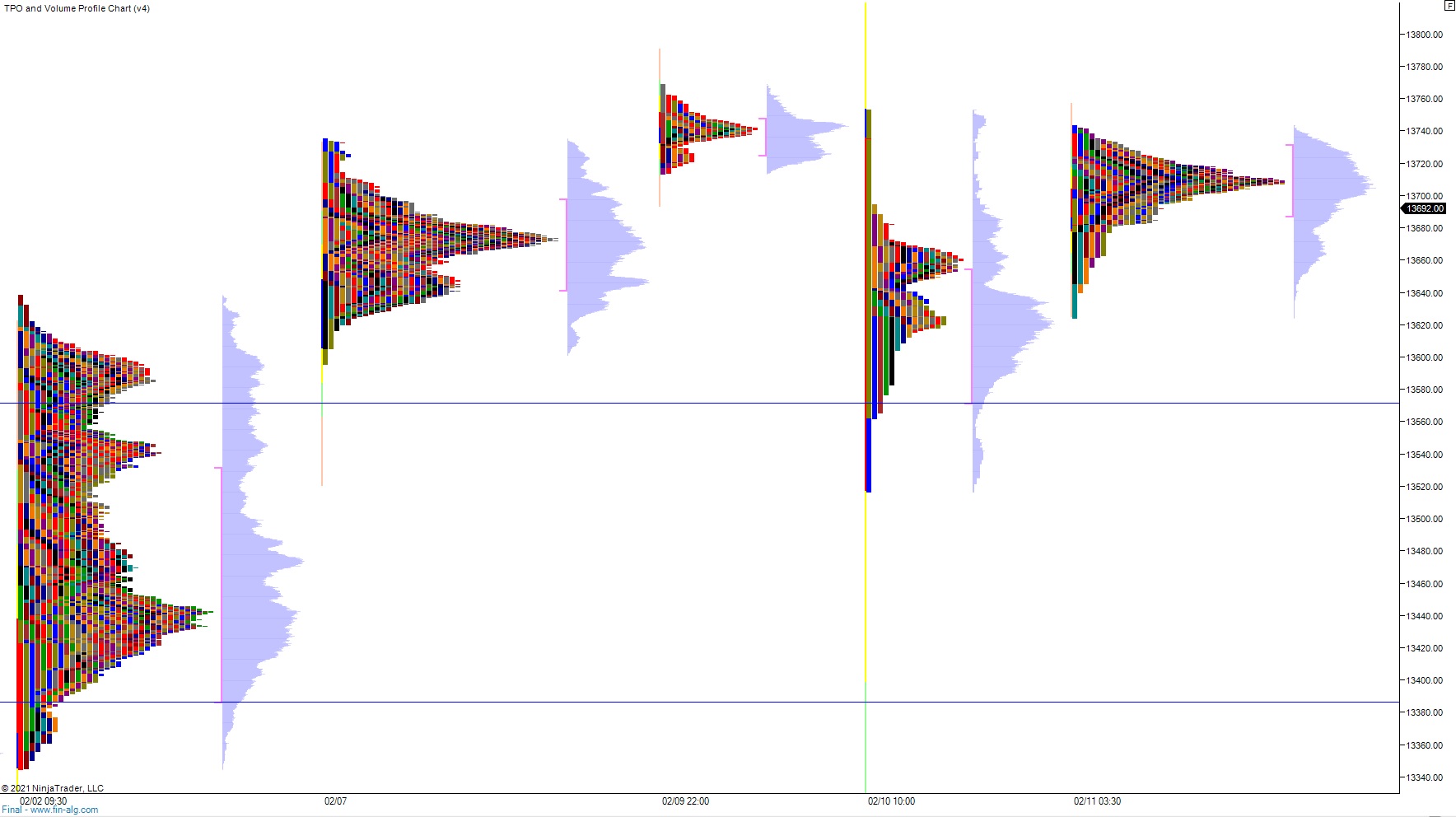

NASDAQ futures are coming into the fifth day of the second week of Black History Month down about -40 after an overnight session featuring normal range and volume. Price was balanced overnight, balancing along the upper half of Thursday’s range, and as we approach cash open price is right along the Thursday midpoint.

On the economic calendar today we have consumer sentiment at 10am.

Yesterday we printed a neutral day. The day began with a gap up in range and after a choppy open where sellers were unable to close the overnight gap we began a slow campaign higher. The buying stalled shortly after going range extension up. Then a hard sell hit the tape during New York lunch, around 12:30pm, pressing the overnight gap fill and beyond, probing a bit below the Wednesday midpoint and tagging the naked VPOC. At this point we were in a neutral print and and excess low formed. Buyers then worked price back up to near where the open print was. Sellers attempted a secondary rotation lower but could not make a new low of day. This set up a ramp back to the upper quadrant of the daily range into the close.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 13,721.50. From here we continue higher, taking out overnight high 13,742 on the way to tagging 13,800.

Hypo 2 stronger buyers sustain trade above 13,807 early on, setting up a run to 13,882.50.

Hypo 3 sellers press down through overnight low 13,663.25 setting up a run down to 13,600. Look for buyers down at 13,571.50 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: