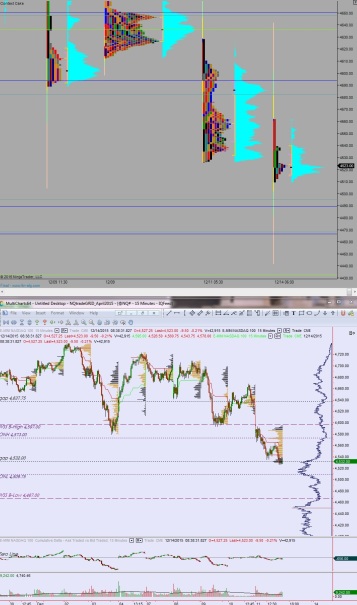

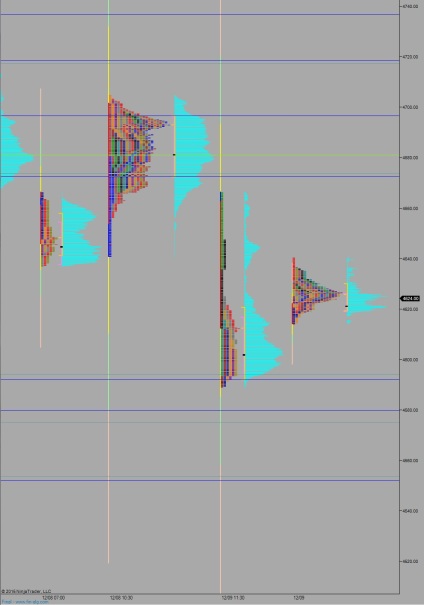

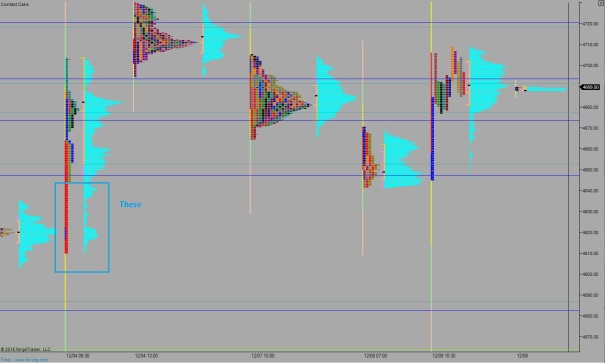

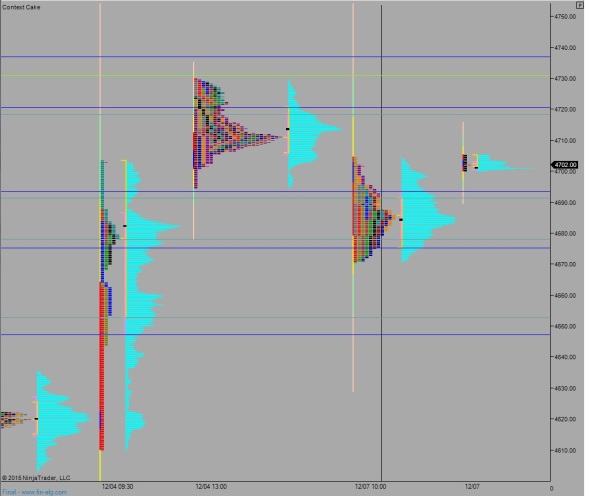

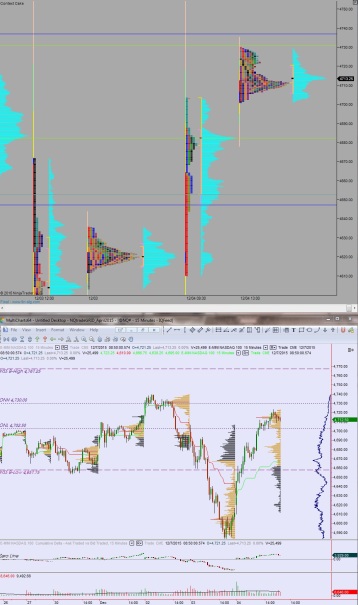

NASDAQ futures are gap up (borderline pro gap) heading into Tuesday after an overnight session featuring slightly elevated range and volume. Volume metrics are still skewed as some transactions take place on the December contract, and the bulk of orders go through on the March contract. Price held Monday’s close in balanced trade which gave way to buying around 3am. The result is two distinct market profile prints for globex (two small bell curves on the market profile chart below). At 8:30am Consumer Price Index data came out inline with expectations.

Also on the economic calendar today we have the NAHB Housing Market Index at 10am and Net Long-term TIC Flows at 4pm.

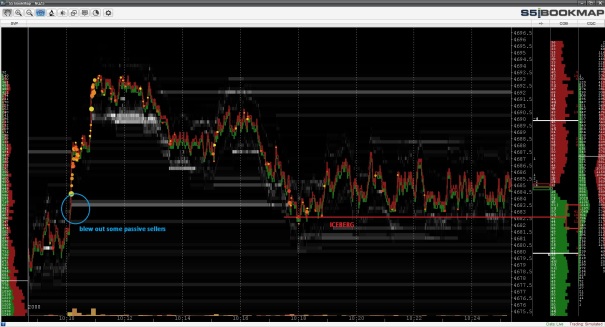

Yesterday we started the week out with violent chop trade which gave way to selling. Responsive buyers showed up ahead of the weekly ATR band and formed a sharp excess low. Price then traversed the entire range to form a neutral extreme up day–a day type carrying the third-most amount of directional conviction.

Heading into today my primary expectation is for sellers to push into the overnight inventory and trade down to 4570. I will look for buyers to defend here, ahead of the gap fill, and work to take out overnight high 4598.75. Look for a test of 4610 then two way trade ensues.

Hypo 2 buyers gap and go, take out overnight high 4598.75 early and sustain trade above 4610 setting up a move to close the 12/10 open gap up at 4637.75 before two way trade ensues.

Hypo 3 trend day up emerges, taking out the 12/10 gap up at 4637.75 and sustaining trade up here before going up to test 4650.

Hypo 4 full gap fill down to 4560.50. Look for sellers to probe down to 4546.25 then two way trade ensues.

levels:

Comments »