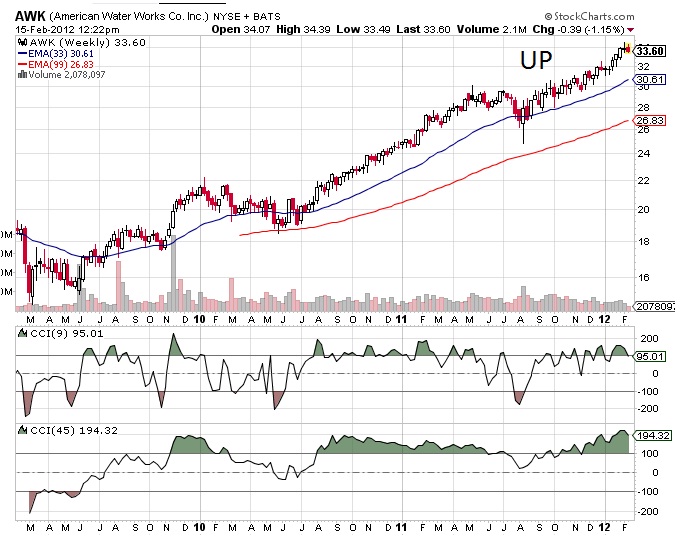

But what’s the next move?

Perhaps today is a needed pause for the bulls but more and more of the charts I’m looking at are either decent short entries or in need of a breakout to the upside. Extended names like BKE, CLNE, and KORS are offering decent entries on the short side. Some of my holdings DVAX, LNKD, FR, and F are nearing the fuck or walk stage. I’m sticking with the names and being patient, giving the benefit of the doubt to the bulls if you will. But to be clear, I have the “65% cash on the sidelines” conviction.

The market feels like it’s hunting the next catalyst for direction. So much discussion takes place between us pen pals. The media conveyor never shuts off but today it feels slow like a 1996 union job. It’s just a matter of time until the market finds direction. My ideal scenario is to see a dip in the indices while my longs continue to rest. Then I can go back to gobbling up stocks like Lisa Lampanelli in a hotdog eating contest. At this junction it appears it wouldn’t take much sell side volume to alley shiv unsuspecting longs with the cold blade of volatility. Or we continue to see a pleasant spring time levitation.

In summary:

Still long bias

Want more stock but only on my terms (cheaper)

Don’t underestimate Lampanelli’s stomach capacity

Having a short or two in your arsenal could be decent (playing both sides (no homo))

Comments »