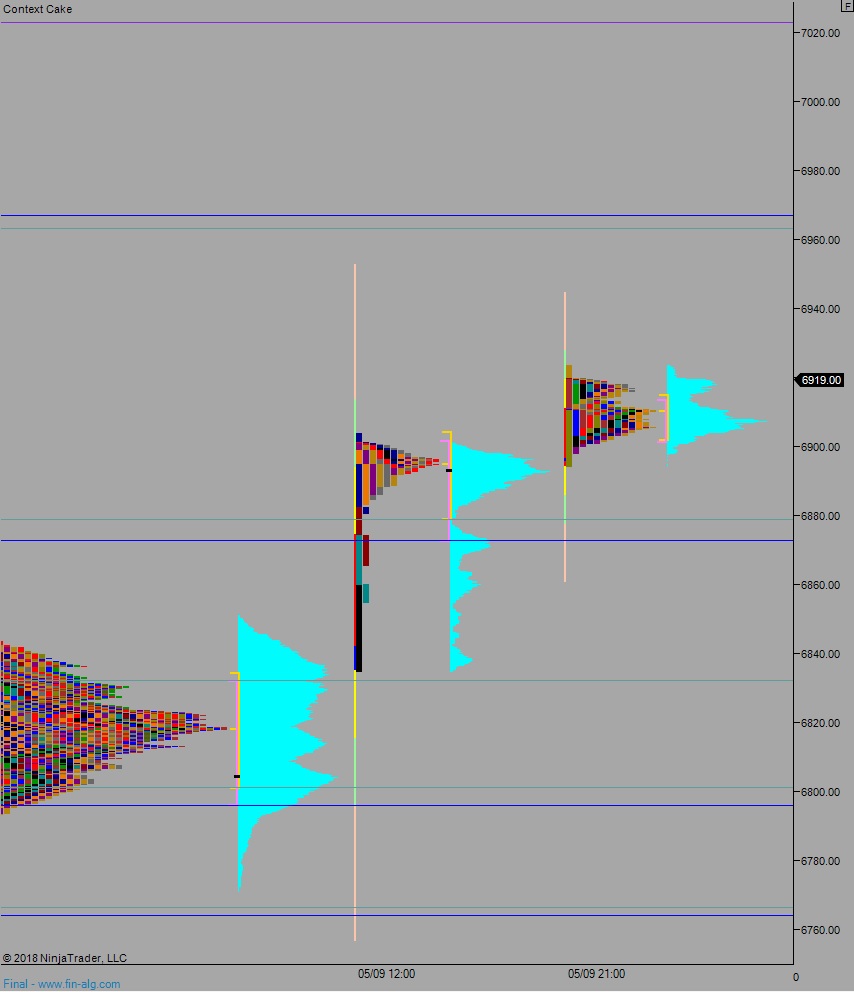

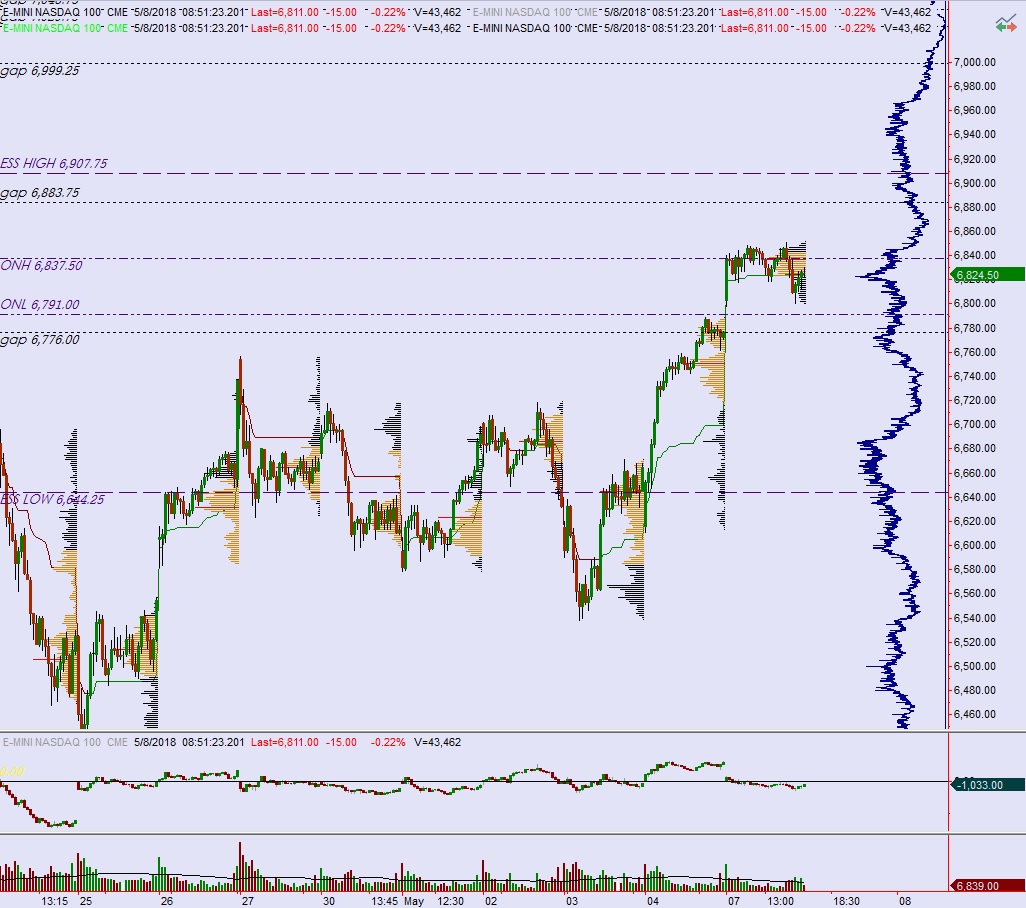

For the first time in 2018 we experienced volume and range within the confined of ‘normal’ relative to a five year study of the instrument. There have been several days with normal range, or normal volume, but not both. This may or may not be significant. Price worked to a new weekly high overnight before coming into balance.

The only economic event today is University of Michigan’s primary May reading of confidence.

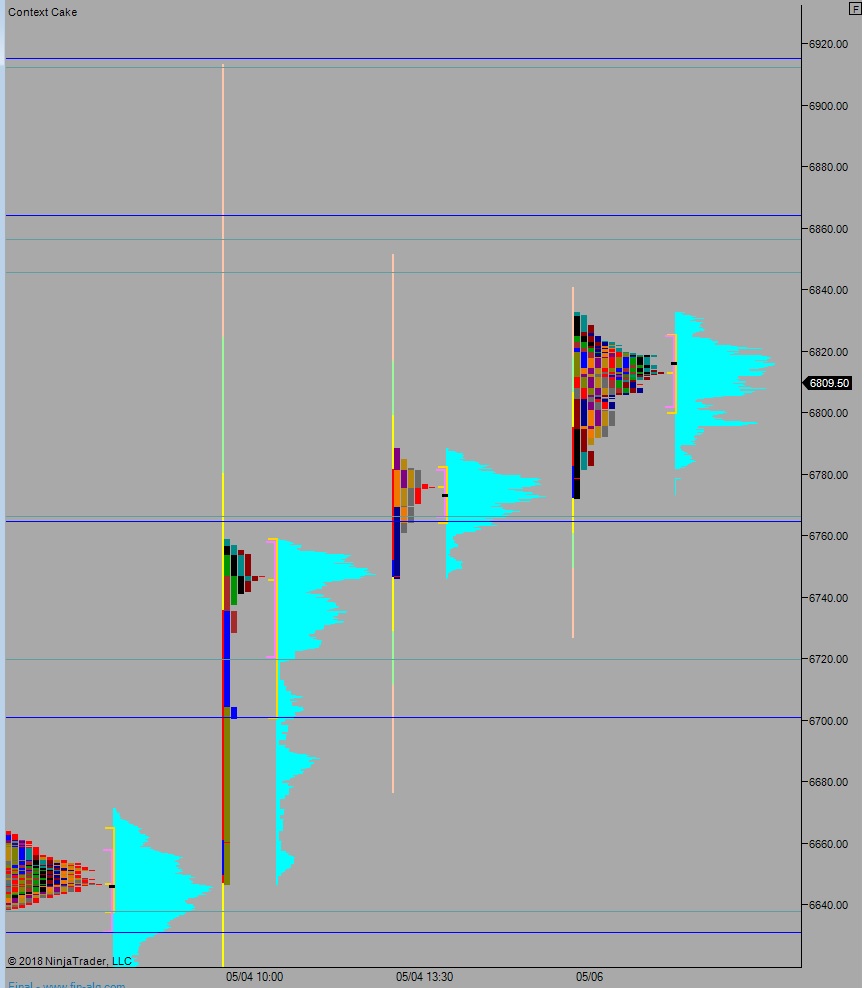

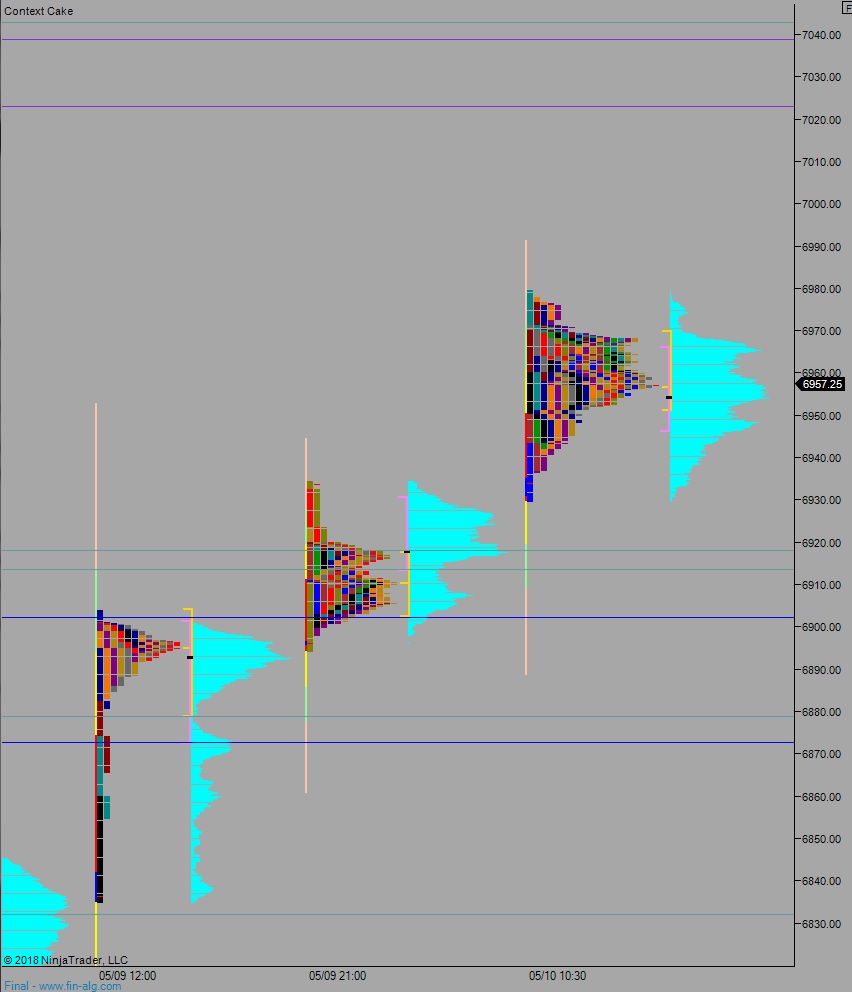

Yesterday we printed a double distribution trend up. The day began with a gap up and sellers unable to work into it. Then the rest of the day was spent slowly campaigning higher prices unseen since March 19th.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6964.75. From here we continue higher, up through overnight high 6979.50 setting up a move to close the open gap at 6999.25 before two way trade ensues.

Hypo 2 sellers trade down through overnigh5t low 6948.50. Look for buyers around 6917.75 and two way trade to ensue.

Hypo 3 stronger buyers work up to 7022.75 before two way trade ensues.

Levels:

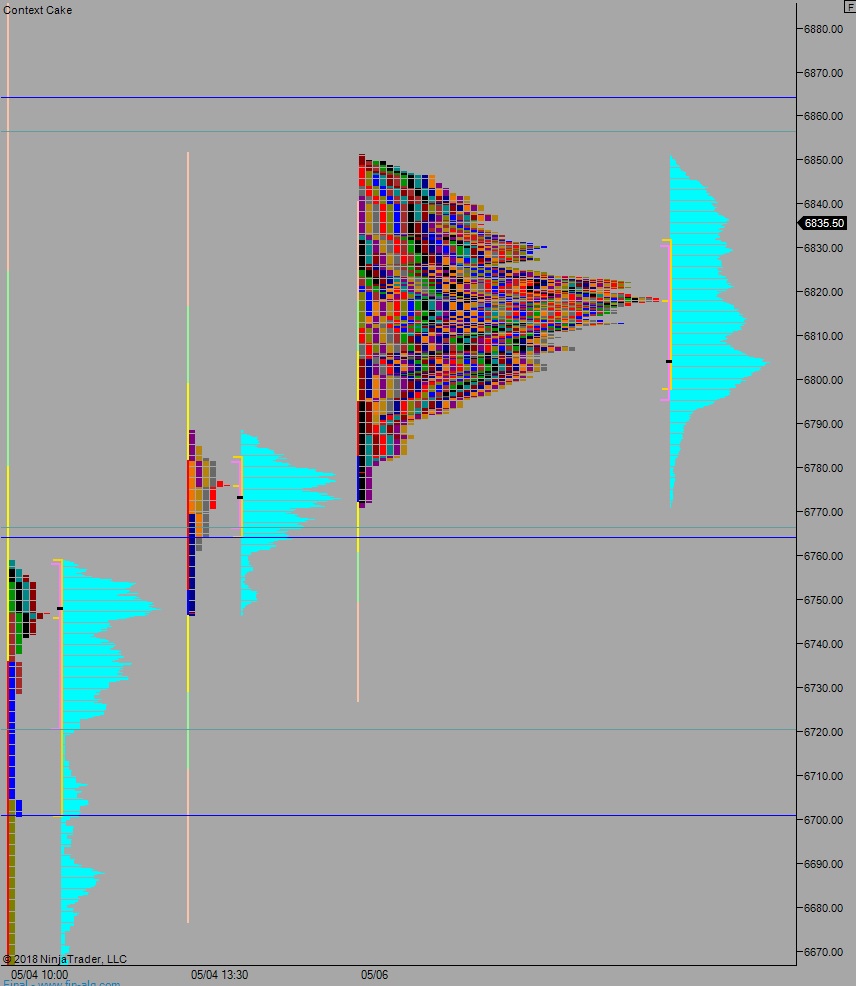

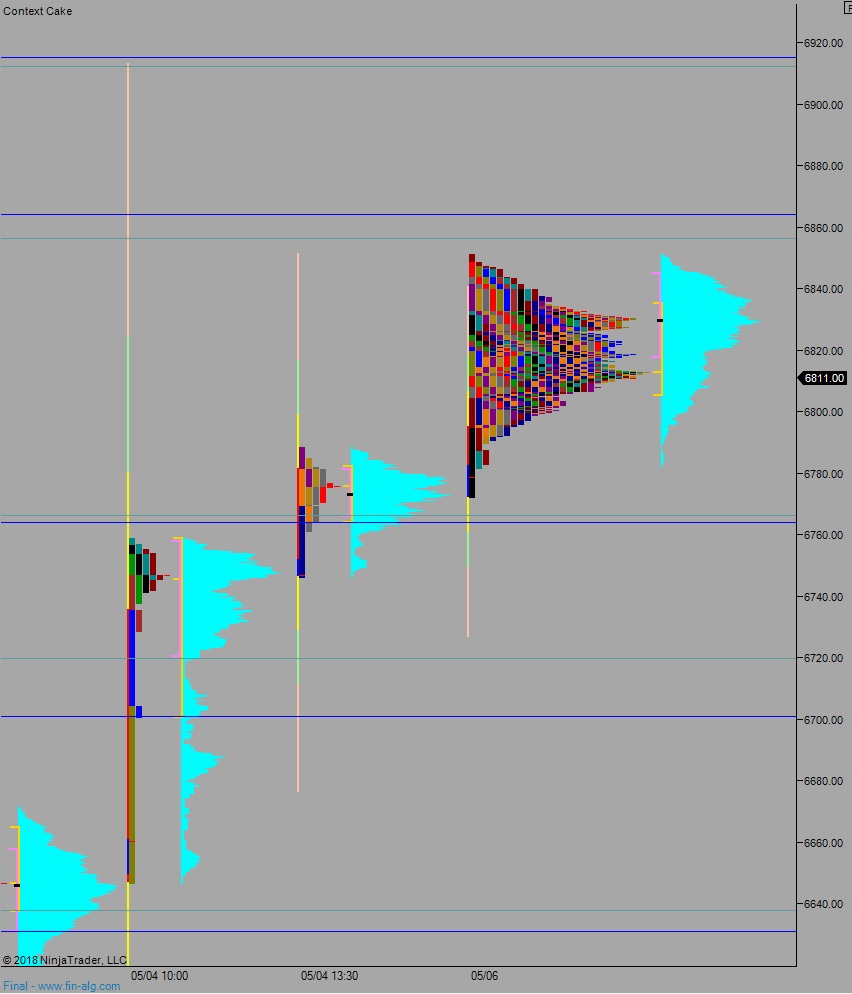

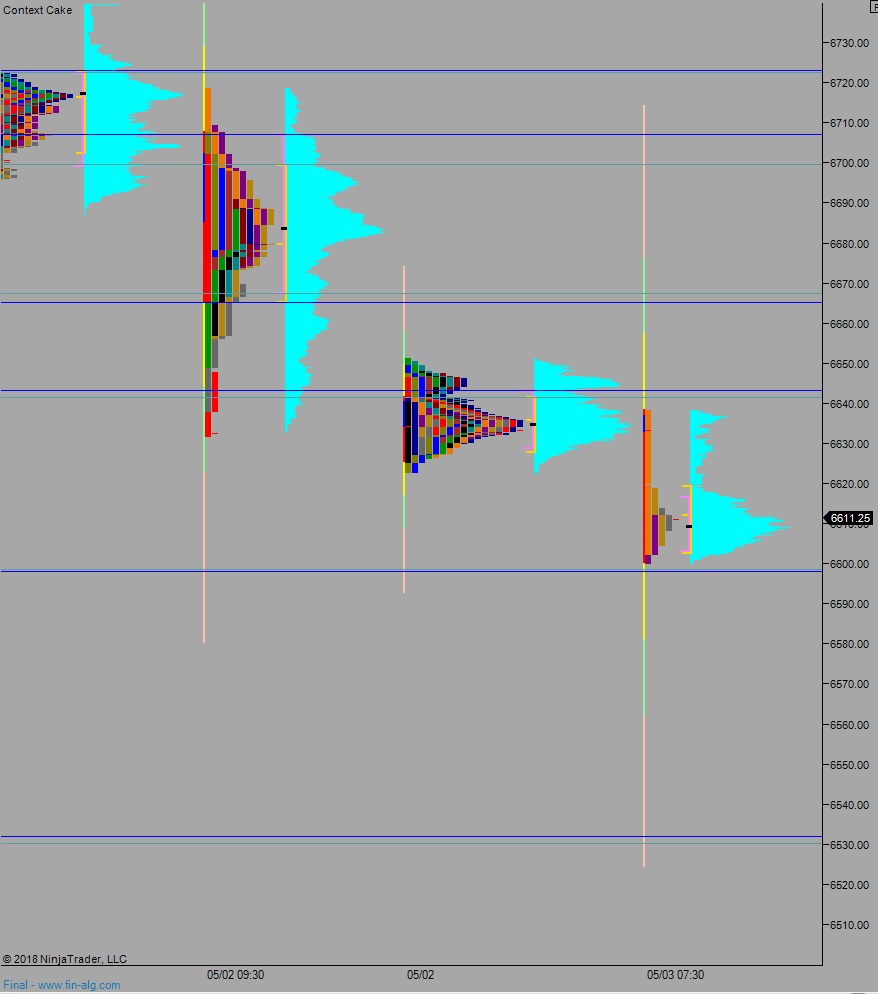

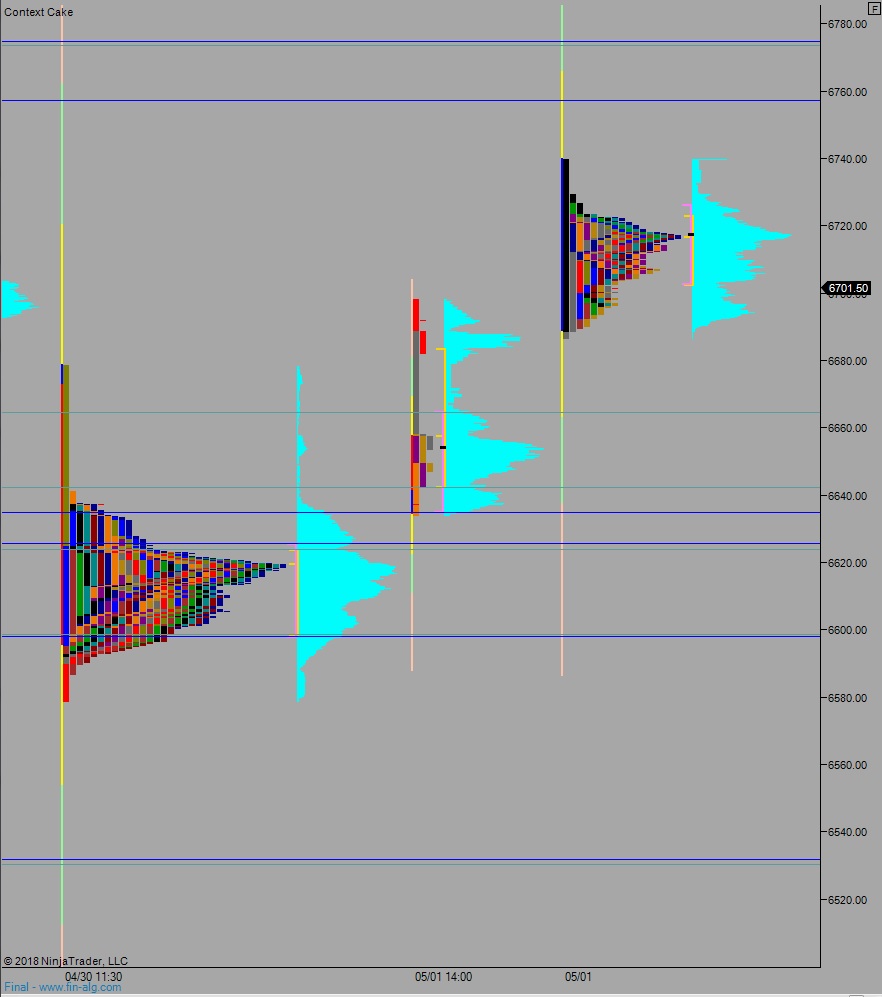

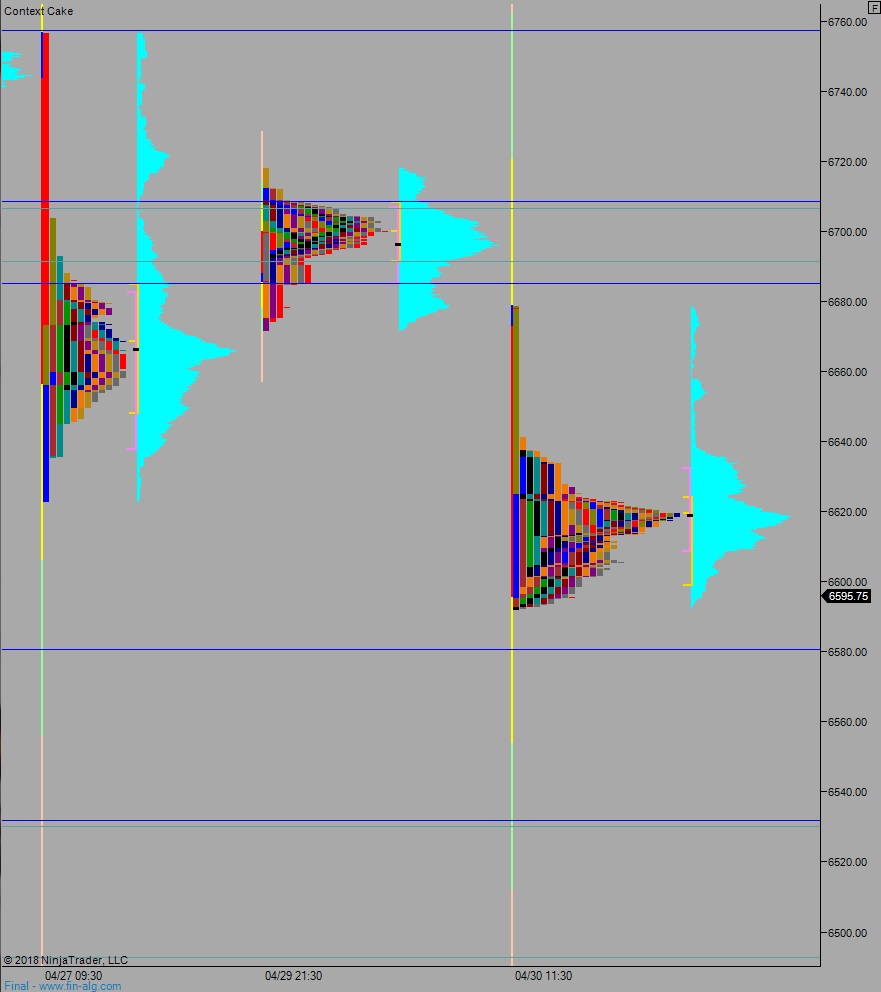

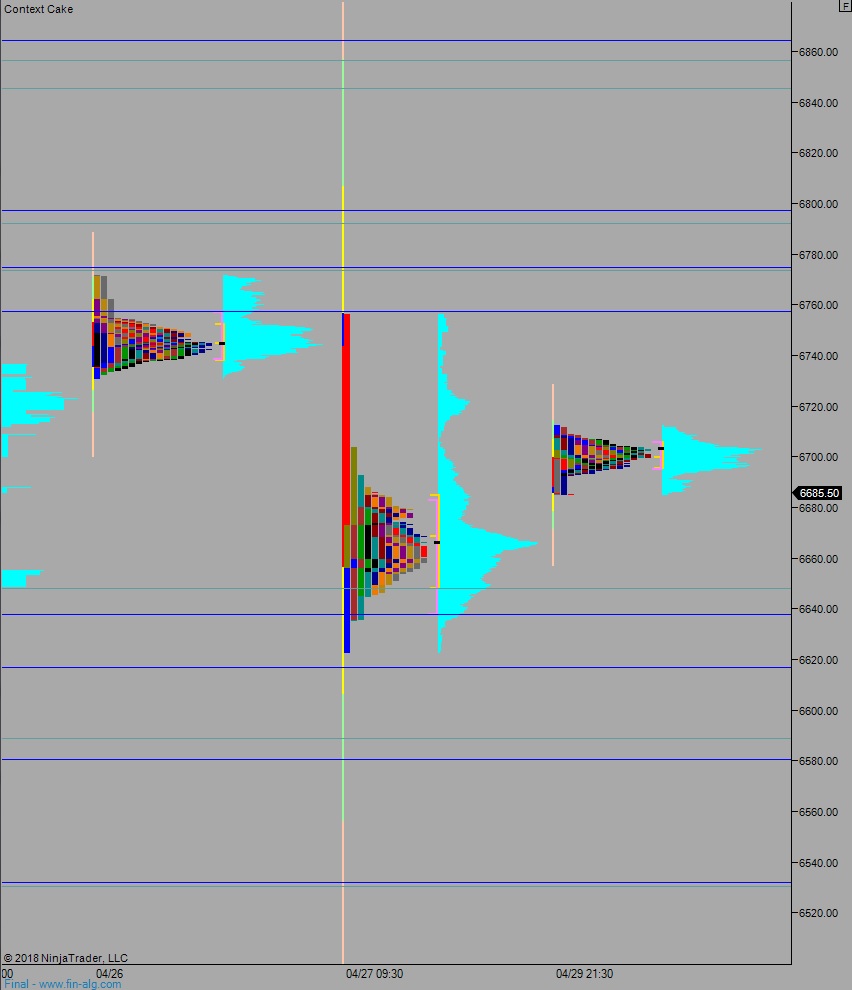

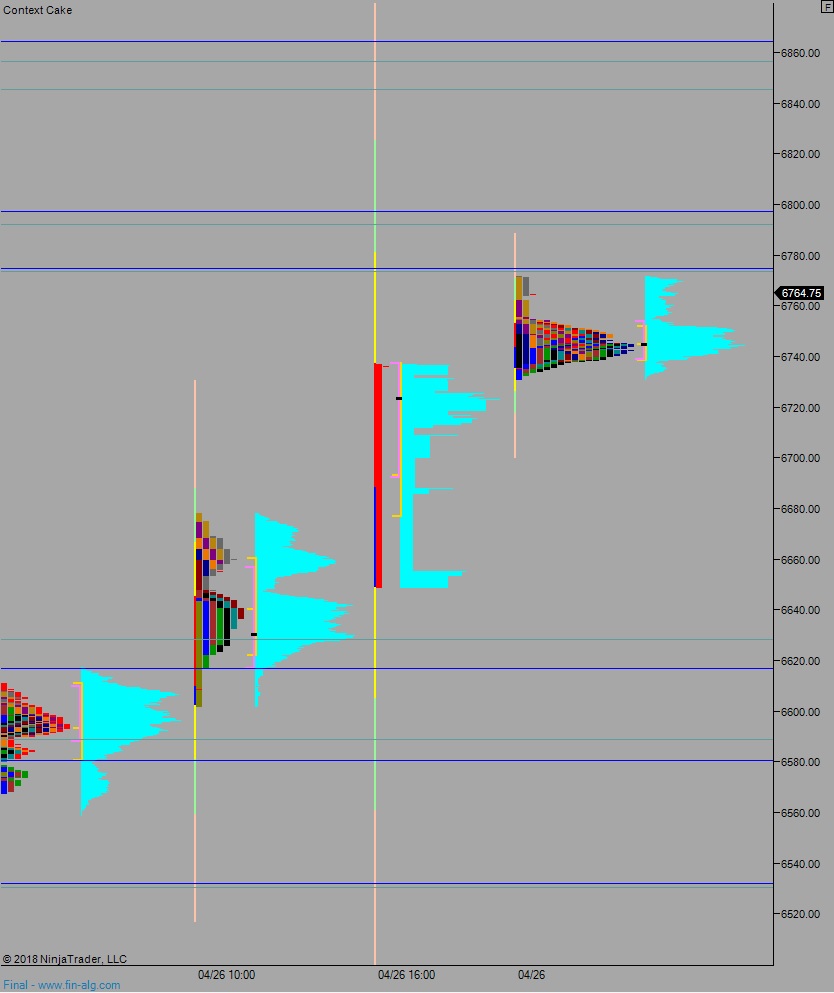

Volume profiles, gaps, and measured moves: