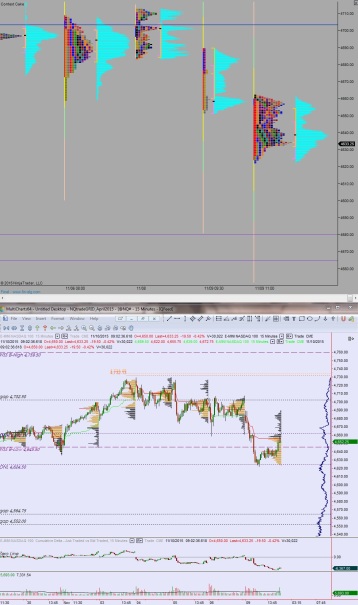

Futures are priced for a gap up into Wednesday over at the NASDAQ 100 after an overnight session featuring normal range and volume. Price spent most of the session drifting higher and managed to take out the Tuesday high and continue up through the Monday midpoint before stalling out on the top-end of current value. At 7am MBA Mortgage Applications came out slightly lower than expected, there was a muted response.

There are no other economic events scheduled for today.

Yesterday we printed a normal variation up day. Price opened gap down and made a liquidation thrust lower that responsive buyers quickly gobbled up. One more attempt lower was made just before 10:30am which managed to print an excess low. After setting the low we grinded sideways above the mid before one last sell program tested for interest below the mid. It was faded and we rallied into the close.

Heading into today my primary expectation is for sellers to work into the overnight inventory but to stall before closing the overnight gap. Look for responsive buyers to defend 4648.75 and make a move to take out overnight high 4661.75. Just above here look for responsive selling and two-way trade to ensue.

Hypo 2 sellers push a full gap fill down to 4643 before two way trade ensues. Look for sellers to keep price below overnight high 4661.75 and to make a move to take out overnight low 4636.25. Look for signs of responsive buying around 4622.75 and two way trade ensues.

Hypo 3 is a pole climb. Up above overnight high 4661.75 is a thin profile structure. If buyers make a strong push above overnight high, then it is likely to continue all the way up to 4683.50 before finding responsive sellers.

Levels:

Comments »