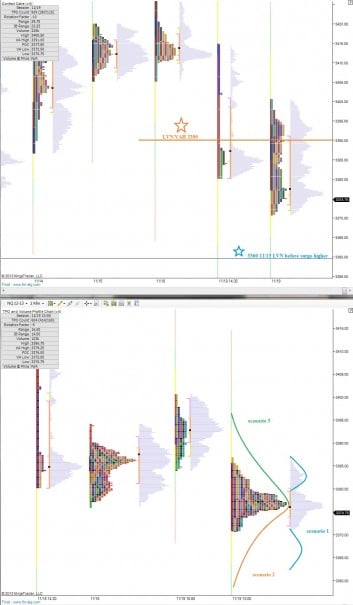

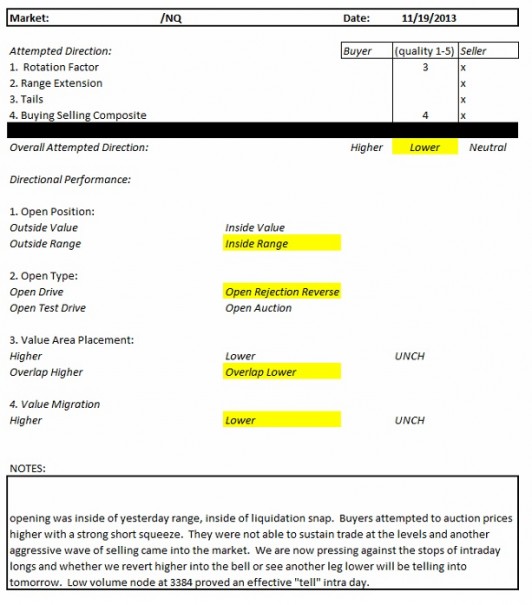

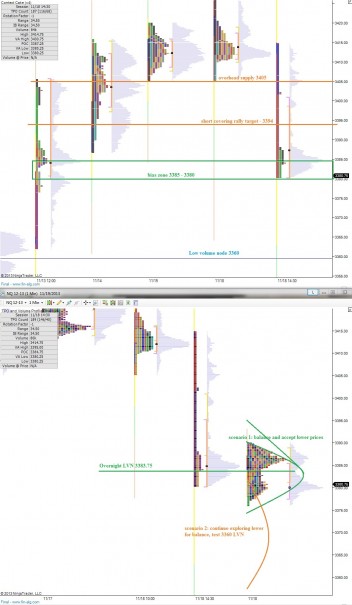

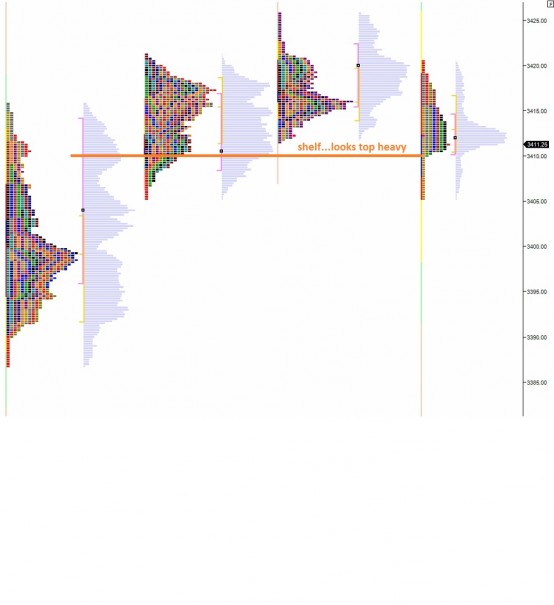

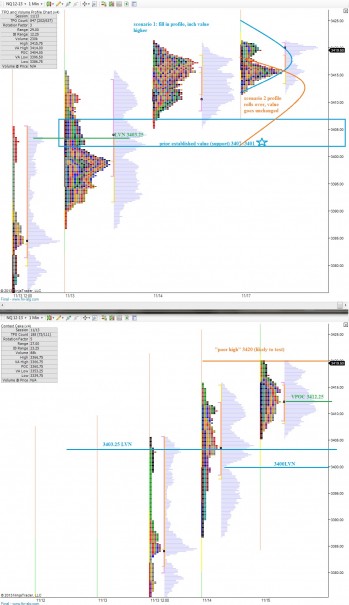

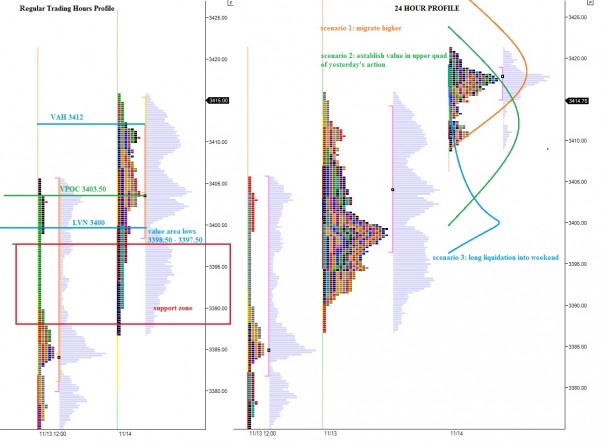

For a good portion of the week, market participants slugged it out at the 3390 price level in NASDAQ futures. We kept printing low volume nodes at the level which is indicative of fast market action. Indeed we saw several swings away from the level good for 5-10 points at a time,

Then yesterday came, and this is something you will see often in market profile work, the market spent hours at 3390 and built a ton of volume. So much volume in fact, 3390 became the volume point of control on yesterday’s profile.

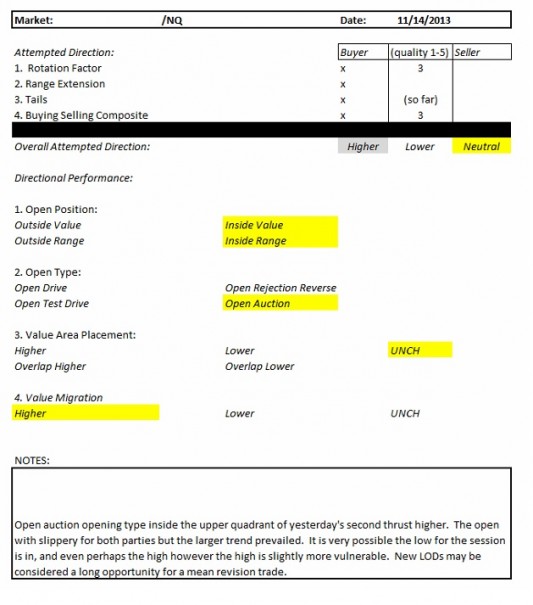

After building the base, the market began migrating higher and held the progress overnight. The sellers were in charge Monday through Wednesday but now buyers are attempting to dictate direction.

I will be watching 3413.25 above to measure buyers’ progress and 3395, 3390, and 3385 to track their defense.

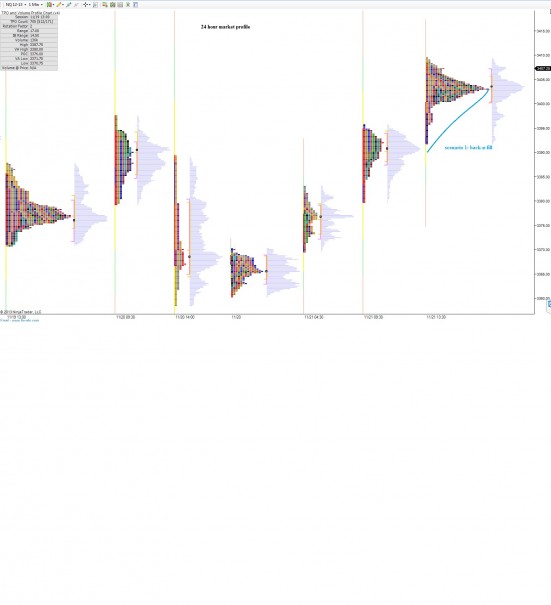

The 24 hour profile suggests we may see some back-and-fill action occurring and we are set to open in a slippery zone so we may see some chop. If instead we see an aggressive drive above or below the aforementioned levels, be cautious for trending action.

Comments »