The index markets continued lower overnight, extending the move made yesterday afternoon. The question now is whether the news driven selling from yesterday has created more overhead supply then can be handled. This would result in value migrating lower and washing out last week’s progress.

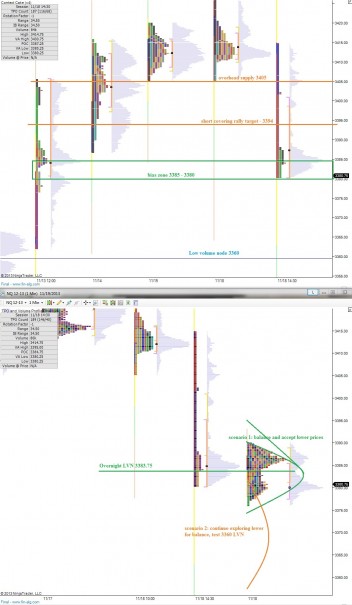

Should a short-covering type rally occur today, I would expect it to run up to about 3394 on the NASDAQ futures. If the action is able to sustain trade above 3394, the expectation is for buyers to target 3405 where I suspect we will see the effects of overhead supply from the Friday-to-Monday action.

Price is slippery below due to the thin profile structure we are working inside of. It would not surprise me to see trade back down to last Wednesday morning’s trade, before the surge in prices. Should this occur, I will be using the low volume node at 3360 as support to lean on. Should we see price accepted below this level it would suggest a major sentiment shift away from all of last week’s action.

Our early clue to whether bulls can reassert intermediate term trend force will be the overnight low volume node at 3383.75. Sellers hold the short term and overnight trend control. Stay tuned to the midday report for insight into day control.

I have highlighted these levels, as well as a few scenarios on the following market profile charts:

If you enjoy the content at iBankCoin, please follow us on Twitter