Shortly after knocking my head pretty good on the cement last summer I received an email from Stocktwits asking if I could be their community organizer in Detroit—my beloved home town—a place surrounded by a massive fresh water reserve. And being only 24 hours off my deathbed I was experiencing the clarity one achieves when fate comes knocking. I knew what had to be done.

The purpose of our Detroit Stocktwits Meetup is to liberate the small-to-medium investor from all the charlatans that plague the finance industry. And also to cut away senseless fees using the latest tools in fintech.

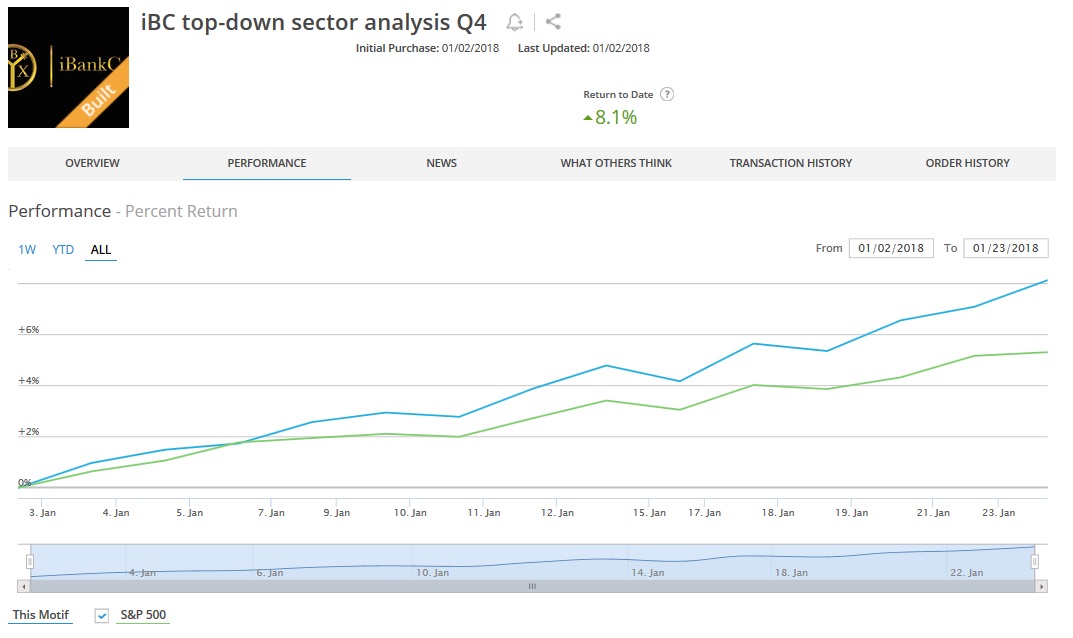

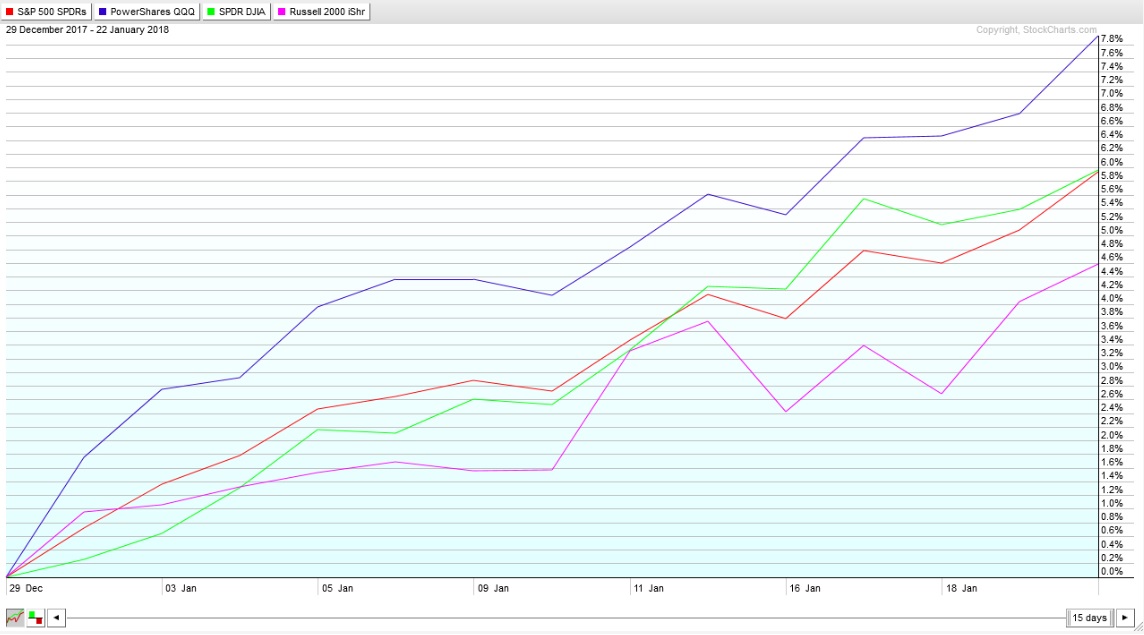

My favorite investing method right now, hands down, is to pair Exodus and Motif to build a quant strategy that dominates the financial markets. Our latest installment in the quant book is up +8% year-to-date, beating all other major indices. Look:

And despite all my encouragement that normal small-to-medium investors stick to passively allocating to this type of quarterly strategy, they still want to know more about active trading.

What am I supposed to do? Not share everything I have learned about active trading these last 9 years? COME’ON…

SO WE GONE TALK ABOUT ACTIVE TRADING.

And it is going to make people uncomfortable. Because the first thing I will tell them is how much money they are likely to lose whilst learning. Hopefully they lose less than I did. That is my goal.

If you have followed this blog for any amount of time then you know what tools I like for active trading, but I shall list them again, for any new readers. It is a few more than two, so here we go:

- quality raw data – DTNIQ feed

- market profile charts – Ninja trader with the fin-alg TPO add-on

- automated trading and candle charts – MultiCharts

- home made tools for context/bias – switchboard and my trading model

- reading and interpreting order flow – Bookmap

- optional – audible order flow – Tickstrike

- news alerts – Benzinga Pro

Listen, I constantly refine and simplify my approach. The less clutter, the better. I trade one instrument, NASDAQ 100 futures. If I can eliminate a tool or expense, I do. I need all the above tools to consistently receive and interpret what is happening in the world.

As useful as those tools are for me, you could sit at my trading desk with all the same inputs and have your jaw clean knocked off your face. It is like sitting in the cockpit of a Formula 1 race car—there is no way you will drive like Mario Andretti. What takes people far longer to cultivate is a winning mentally.

This takes time. It took me a long time. And I still do dumb shit sometimes. The key to this game is staying power. We are going to talk about the habits and lifestyle choices that, for better-or-worse, help you stay in the finance game for a long time.

Here is the thing. I am just getting started. I have another solid 50 years of trading and investing ahead of me. That is a long time to learn and grow and advance my vocation. The markets have existed long before me, and will continue to exist long after I am gone.

So I trade less now. Only when the best opportunities surface.

Like those 20 points up we took off the open Tuesday morning. That was a lay-up trade. We had a plan, we had a directional bias, and we had a high probability target (overnight high).

Anyways listen. We are meeting in the hood tonight, down in Corktown, by the rubble of old Tiger’s stadium to talk active trading. If you want to ask any questions remote, I am going to go live on Instagram around 6:45pm eastern. Go follow my account now @vincalim to receive an alert when I go live.

Here is a link with all the information in case you are nearby and want to come hang out:

ANNOUNCED: RAUL to host Detroit Meetup. Topic? Active Trading

If your goal is to dominate the financial markets from a position of confidence, then join us Tuesday evening at Brew Detroit. Or remote. Together we shall liberate ourselves from the Goliaths and roam the planet FREE, no ones master, no ones slave.

If you enjoy the content at iBankCoin, please follow us on Twitter