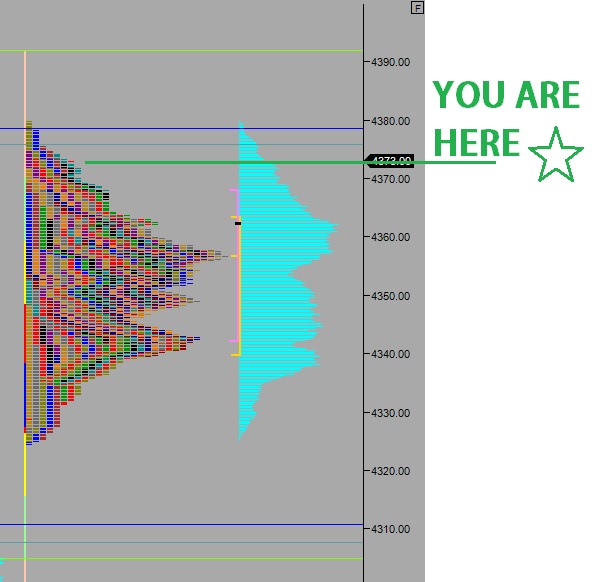

NASDAQ futures are coming into Friday flat. The globex session featured a normal range and volume during which price managed to hold yesterday’s high and exceed it. Overnight we pushed deep into the range from 09/17, the Fed rate decision day that marked intermediate swing high.

At 9:15 am the Industrial/Manufacturing Production data is out. At 10am the U of Michigan Confidence preliminary read will be released. Perhaps the number will carry more weight as this weekend the school faces off against Michigan State University in football. I have no idea if that matters. At 1pm the Baker Hughes rig count and finally at 4pm the Total Net TIC flows.

Yesterday we printed a big neutral extreme up day. It started with a gap up and price inside Wednesday’s upper quadrant. The we went RE up and stalled, traversed the entire range, tested the low, immediately found buyers and spent the rest of the day trending higher.

Heading into today, my primary expectation is for buyers to work toward overnight high 4426.50. Look for responsive sellers to engage and two way trade to ensue north of the 4400 century mark.

Hypo 2 sellers push and take out overnight low 4405. Look for continuation down to 4389.75 then two way trade to ensue.

Hypo 3, sellers accelerate through 4389 to target 4374 then responsive buyers and Friday churn.

Hypo 4 we continue trending higher to probe above the 09/17 high at 4441.50. Look for responsive selling.

Levels:

Comments »