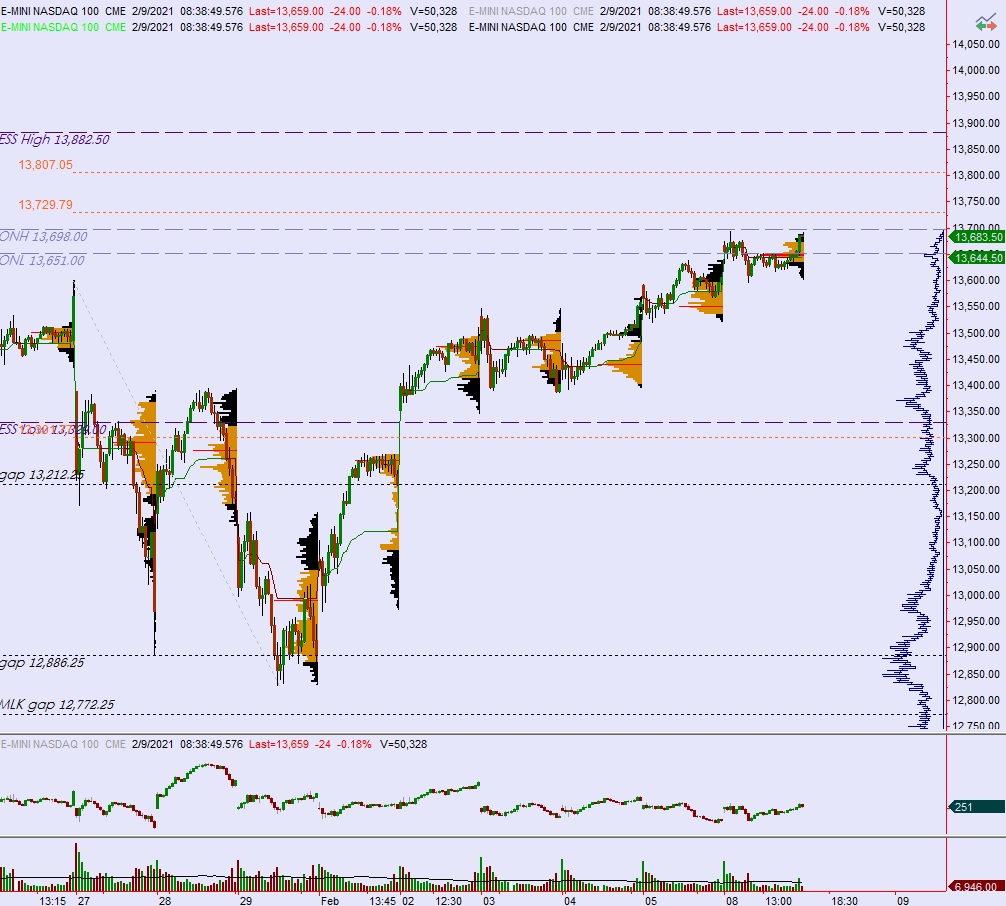

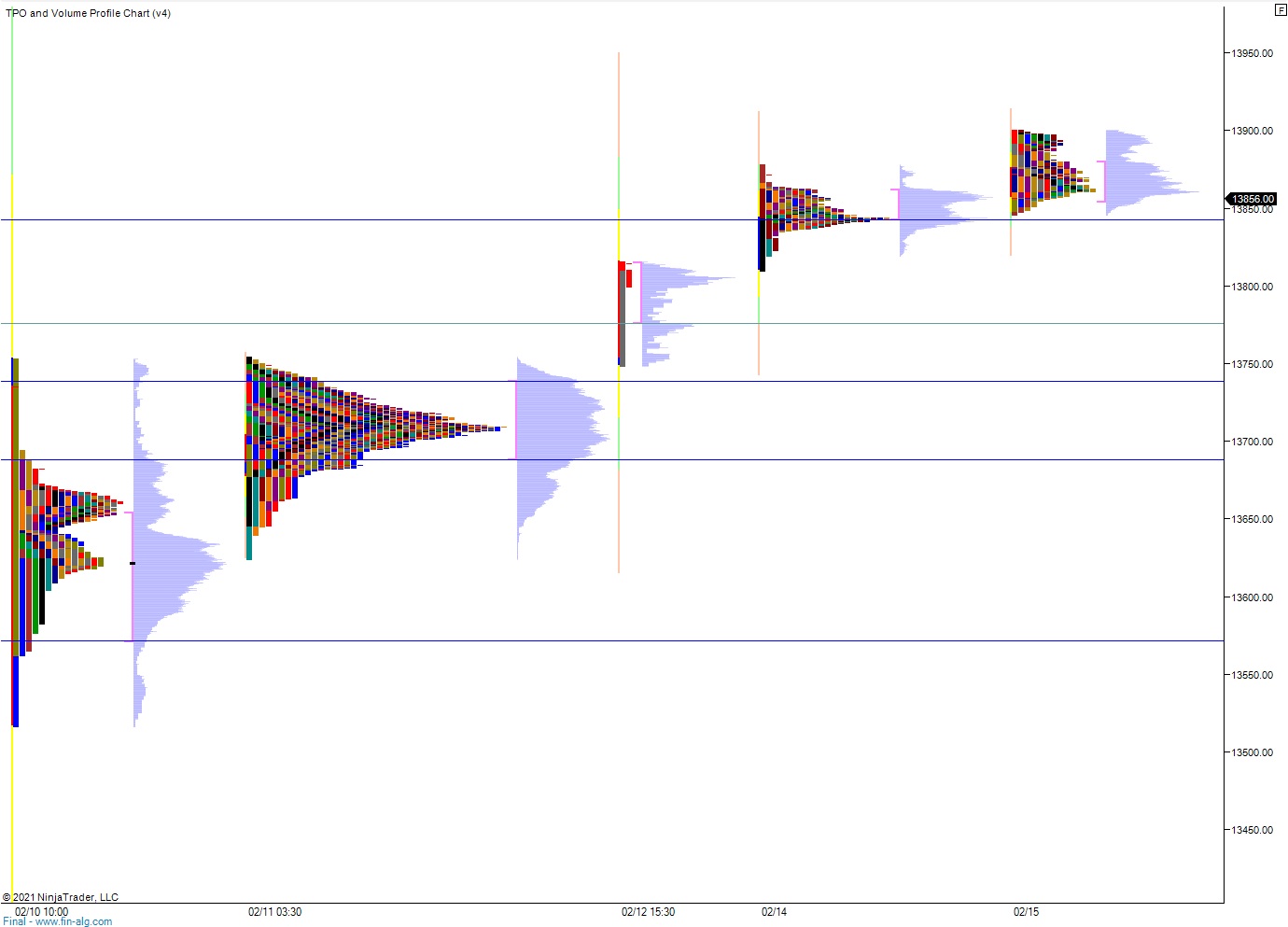

NASDAQ futures are coming into the second day of the third week of Black History Month (option expiration week) gap up after an overnight session featuring elevated range on extreme volume. Price drove higher Monday night until about 2am New York when sellers showed up right along the 13,900 century mark. Since then the auction has been balanced, balancing in the middle of the overnight range. As we approach cash open, price is hovering up beyond all prior highs.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

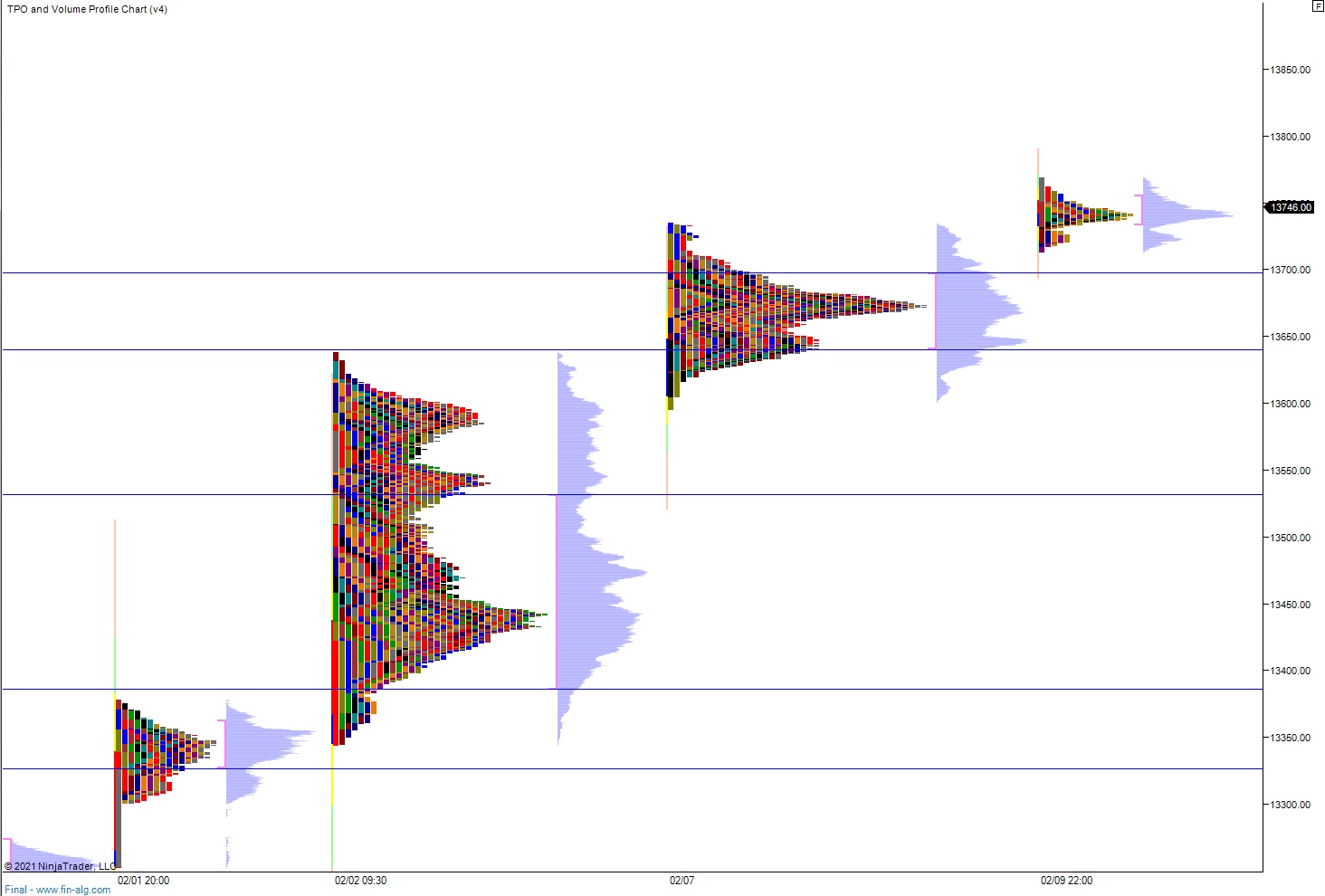

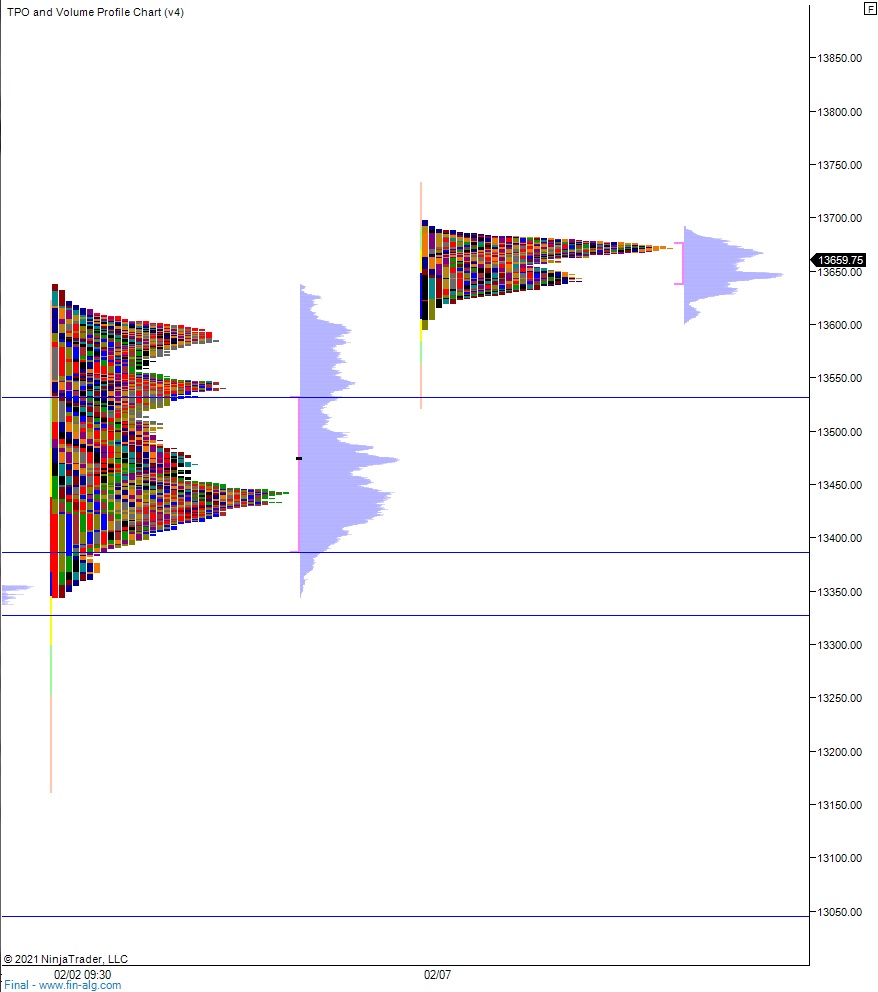

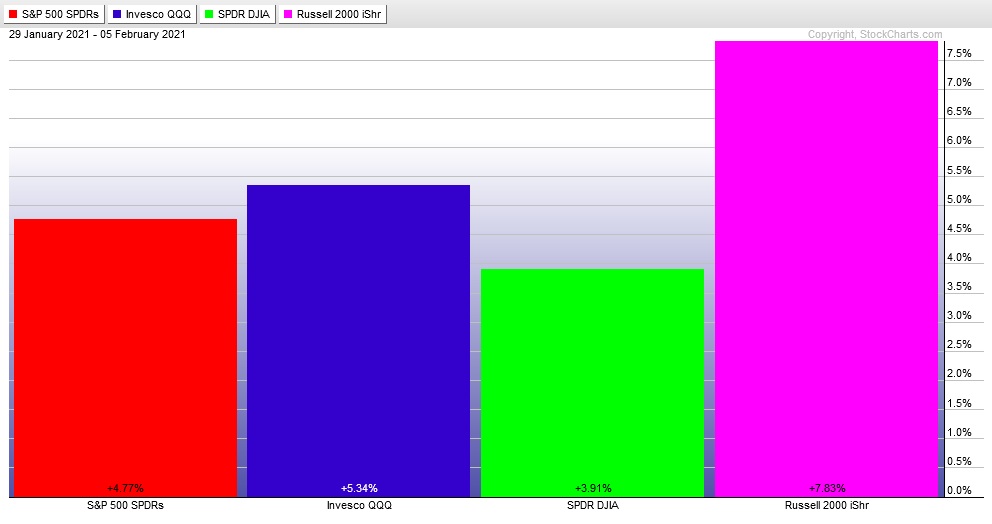

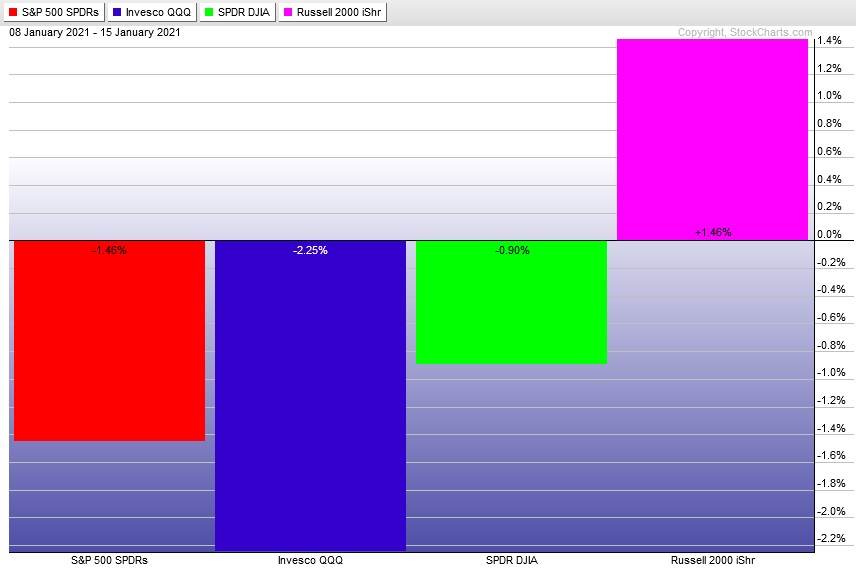

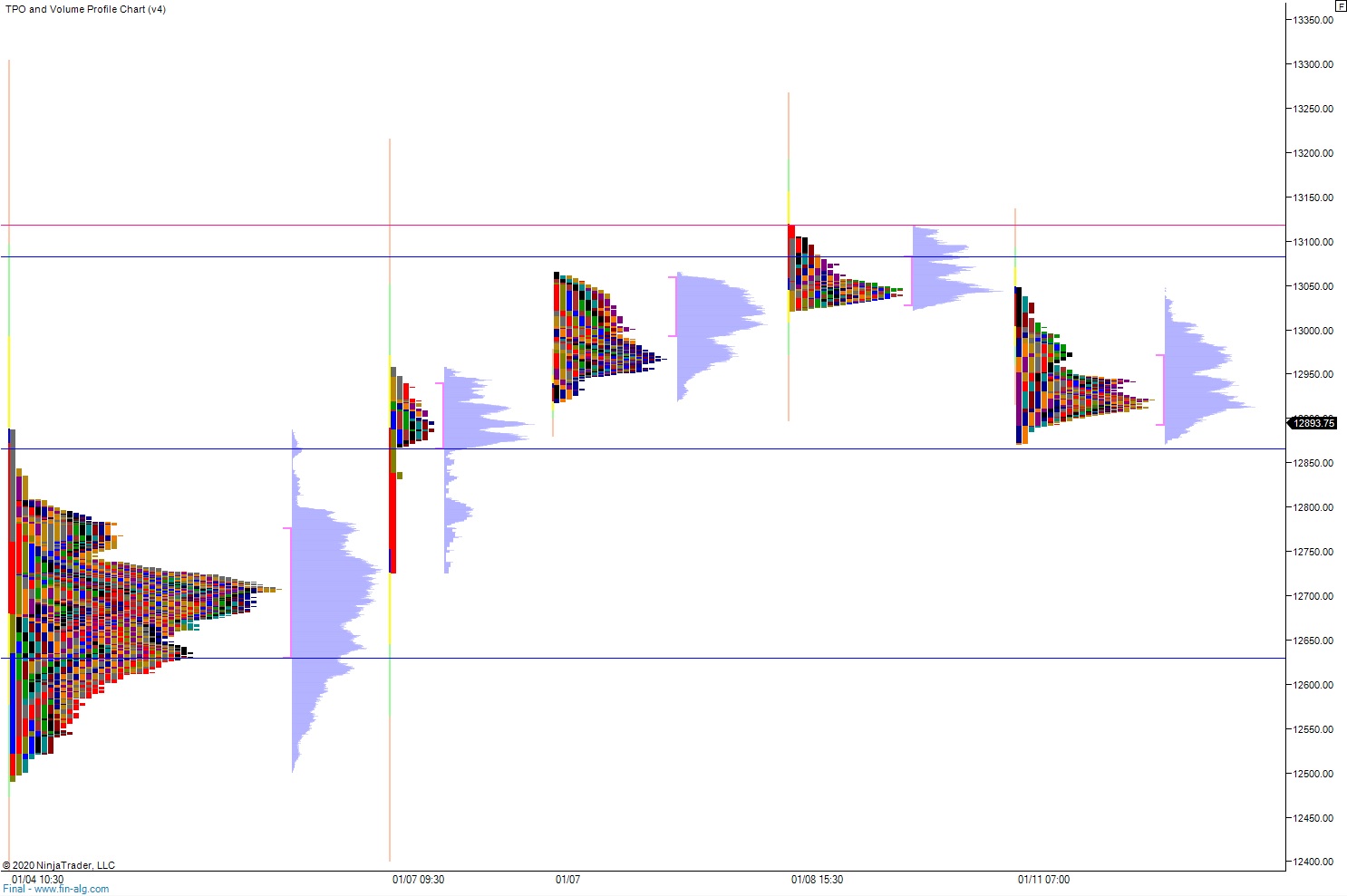

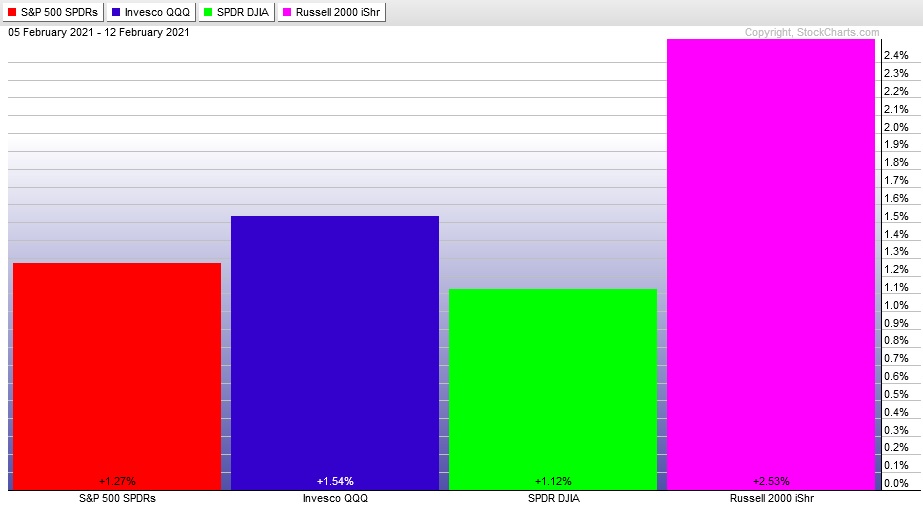

Last week featured a gap up then a slow rally through Tuesday. Fast selling Wednesday morning was ultimately erased by early Thursday buyers. Price chopped along the highs until a late Friday ramp higher put us back on the highs. The last week performance of each major index is shown below:

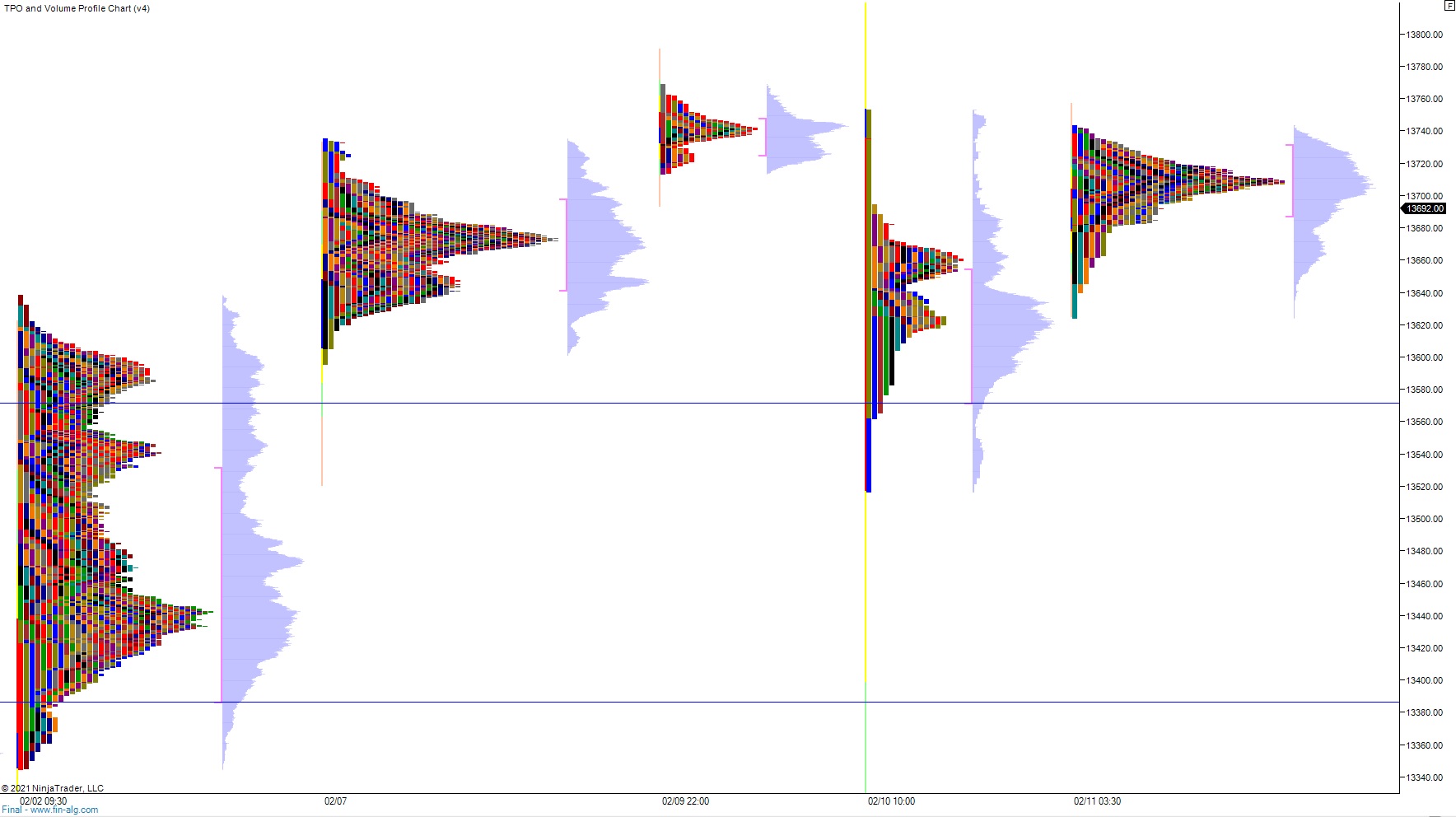

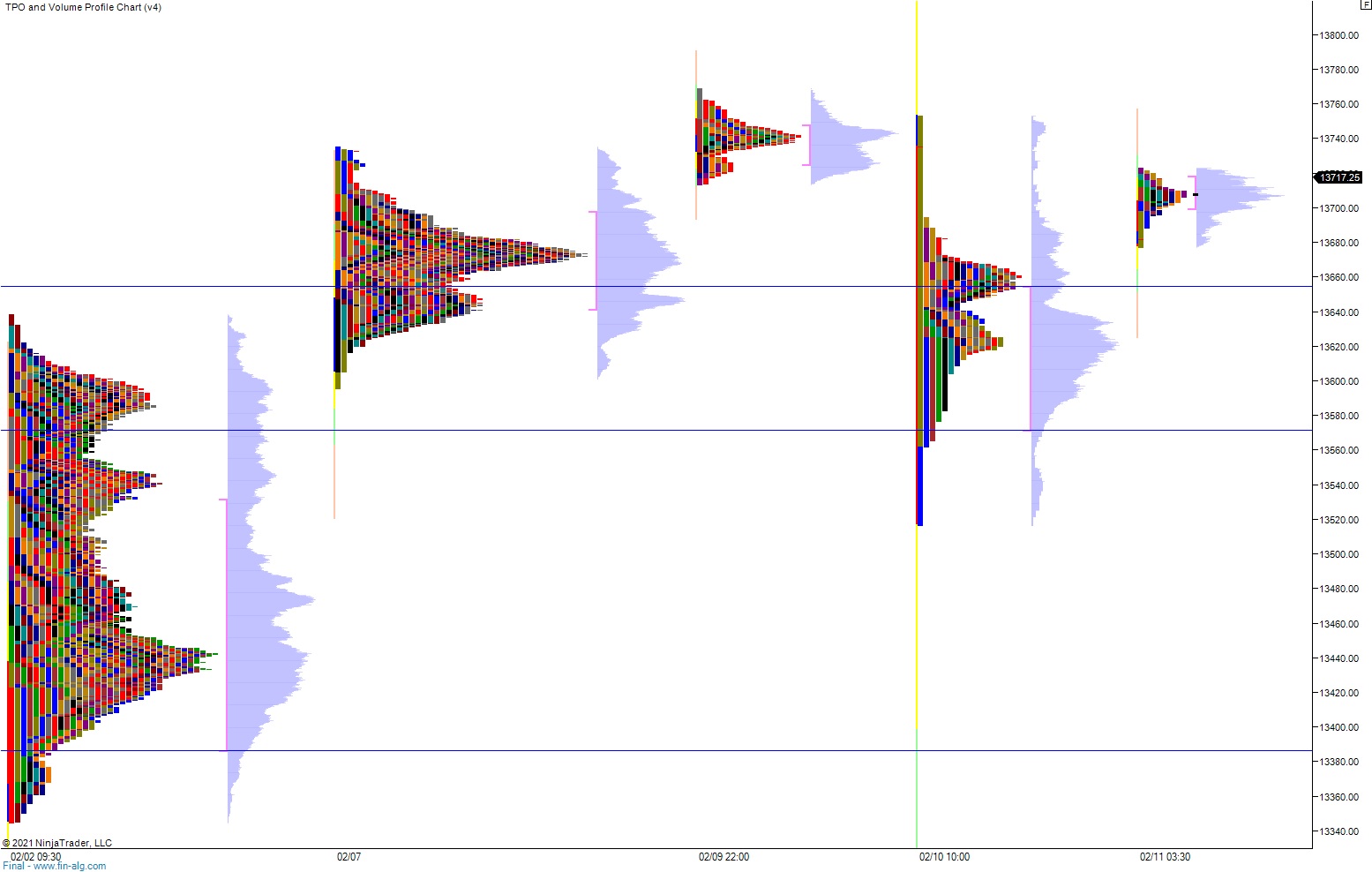

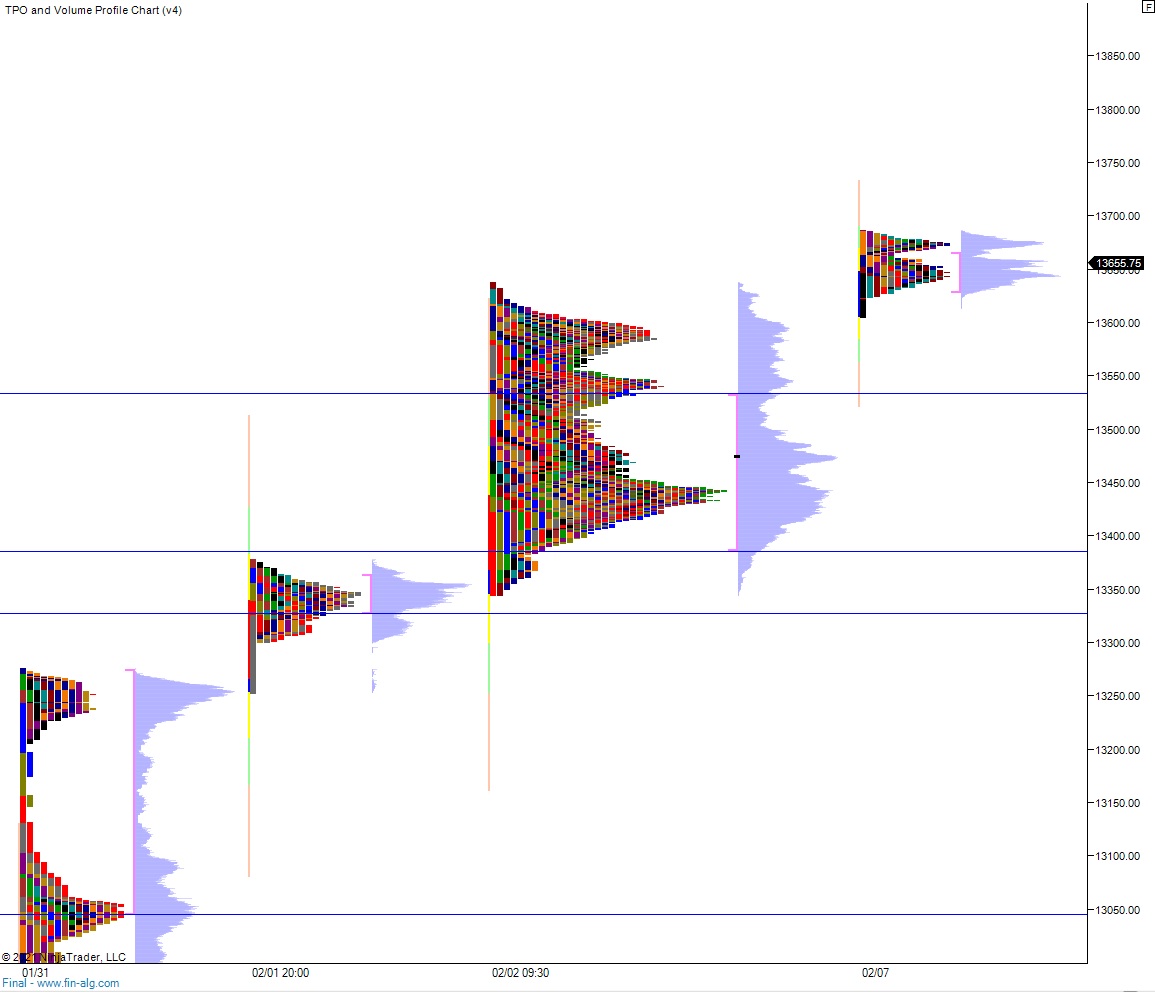

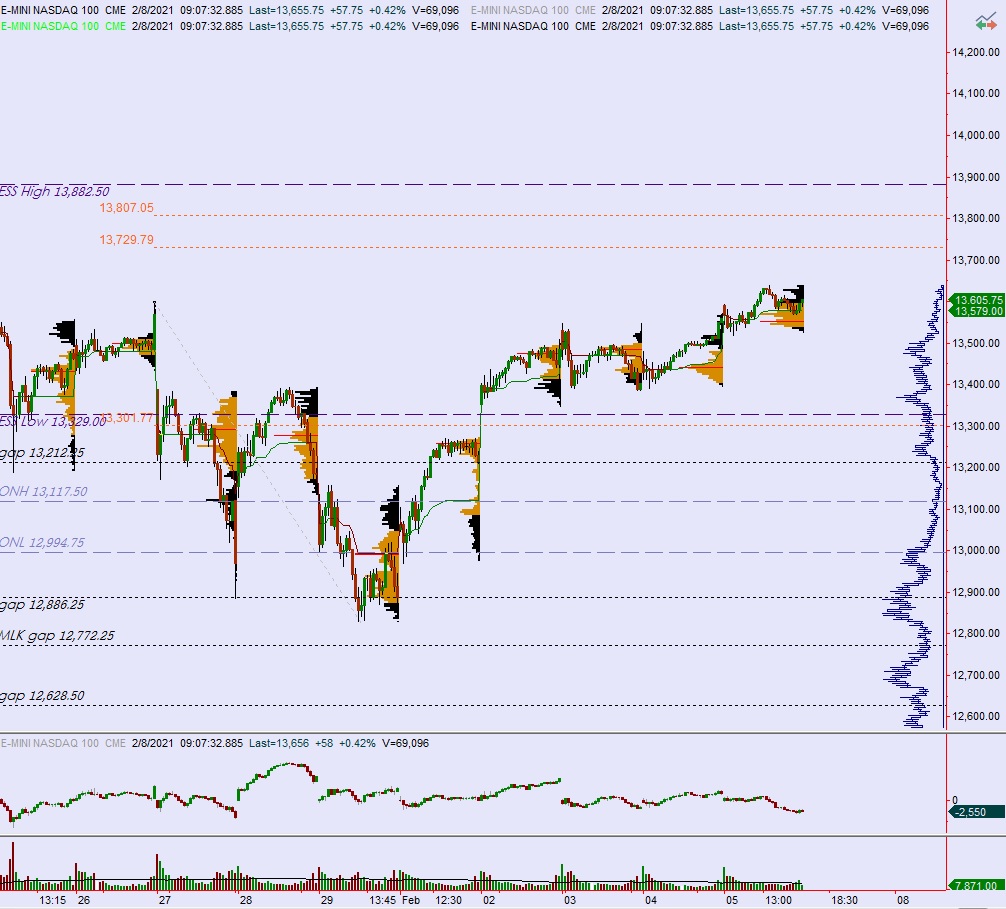

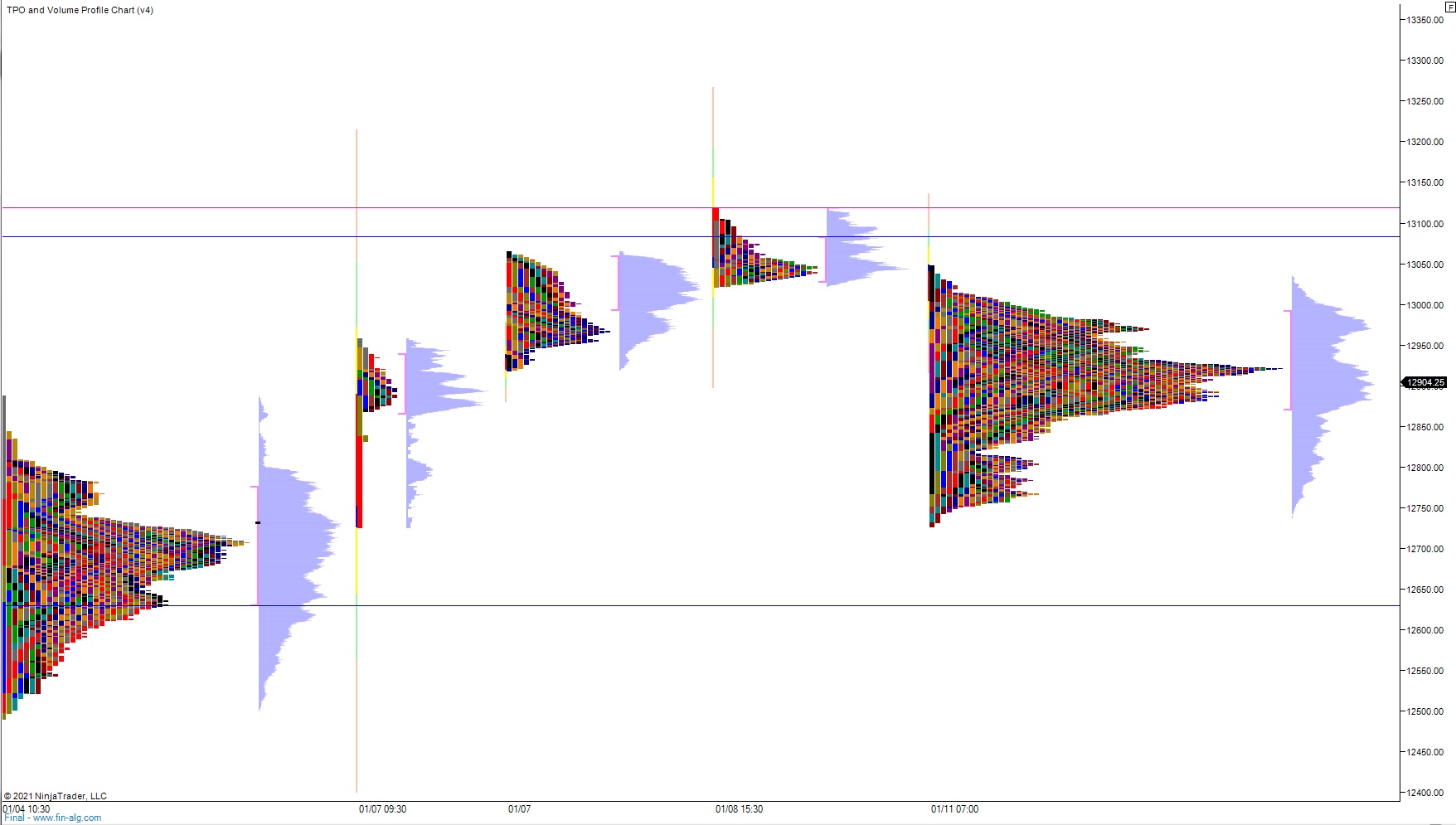

On Friday the NASDAQ printed a double distribution trend up. The day began with a gap down in range and after a mini drive down on the open a sharp excess low formed before sellers could take out the Thursday low. Price chopped along the open print for an hour before going range extension up and closing the overnight gap. Price continued higher, taking out the Thursday high by a few point before flagging along the highs for several hours. A late-day ramp say price rally hard into the close and ultimately close on the highs.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 13,900 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 13,814.75. Look for buyers down at 13,776 and for two way trade to ensue.

Hypo 3 stronger sellers trade down to the Friday naked VPOC 13,738.75 before two way trade ensues.

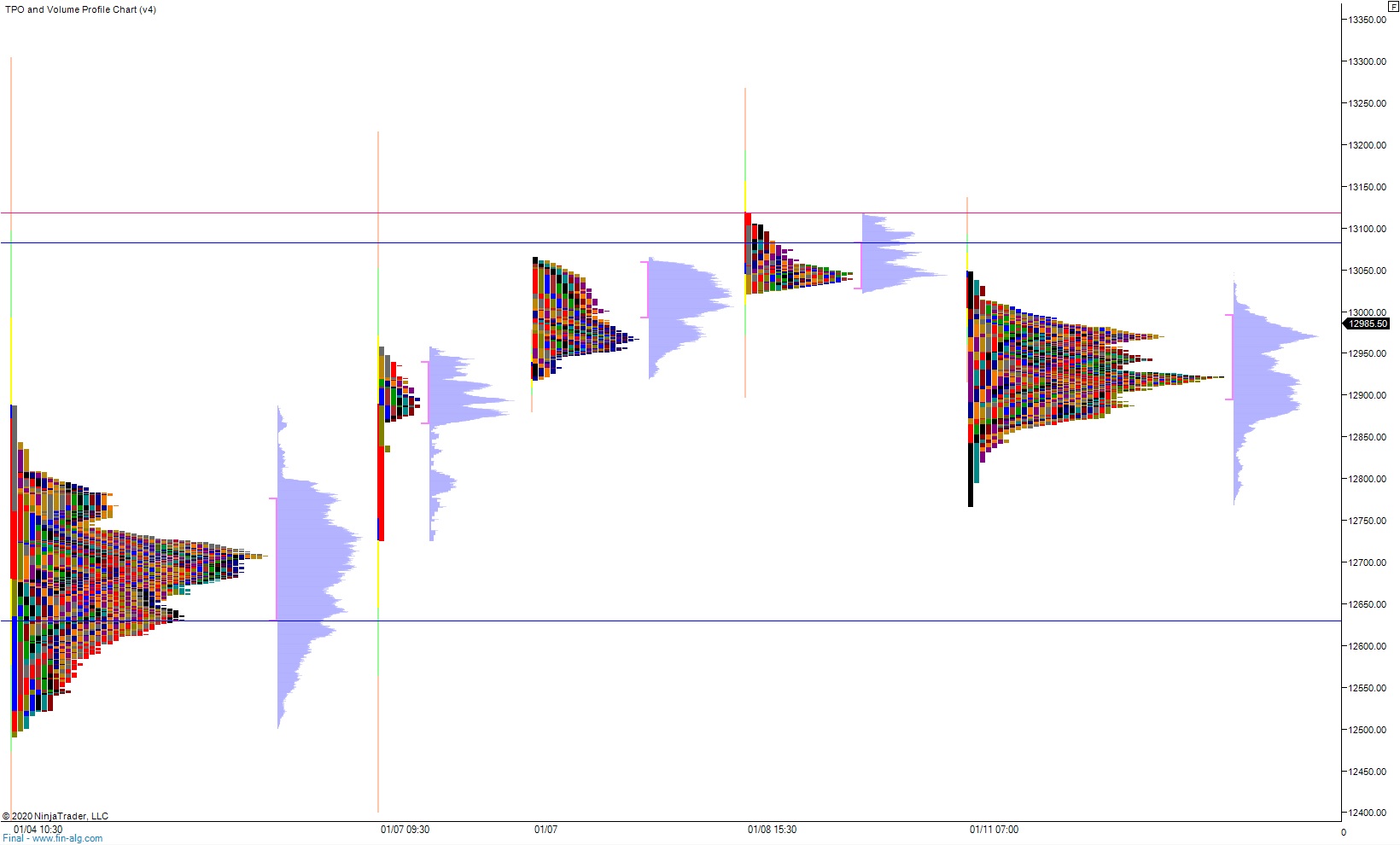

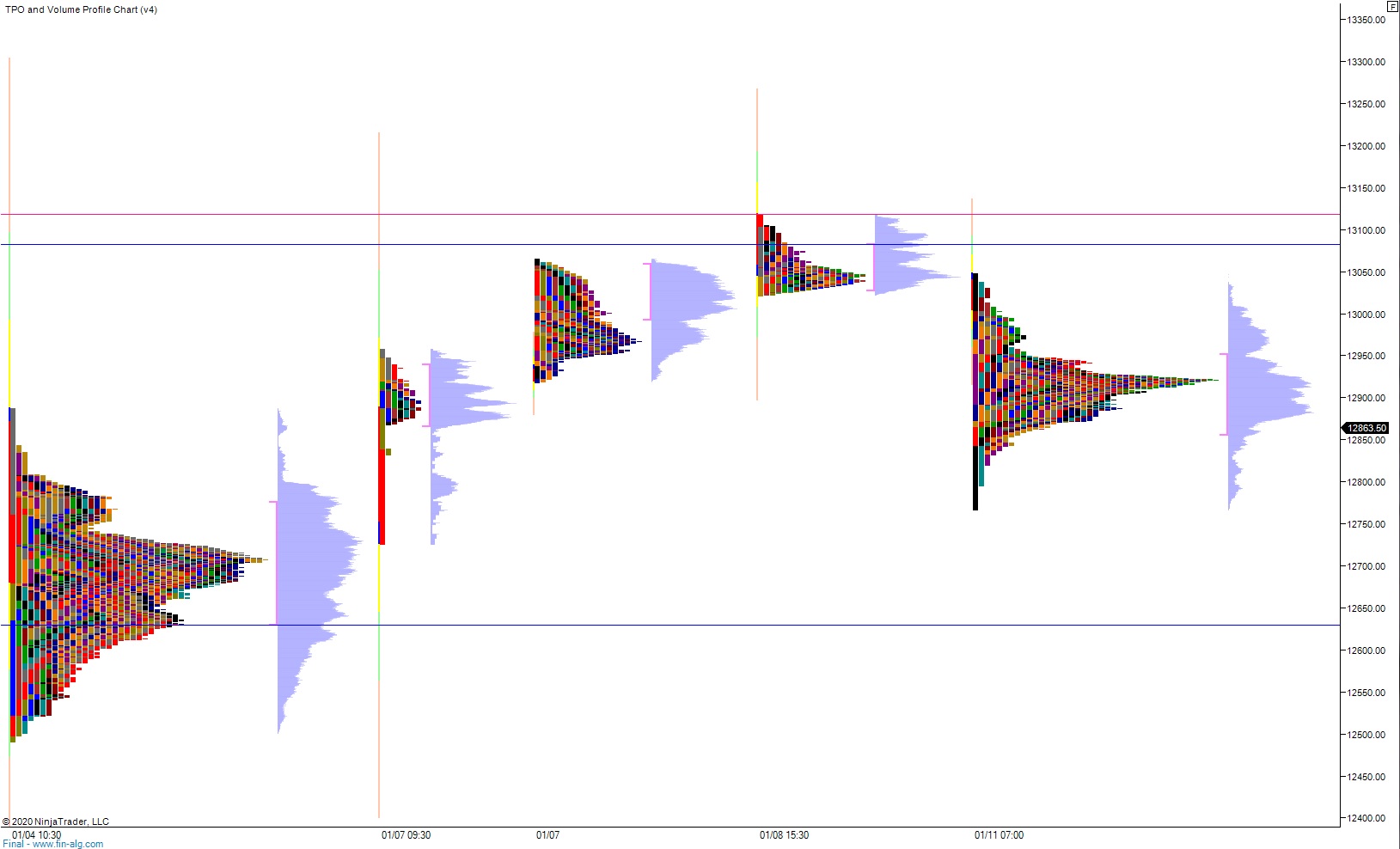

Levels:

Volume profiles, gaps and measured moves: