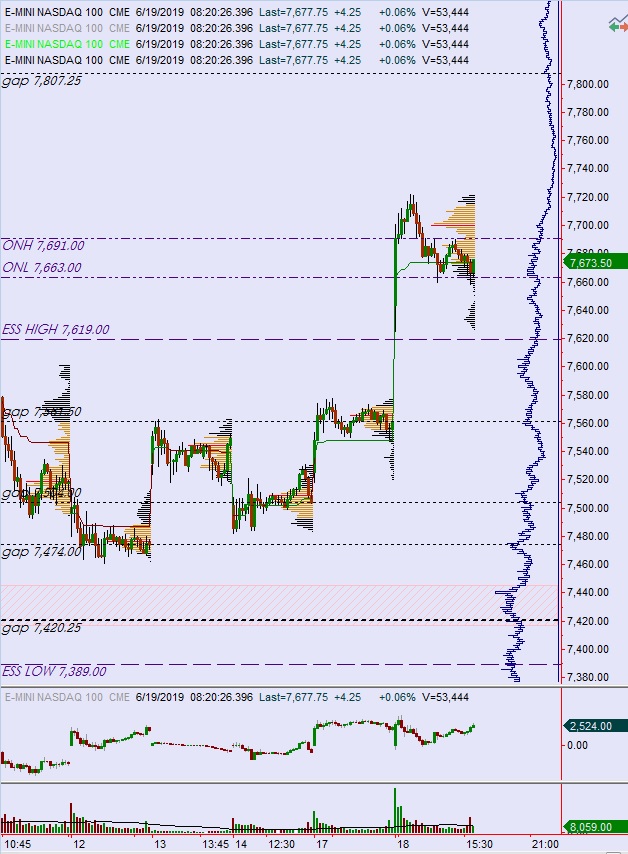

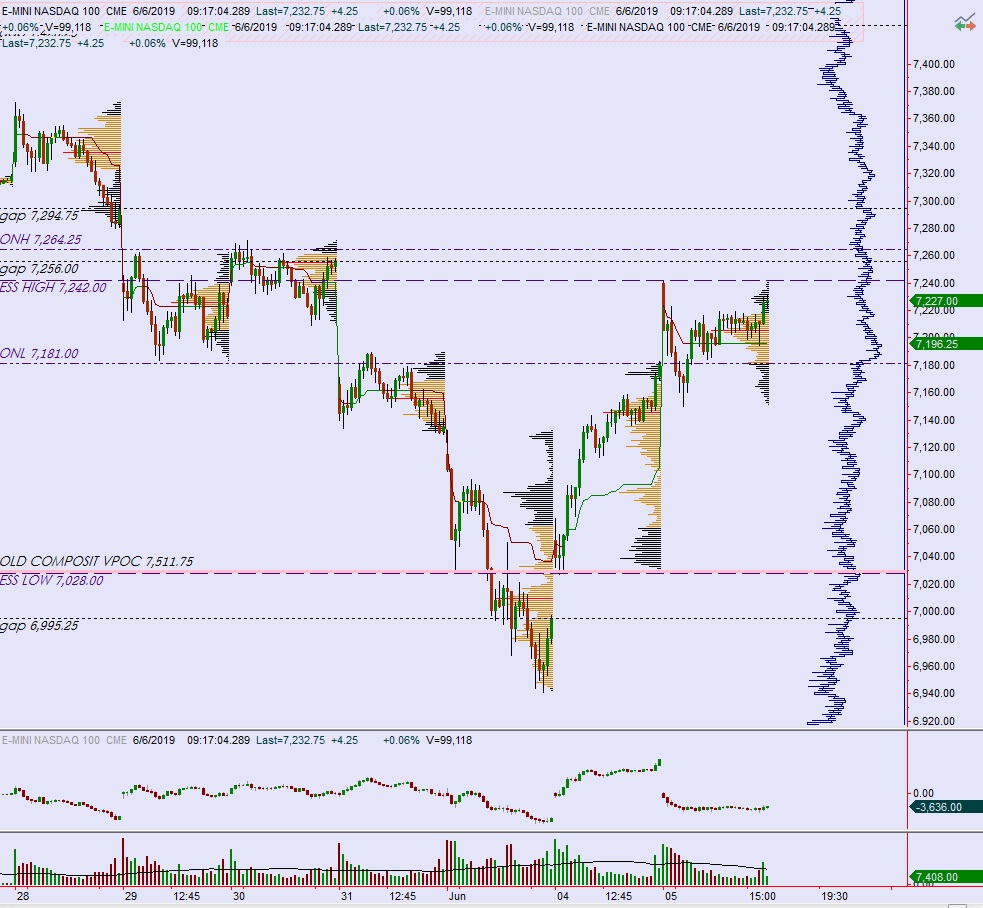

NASDAQ futures are coming into the new week/month/quarter gap up after an overnight session featuring its own gap up, then elevated range on extreme volume. Price chopped along overnight until about 8pm New York when it attempted to press down into the gap up that occurred when globex opened for trade at 6pm. Buyers rejected the move and price worked up beyond the initial chop. As we approach cash open, price is hovering near globex highs, trading inside the 05/03 range, just about 30 points off of record highs.

On the economic calendar today we have ISM manufacturing/employment along with construction spending at 10am, then both a 3- and 6-month T-bill auction at 11:30am.

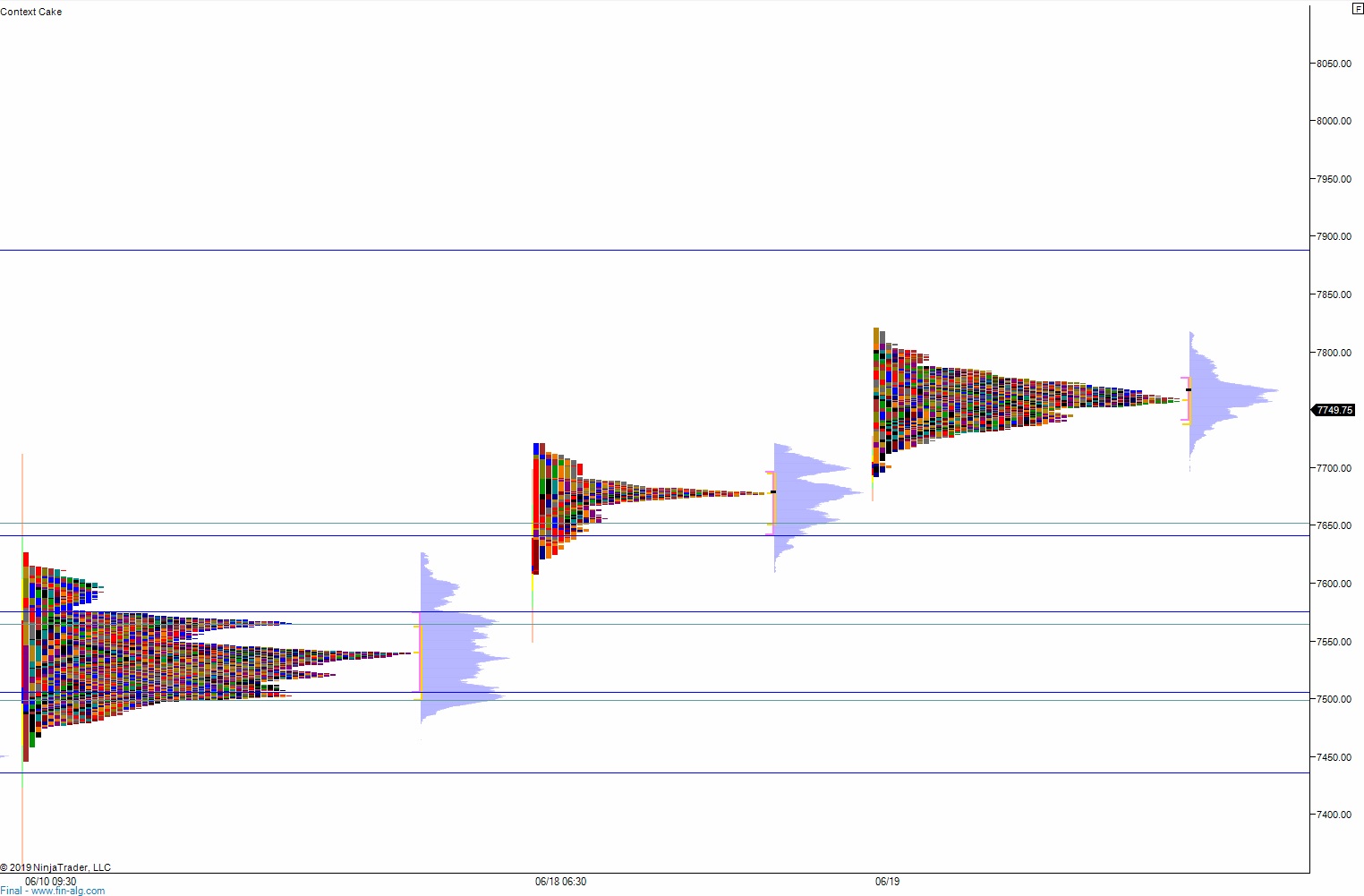

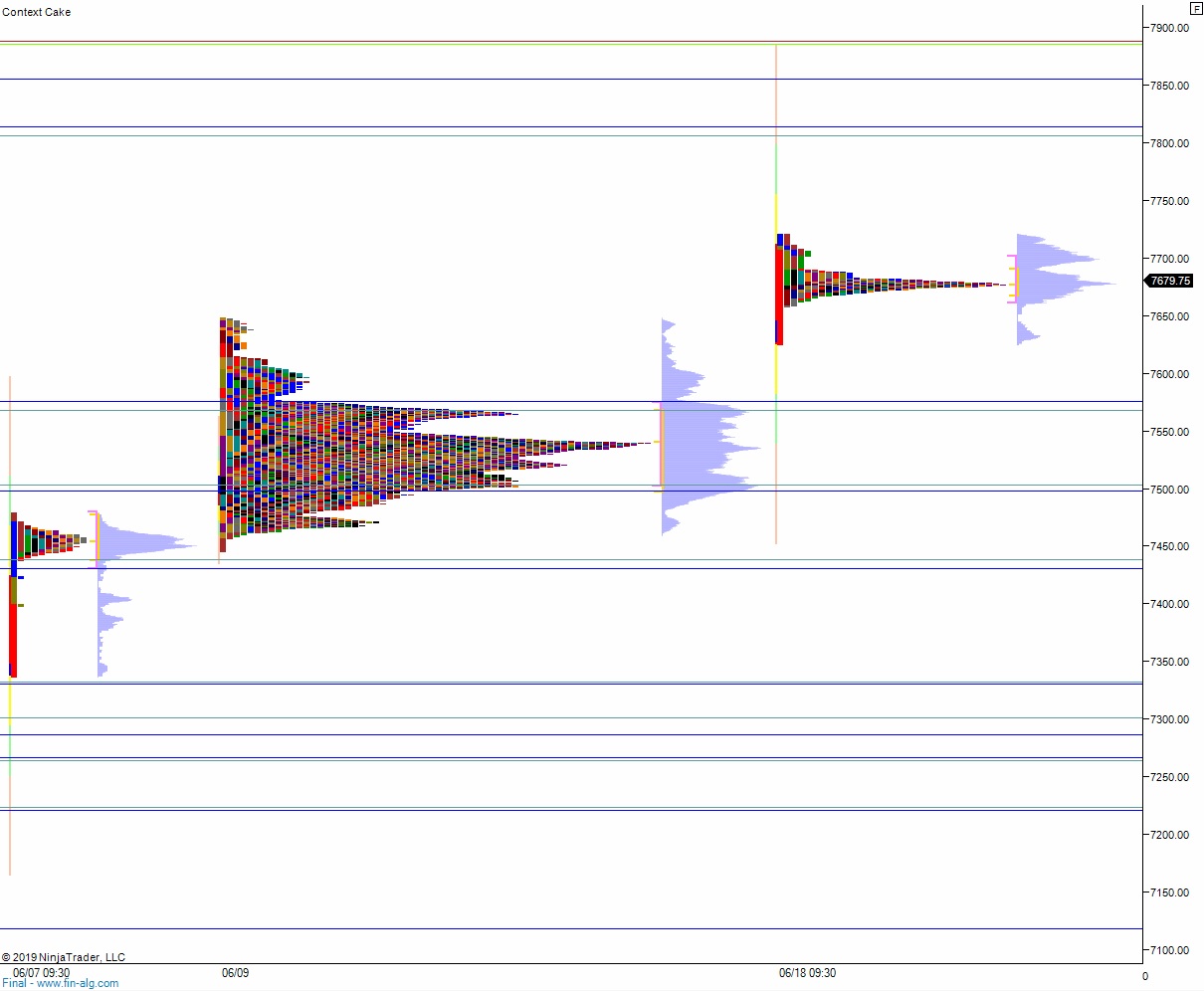

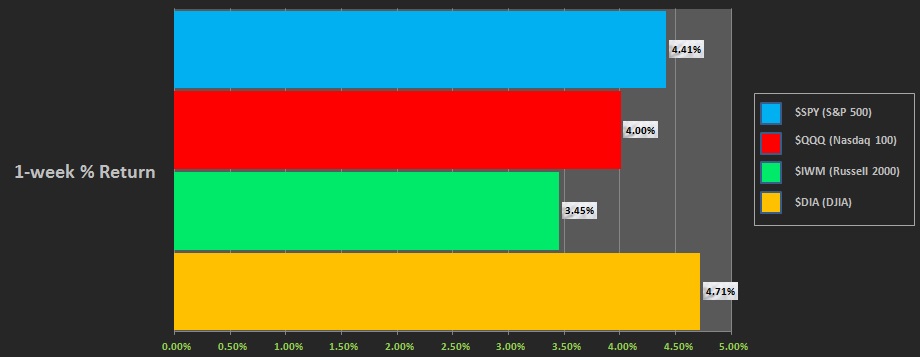

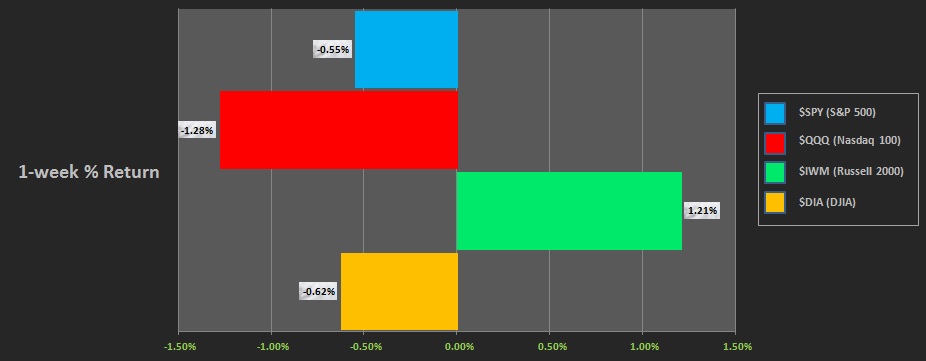

Last week was mostly a sideways drift. Monday was flat, Tuesday saw strong selling but no follow through for the rest of the week. Instead we marked time by trading inside the Tuesday range, going sideways for the rest of the week. The Russell demonstrated relative strength throughout the balance. The last week performance of each major index is shown below:

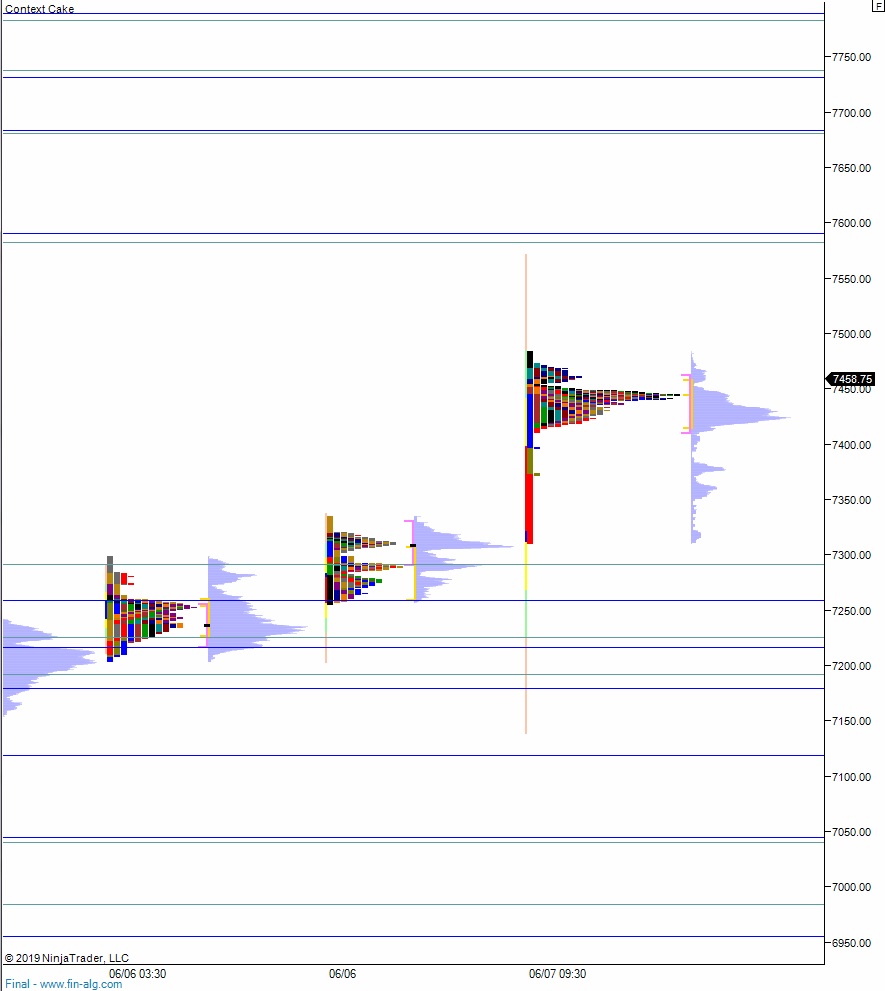

On Friday the NASDAQ printed a normal variation up. The day began with a gap up that was sold into. Buyers showed up just below the Thursday low, before sellers could press range extension down, and price rallied to back near the highs. We did not go range extension up however until the final moments of the session when a strong ramp took prices to a 3-day high as we ended the week.

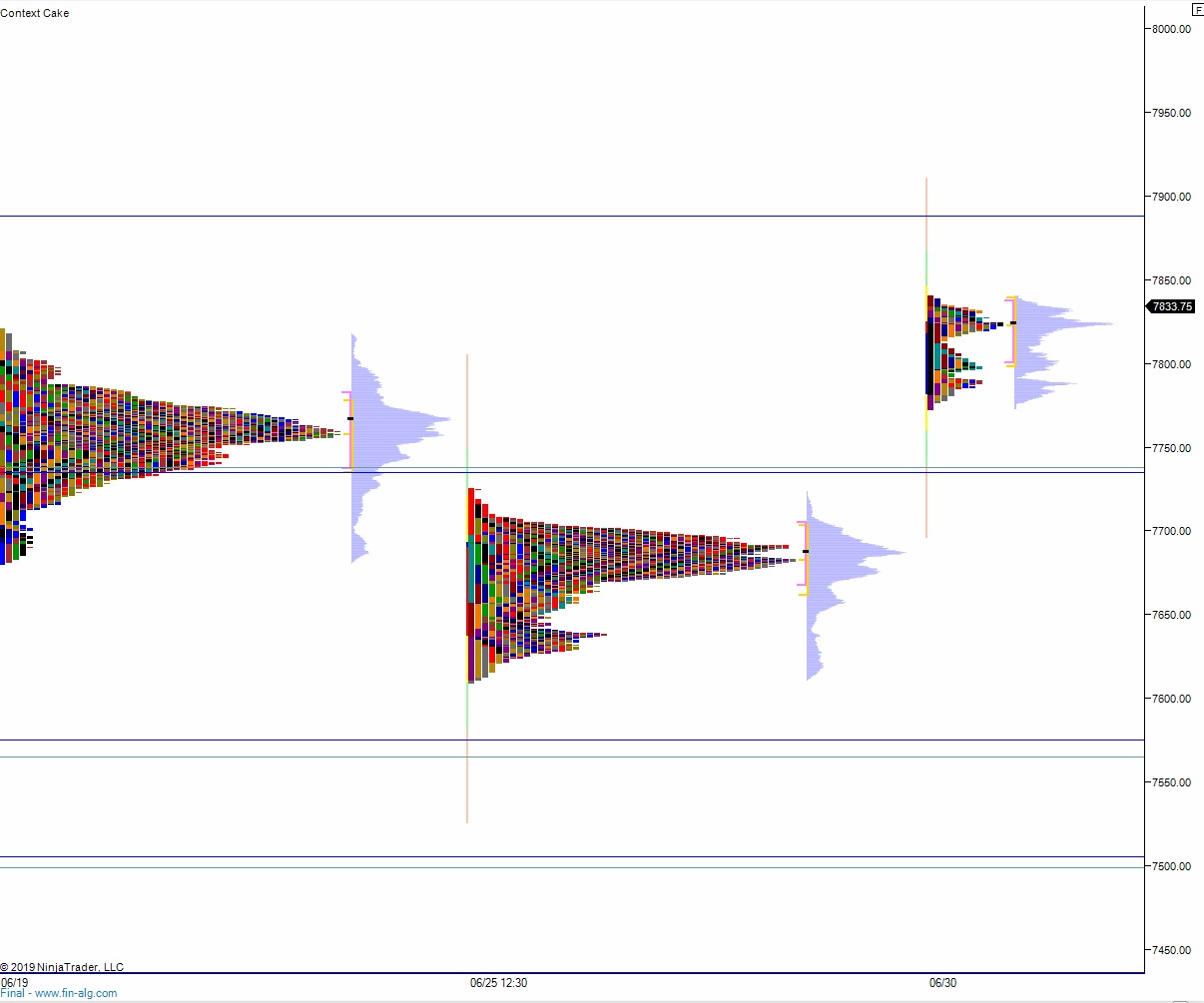

Heading into today my primary expectation is for buyers to gap-and-go higher, closing the open gap up at 7865 then continuing higher to tag 7888 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and take out overnight low 7772.75 setting up a move to target 7759.50 before two way trade ensues.

Hypo 3 full on trend up. Trade up through 7888 and sustain trade above it, setting up an exploration of open air.

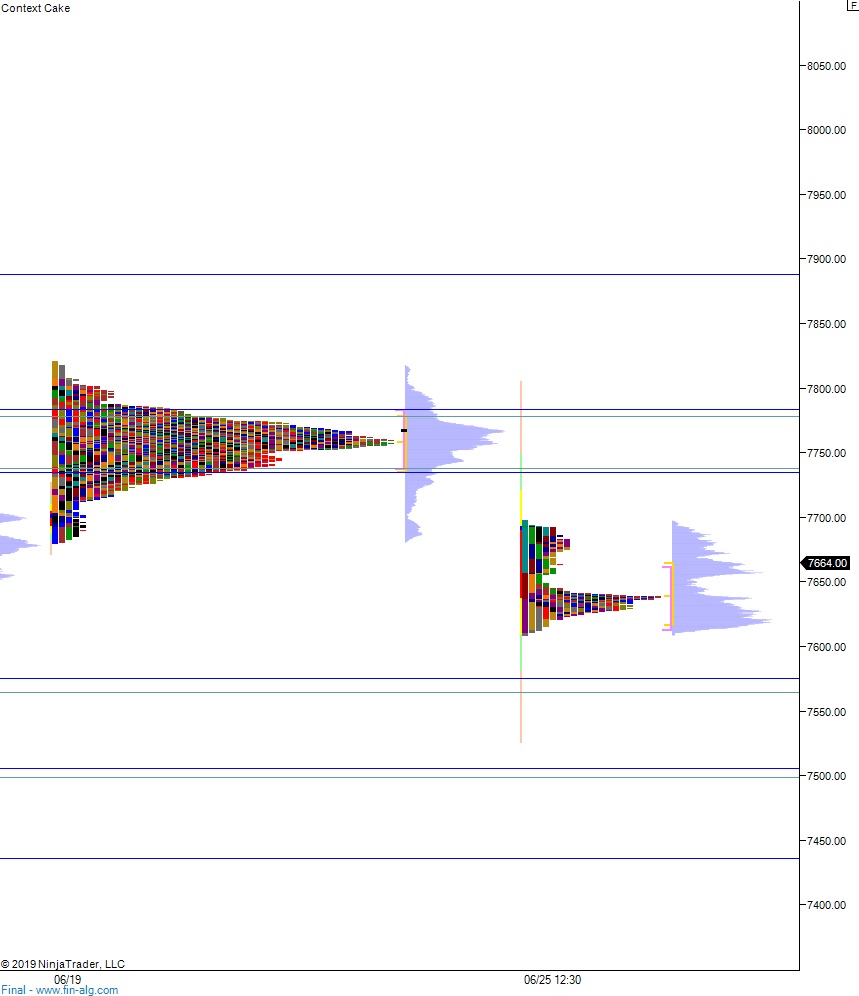

Levels:

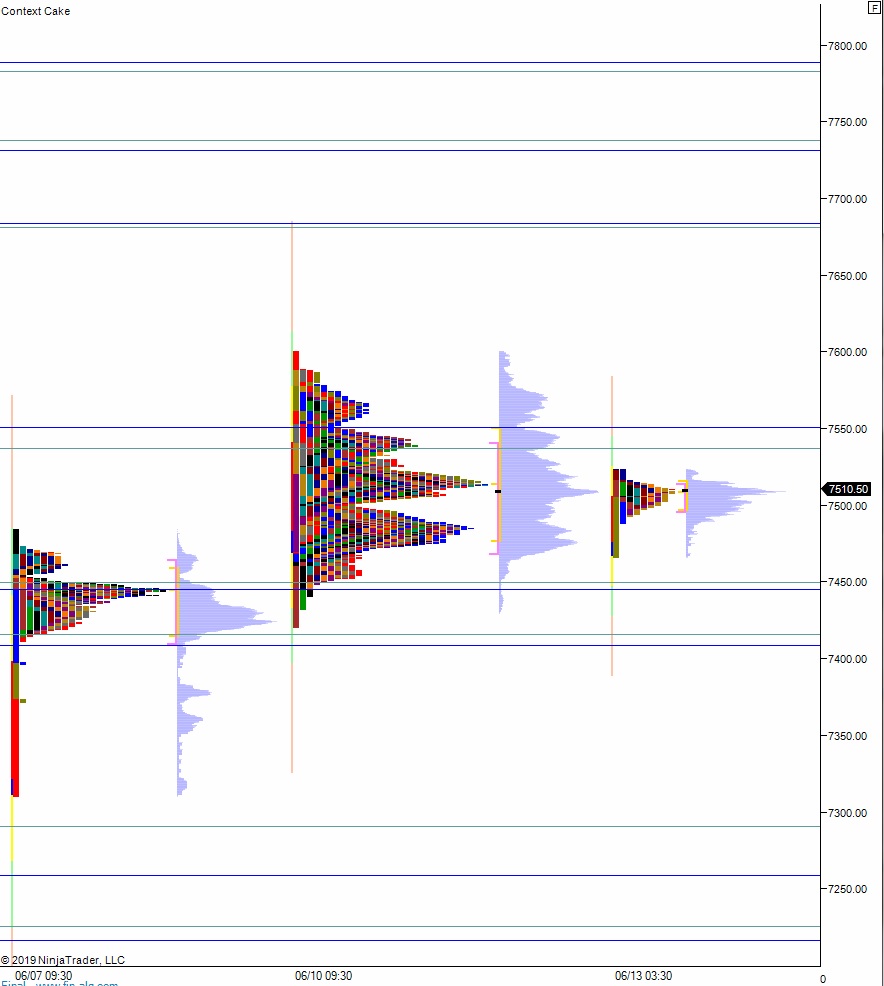

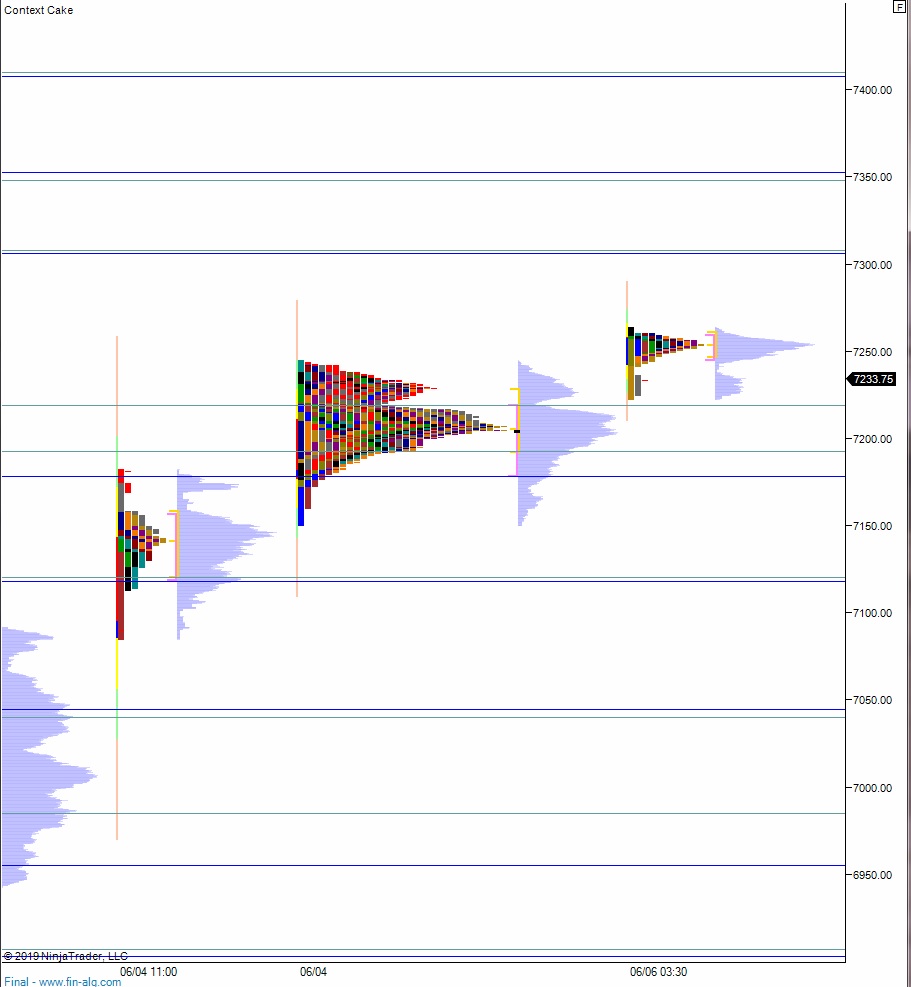

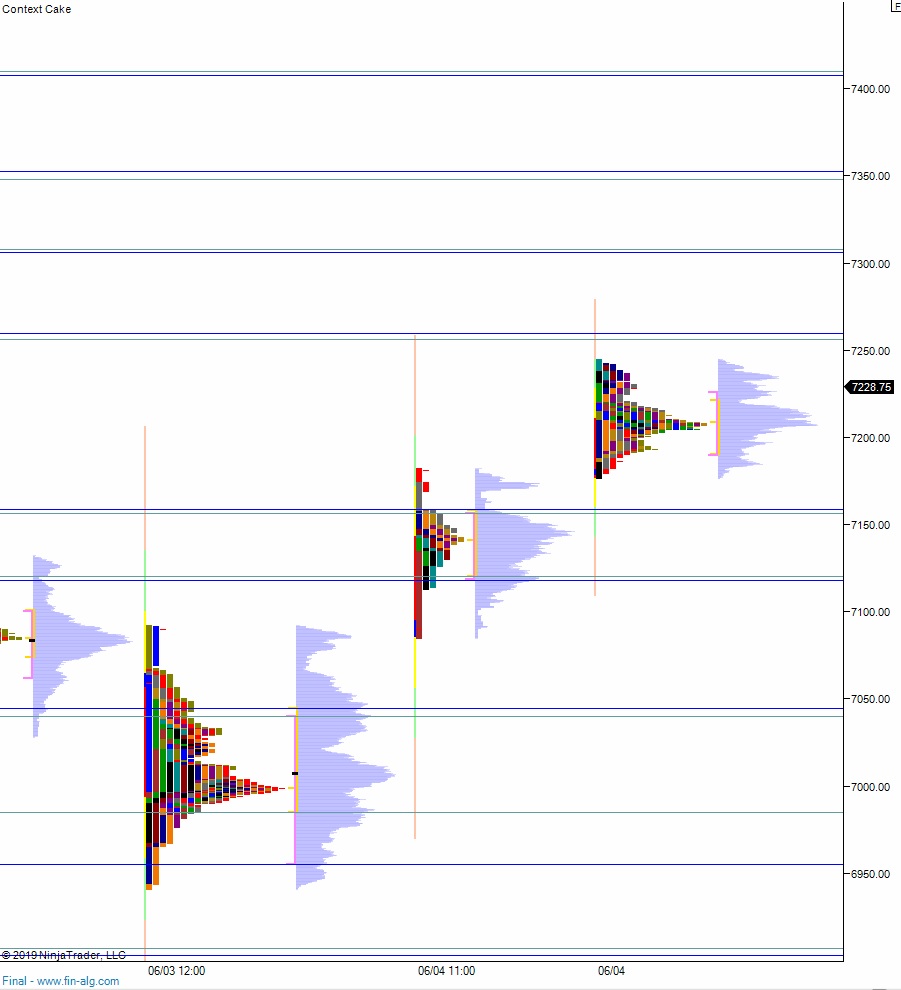

Volume profiles, gaps, and measured moves: