Greetings and Happy pagan Eater lads!

Floods coming.

But enough of the doomsday premonitions, today is a most joyous occasion. Last night a six foot tall bunny was spotted in the neighborhood, walking upright, laying candy-filled eggs all over the place. A caravan of baskets floated in his wake, settling in homes along the way, filled with treats for all the boys and girls fortunate enough to live with hard working capitalist parents.

The socialists received nothing but stewed beets. They will be much healthier through the years but also quite bitter. Hopefully they remember to set their calendars next year so they do not miss their chance to sit on the bunny’s lap for 1 minute. If not, too bad! You sit on ground for rest of year.

The winds of change are blowing. Rains bring promise of bulbs a’blooming and there is an animistic excitement in the city’s techno halls.

Last week bulls came out and defended the stock market, but they piled into risk averse investments like medical REITS and appliance stores. For real though, look at last week’s industry flows:

best performing industry list from last week reads like an AARP member discount catalogue #riskaversion pic.twitter.com/IbAVNikGom

— RAUL (@IndexModel) April 1, 2018

This resulted in the DOW outperforming all major indices. This could mean two things—bears are still in control—or the risk cycle has reset and begun anew.

First the staples rally, then the tech darlings, then degenerate lottery plays. Unfortuantely, my degenerate lotto play $SCON did not participate in the 8th inning festivities, if in fact we have reset. So it is going to be a long ride.

But that does not matter to you. What matters to you, at least I hope, is what needs to be done next week to make money. Said money will be stockpiled and eventually used to procure real land as far north as your constitution will allow, safe guarding you from the inevitable herds of humans migrating up from the equator.

The fact that #MAGA fanatics do not believe in global warming, yet cower behind their guns upon seeing people migrating north blows my mind. Do you not see all life dying at the equator? Becoming literal dead zones that not even extremophiles can endure? Deniers truly are some of the dumbest people on the planet, relegated somewhere on the idiot spectrum just above the flat-earthers.

USE YOUR EYES to observe the objective facts.

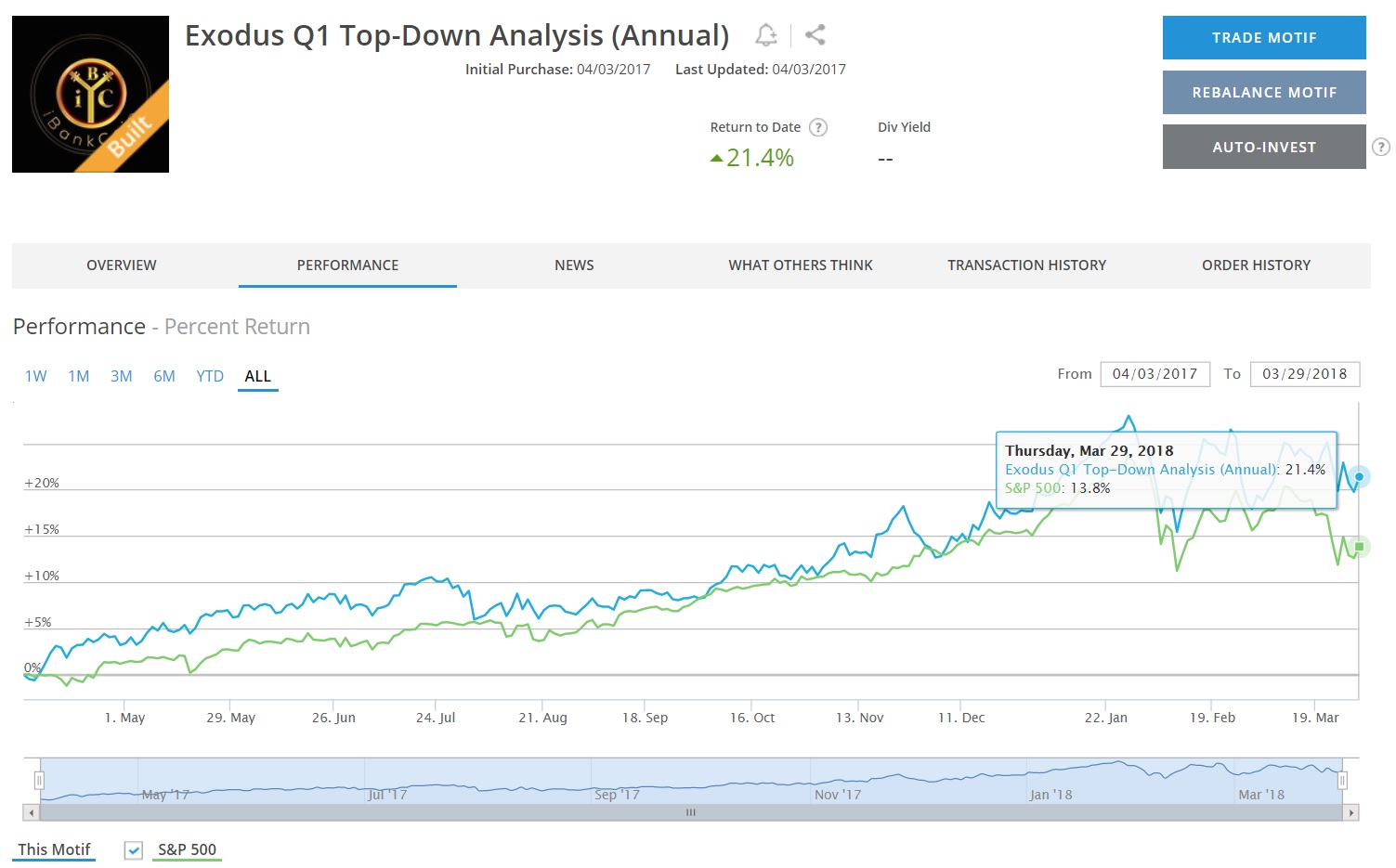

Anyhow. What you need to do to make money next week, according to the models, is expose yourself long to broad market indices and ride them sum’bitches higher all.week.long.

So it is written, so it shall be. I am like your Moses, saving you from the liars and mind controlling media, telling you to only pay attention to raw stock market data.

Raw data doesn’t lie or spin narratives out to thousands of talking TV heads. Follow me to the promised land!

Hallelujah

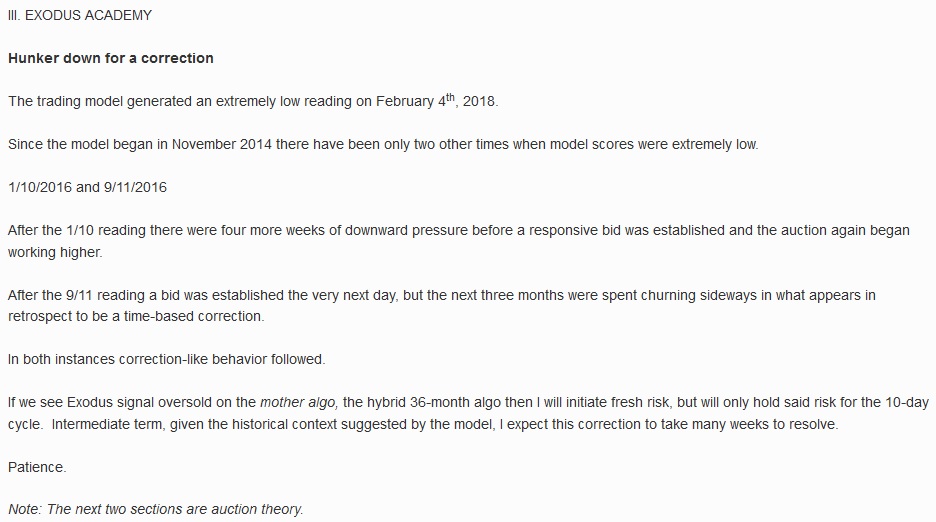

Exodus members, the 176th edition of Strategy Session is live, go check it out!

Comments »