Price is set to open gap down on the NASDAQ this Friday after a globex session that featured normal range and volume. Price managed to press beyond the low set Thursday early yesterday evening before coming into balance. Around 6am a wave of selling pushed another small leg lower. Responsive buyers showed up right around the open gap left behind on 08/17 at 4564.75. At 8:30am Advance Retail Sales data came out weaker-than-expected and the initial reaction is buying.

The only other economic event we hear today is the Primary reading of University of Michigan Confidence at 10am. I have seen the primary read turn the market in the past, especially during elevated volatility, so be aware of this number today.

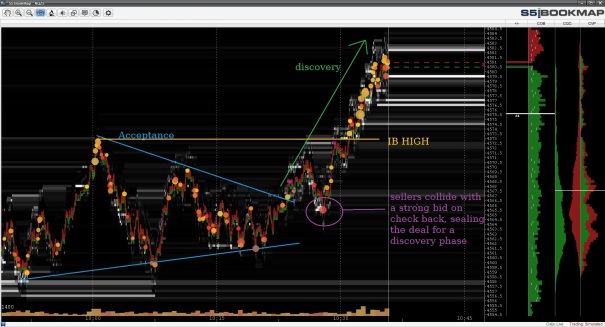

Yesterday we printed a second consecutive neutral extreme down day. It was the third gap down open on the week and buyers quickly stepped up to buy it. Price managed to close the overnight gap before sellers defended the Wednesday range and formed a sharp excess high. From here they continued working through the entire range to break IB low and push us neutral. The selling continued right up to the bell giving us a close on the low and neutral extreme classification.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the overnight gap up to 4586.25. Look for responsive sellers up at 4587.75 who work to target overnight low 4564. Look for sellers to target the Amazon, Alphabet, Microsoft (AAM) gap down at 4552 before responsive buyers come in and two way trade ensues.

Hypo 2 buyers strong. Close overnight gap up to 4586.25 then take out overnight high 4590.50. Sustain trade above this level and then another leg higher to test the 4600 century mark. After some churn, buyers continue pressing and work up the thin profile to target VAL 4623.25.

Hypo 3 thin ice breaks. Sellers gap and go, take out overnight low 4564 and close the 4552 AAM gap early. Trade sustains below this level setting up a liquidation. Stretch target is the composite high volume node at 4530.

Levels:

Comments »