My second major theme for 2013 is that department stores all face serious headwinds, and are the most vulnerable industry. Here’s a link to my first theme going into 2013. Anyone who loves the stock market and has been dragged out shopping during the holiday season should love this piece.

First off, I never shop in department stores unless I’ve been dragged there by my girl. What that means is when I’m there she’s shopping, I’m a pack mule for carrying cargo. Mentally I’m completely removed from the shopping experience, instead diverting my mental capacity to investigation. I look at the racks, what people are shopping for, ask for a manager and see how long it takes, and talking to employees about their sales goals. This is old school channel checks, it’s incredibly subjective, and perhaps only a defense mechanism for my otherwise disdain for being dragged around town. BUT, this year, I’m telling you as objective as I possibly can, volumes are down.

CASE IN POINT: Sephora. This is one store where I can get concrete information. Their store at The Somerset Collection, our best shopping center, and a top 10 grossing store nationally for the company, is missing their sales targets by nearly 10%. They’re also over on their labor budget. I consider the products they carry especially sensitive. Ladies from the upper-middle class need makeup because, as Chuck Bennet so eloquently stated, without it they’ll “get no handbags.” Women don’t bend the budget knee and give up their beauty products without a fight. It’s the first in three years they haven’t blown their sales forecasts out. Red flag.

The second force, the big chipper, the internet. Yes of course I know department stores have a huge online presence, but they also have huge physical shops–full of expensive sales reps, nice warm air, shined floors, and well you get the picture–overhead. Smart phones are more prevalent than last year and shopping on the go (read: at work) easier. Out on the internet the competition is leaner, have better developers, and way more budget flexibility to advertise. Department stores a losing online.

Finally, we’re going over the fiscal cliff. Whatever, WHATEVER the fuck that means. Rest assured either by simply being more cognizant of the risk or the high likelihood of it’s occurrence, the upper-class expect higher taxes. And they’re bitter in general. They watch way too much news. Cliff imagery. Domestic Terrorists. Doom’s day preppers. NRA. Careless citizens snapping pics of people moments before death by train. Increased hurricane damage. It’s all enough to BUY A GUN, at the least. Suddenly, blowing money on RL over at M seems less important. Why not go on EBAY and get a ten pack of polo shirts from Izod or APP?

With all this in mind, I took to the almighty PPT. I was happy to receive thesis support instantly, Department Stores are the lowest ranked industry in the service sector. Their January seasonality is 50/50 with an abysmal average return less than 1%. Things perk up slightly in February, and March is downright bullish, seasonality speaking. Here’s a very brief fundamental comparison:

According to these few fundamental comparisons, Sears obviously is getting their ass kicked. Shorting shares of SHLD has been a well publicized trade, it has been a loser . The stocks up nearly 30% this year. Shorts could get their redemption this year. But I see more vulnerability in the slightly higher end (but not too nice, remember upper-middle class). Which makes me not want to short KSS, except investors may be ready to dump the shares after watching their modest annual gains gap into the red earlier this month, POOF! JCP already crushed their shareholders this year, down big. It’s more vulnerable to a squeeze higher on its inevitable march to zero.

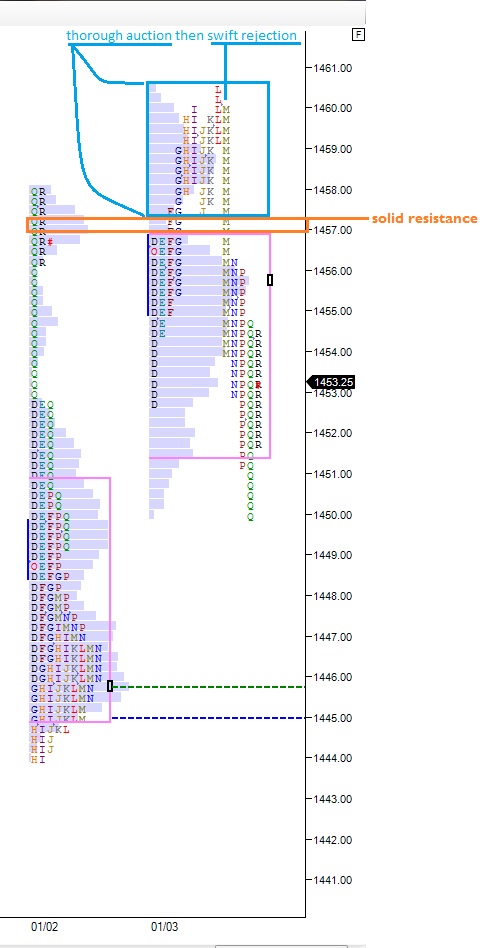

Mostly I’m interested in Macy’s (M) and Saks (SKS). I suppose a head-to-head comparison is in order. After all, either of these stocks aligns well with my overarching thesis. For now I’ll leave you with my short-term chart annotations for all the highlighted stocks:

Comments »