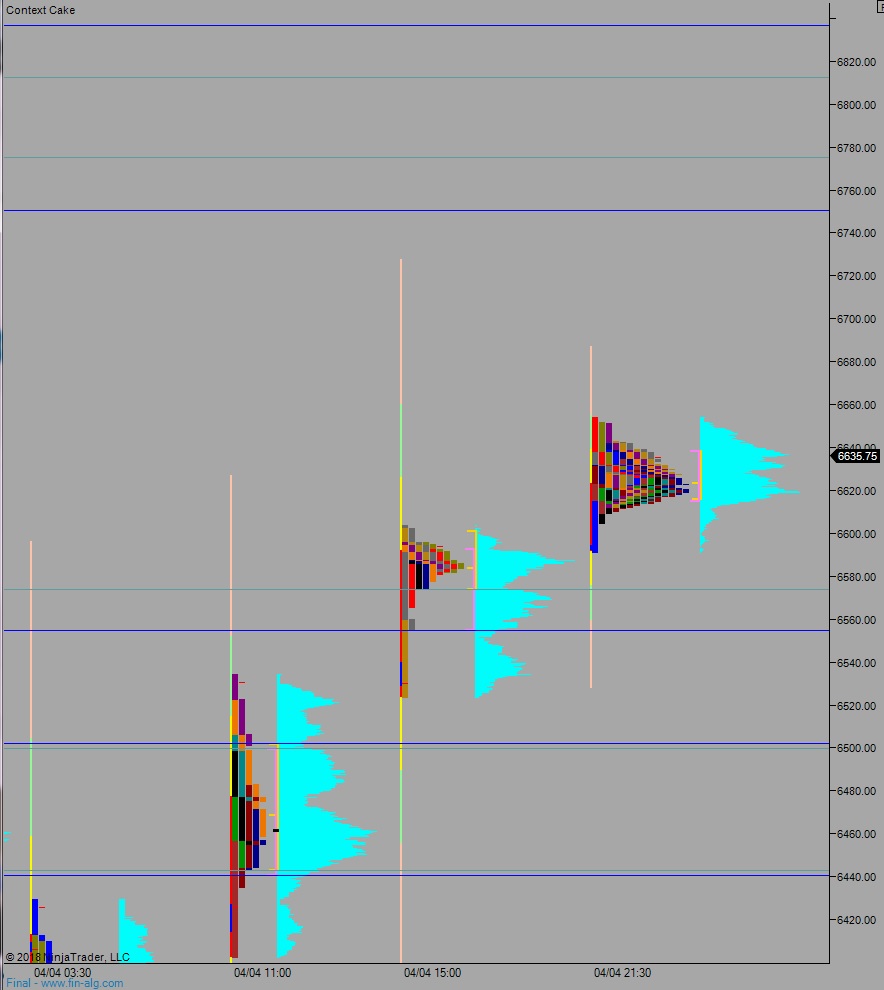

NASDAQ futures are coming into Thursday gap up after an overnight session featuring extreme range and volume. Price worked higher during the evening, eventually coming into balance along last Thursday’s session high. As we approach cash open, price is hovering along overnight high and outside of the Wednesday range. At 8:30am initial/continuing jobless claims data came out mixed and trade balance came out worse than expected.

There are no other material economic events today.

Yesterday we printed a double distribution trend up. The day began gap down and after a brief two-way auction could not take out the weekly lows strong buyers stepped in and closed the overnight gap. Then a strong secondary wave of initiative buying came in after New York lunch and rallied the market into the close.

Heading into today my primary expectation is for a gap-and-go higher. Trapped shorts are squeezed higher, up through overnight high 6654.50. We trade up to 6700 before two way trade ensues.

Hypo 2 stronger buyers trade up to 6722.50 before two way trade.

Hypo 3 even stronger buyers trade up to 6750 before two way trade ensues.

Hypo 4 sellers work into the overnight inventory and regain the Wednesday range 6591.75. They continue lower, down through overnight low 6581. Look for buyers down at 6573.75 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves:

trapped shorts, like in $TSLA ?

https://www.forbes.com/sites/kenrapoza/2018/04/04/mysterious-world-changing-deal-makes-verge-the-new-sexy-crypto/#e184d977a275