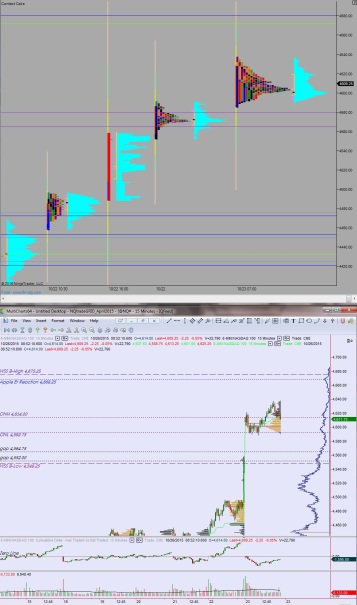

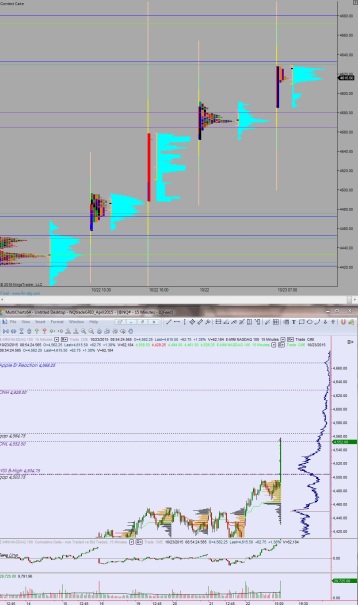

NASDAQ futures printed a low volatility balance session last night that traded inside of the range set yesterday. At 8:30am Durable Goods data came out slightly better on the top line read, and slightly below expectations ex-transportation.

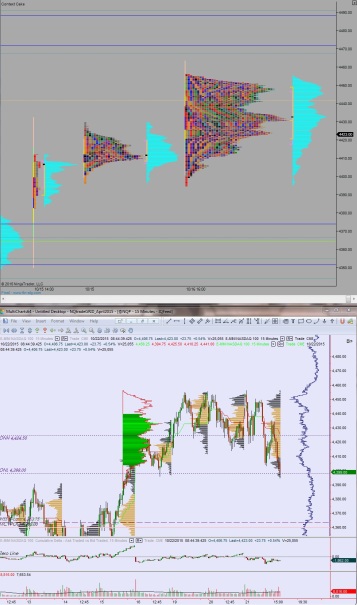

Today is a busy day on the economic calendar which is likely to produce some chop. We have S&P/Case-Shiller Composite-20 at 9am, the Markit Composite/Service PMI stat at 9:45am, and Consumer Confidence at 10am. However all of these economic events will likely carry less impact on NASDAQ futures than Apple earnings, set for release after market close.

Yesterday we printed a normal variation up day and an inside day, meaning, we trade within the range printed last Friday. This suggests balance and waiting.

Heading into today, my primary expectation is for more of the same. More chop, more waiting. Look for buyers to push into the overnight inventory and work higher to take out overnight high 4619.75 then make a move to probe above value around 4630 before responsive selling is found. Then balanced trade north of 4600.

Hypo 2 a bit more selling pressure, take out overnight low 4601.25 then set our sights on 4580 before responsive buying and two-way trade.

Hypo 3 buyers become initiative, perhaps after 10am, and work higher to target the gap Apple left behind last quarter up at 4668.25 before two way trade ensues.

Hypo 4 selling accelerates, down through 4580 to test 4565 before two way trade ensues.

Levels:

Comments »