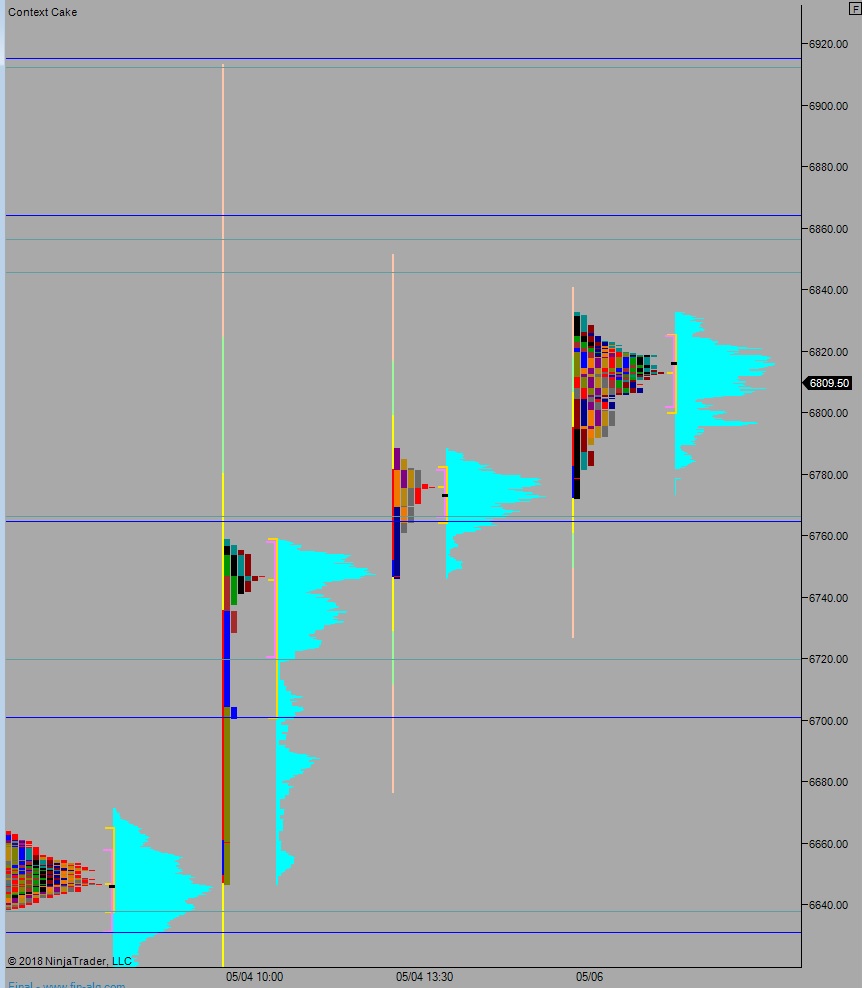

NASDAQ futures are coming into the week gap up after an overnight session featuring elevated volume on extreme range. Price campaigned higher overnight, trading up to prices unseen since about three weeks back before coming into balance.

The economic calendar is light this week. Today we have 3- and 6-month T-bill auctions at 11:30am and consumer credit at 3pm.

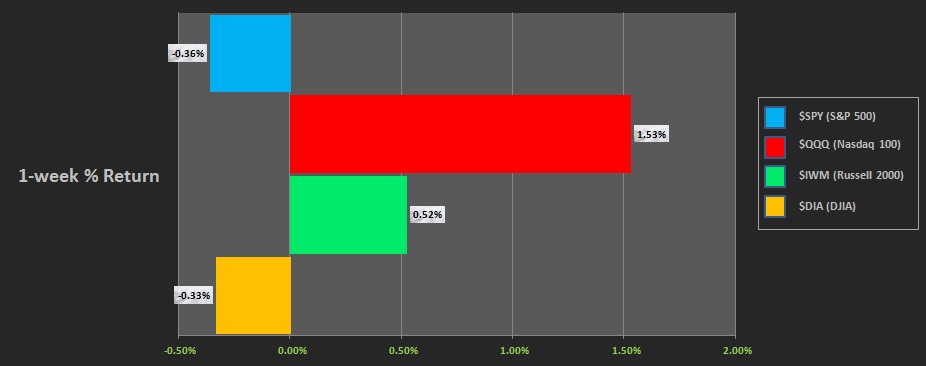

Last week was choppy. Sellers took action early in the week. Price moved methodically lower. Buyers stepped Tuesday afternoon and again Thursday. Friday the NASDAQ showed divergent strength and made preliminary attempts to break away from a muti-week consolidation. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a trend up. The day was spent auctioning higher and working through some key contextual levels that suggest the tech-heavy index may be breaking up and away from a multi-week correction.

Heading into today my primary expectation is for a choppy open. Look for buyers to eventually step in and move up through overnight high 6833. Look for sellers up at 6845.25 and two way trade to ensue.

Hypo 2 sellers work down into the overnight inventory and close the gap down to 6776 and continue lower through overnight low 6772.25. Look for buyers around 6766 and two way trade ensues.

Hypo 3 stronger buyers campaign up to 6857 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: